Investing made simple, with no fees for a year

Always wanted to invest, but didn’t know where to start?

At Wealthify, we make investing as simple as saving. Start with as little as £1 and choose a risk level that works for you, and we’ll do the rest.

Why choose Wealthify?

- Investing for anyone – you don’t need to be rich or have all the know-how to get started.

- Managed by experts – our team do all the hard work to give your money more potential to grow.

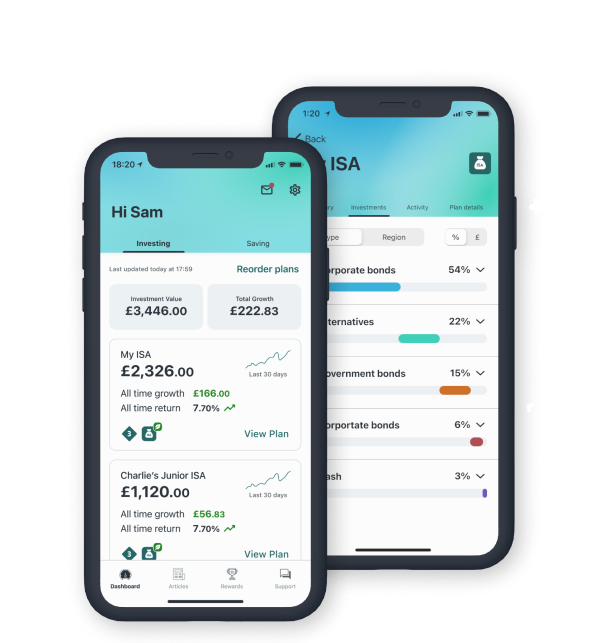

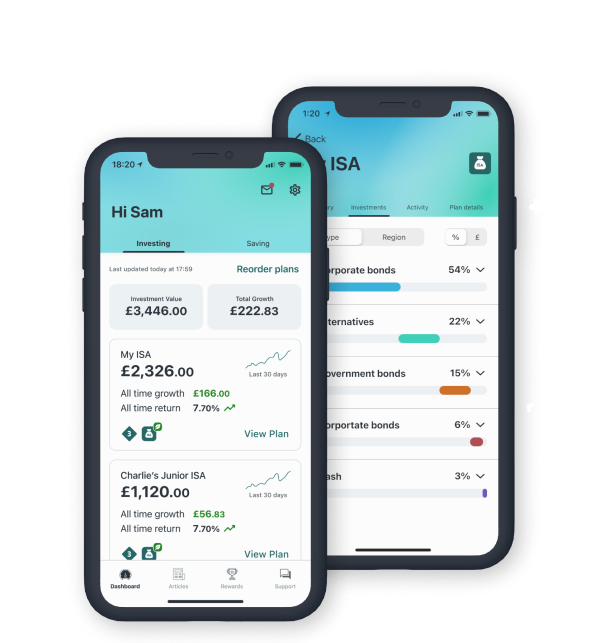

- Stay in control – track your investment performance online or via our app, 24/7.

- Low cost – sign up before 31st January and pay no management fees for 12 months*.

*Offer excludes Wealthify's Pension and is only available to new customers. Fund charges and transaction costs apply.

With investing your capital is at risk.

Why Wealthify

We want to help make your money work harder. It’s simple – you choose what type of investor you want to be, from cautious to adventurous, and we’ll build you an investment Plan and manage it for you.

There’s no minimum investment, and you can withdraw anytime with no penalties. We also offer ethical Plans, so you can easily invest in line with your values.

Cautious

Minimising loss is the priority. Small movements up and down in Plan value are acceptable, with the aim of beating inflation.

Tentative

Limiting loss is important. Moderate movements up and down in Plan value are acceptable, with the aim of achieving reasonable growth.

Confident

Minimising losses is as important as making gains. Movements up and down in Plan value are acceptable, with the aim of achieving good growth.

Ambitious

Making gains is the priority. The risk of large losses and large movements up and down in Plan value are acceptable, with the aim of achieving high growth.

Adventurous

Maximising returns is the priority. The risk of substantial losses and substantial movements up and down in Plan value are acceptable, with the aim of achieving the highest growth possible.

Investing. Reimagined.

You choose what type of investor you want to be, from cautious to adventurous, we’ll build you an Investment Plan and manage it for you.

Keep an eye on your investments online or on the Wealthify app. If you ever need help we’re here for you, our expert team are on hand over secure message, live chat or phone.

Start a plan

Calculate Your Fees

Original

Ethical

| Annual % | Annual estimate | |

|---|---|---|

| Wealthify fee | 0.60% | ... |

| Average investment costs | ... | ... |

| Total | ... | ... |

Choose How You Invest

Enjoy tax-efficient savings with an investment isa

Almost half the adult population of the UK have an ISA, with the highest regional uptake being in the South West of England

Source: Office of National Statistics

Before ISAs there were PEPs (Personal Equity Plans) and TESSAs (Tax-Exempt Special Savings Accounts)

A couple saving their maximum annual ISA allowance into an investment ISA each year, could become ISA millionaires* in just 14 years

*Figures assume two adults both saving their maximum ISA allowance of £20,000 p.a. in a Wealthify Adventurous Plan. Value of investment after 14 years would be £1,057,260, after fees.

Why choose a Wealthify investment ISA?

With saving rates so low, now may be the time to consider an investment ISA, for a chance for better returns.

- Easy sign up process

- Effortless investing

- Your money won't be locked away and you can withdraw it without penalty

- Access your account 24/7

- Low fees and no hidden costs

- No capital gains tax or income tax to pay on your money as it grows

Our Savings Calculator

Want to find out what your savings could be worth if you choose to invest them instead? Our savings calculator provides a projection of how your money could grow in a savings account vs a Wealthify Plan.

Let us know how much you have saved, how long you're planning to save for, and how much you want to put away each month. Our calculator will do the rest!

Calculate your savings pot now

Plan your financial future

Use our savings and pension calculators to see how much you could be putting away for your future.

Invest in your values

Original

Original Plans use low cost investment funds to give you the broadest access to the stock market. They mostly use instruments known as 'passive investments' that track financial markets.

We use funds from leading providers to build our range of five original Plans.

Ethical

Saving for the future is important, and so is staying true to your values.

Wealthify has joined forces with best-in-class ethical fund providers to create a range of five Ethical Plans that let you invest in organisations committed to having a positive impact on society and the environment.

Looking to transfer an existing isa?

Why would you transfer?

- Save money on fees if you're paying more for your other Stocks and Shares ISAs

- Your money won't be locked away you can withdraw or transfer at any time

How to do it?

You can transfer previous years' Stocks and Shares ISAs or Cash ISAs to a Wealthify Stocks and Shares ISA. Tranfers don't impact your current allowance at all, so you can still invest up to £20,000 this tax year. Always, always, always use the transfer form. Never withdraw the money yourself to pay in, as you'll lose your tax-free benefits on that omney forever. Simply set up a Wealthify ISA Plan first, then we will give you the transfer form to fund your plabn with your previous ISA.

INVESTING REIMAGINED

- Low fees

- You're in control

- No minimum

- Withdraw anytime

Investing is now affordable.

Wealthify management fees start from 0.7% a year, going down to 0.4% for larger investments. Additional fund provider charges are typically 0.22% a year. There's also a small transaction cost when you buy or sell the investments in your Plan, which on average works out at around 0.07%.

About our fees

Set your goals and choose how you want to reach them.

Set up multiple Plans, each with a risk level that you choose. We also have a range of Ethical Plans, to help you invest in line with your values.

How wealthify works

Invest as little or as much as you like.

Start with a lump sum or whatever you can afford. Add regular monthly payments and top up your plan whenever you like.

Try it out

Your money is not locked in.

Add to your Plan or withdraw your money whenever you like, without notice or penalty.

How wealthify worksYou can transfer your Child Trust Fund into a Junior ISA, but you can’t have both types of accounts open at the same time.

Parents in the UK save, on average, £42.45 a month for each child.

*Source: L&G Investments

For your first child, you may be entitled to £20.70 child benefit per week. If you put it into a Junior Stocks and Share ISA every month, your child could get around £24,343 on their 18th birthday.

This shows a possible future value for a Confident Plan. This is only a forecast and not a reliable indicator of future performance.

*Source: L&G Investments

What is the Junior ISA allowance?

Grown up investing for your little ones

Setting up a Junior Stocks and Shares ISA is simple and straightforward.

Choose how much you’d like to invest and pick one of five investment styles.

We build a Junior Stocks & Shares ISA Plan and monitor it regularly.

Check how their Junior ISA is performing 24/7 by signing into your dashboard.

Use it or lose it

Use your child’s £4,368 Junior ISA allowance by 5th April, or lose it forever

Transfer to a Wealthify Junior ISA

You can easily transfer a Junior Cash ISA, Junior Stocks and Shares ISA, or Child Trust Fund you have with other providers to Wealthify, as long as you are the registered contact for the account.

Your child can’t have a Junior ISA and a Child Trust Fund at the same time, so if you want to open a Wealthify Junior ISA you will need to follow our transfer process.

We can only accept a transfer of the whole amount of an existing Junior Stocks and Shares ISA or Child Trust Fund.

To find out more, download our Guide to Junior ISAs.

Make your money work as hard as you do

- Start investing with as little or as much as you like

- Choose how much you want to invest and pick a level of risk that's right for you - from Cautious to Adventurous

- Add more money monthly to build up your Plan and withdraw if you need to without penalty

- Check how your Plan is performing whenever you like

- Know how much you're paying out with our clear and affordable fees

Invest in Your Values

Saving for the future is important, and so is staying true to your values.

Wealthify has joined forces with best-in-class ethical fund providers to create a range of five Ethical Plans that let you invest in organisations committed to having a positive impact on society and the environment.

All our fund providers are signatories of the Principles of Responsible Investing (PRI), the world’s leading proponent of responsible investing. They actively-manage their ethical funds, keeping a close eye on the organisations in which they invest, and employing rigorous ongoing screening to ensure that ethical standards are maintained.

So now you can do your bit for the future and give your money a chance to grow.

There’s estimated to be over £19 billion invested in ethical funds in the UK alone. Globally the figure is more like $80 billion.

Ethical investing is a catch-all term for various forms of sustainable investing, such as Environmental, Social and Governance (ESG), Socially Responsible Investing (SRI) and Impact Investing.

The UK’s first ever ethical fund launched way back in 1984. It was called the F&C Stewardship Growth Fund.

We invest

Wealthify Ethical Plans aim to exclude industries and activities that are considered harmful to society and the environment, from tobacco and gambling to deforestation and unfair labour practices.

We only invest in organisations committed to making a positive impact through their environmental, social and governance (ESG) practices.

So you can invest in a sustainable way.

Our ethical fund managers regularly monitor the activities of the companies they invest in and can use their shareholder influence to maintain and raise ethical standards.

We optimise

Our investment team uses a bespoke optimisation tool and regularly reviews your Plan to keep performance on track.

Above all, we aim to make sure your investments take advantage of the good times and are sheltered from the bad.

However, please bear in mind the value of your investments can go down as well as up and you may get back less than you invested.

Pension Calculator

Want a better idea of what your pension could pay? Our calculator can give you an idea of how much you might want to save for your retirement.

Let us know how much is in your pension, when you're planning to retire, and how much you regularly contribute. The calculator will apply our projected investment performance and give you an idea of how much your pension might pay.

Calculate your savings pot nowSimulated Past Performance

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 29th February 2016 and 31st March 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

The above graph illustrates past performance for Original Plans only. Even though the past performance data shown is simulated, it represents real transactions we've carried out for actual customer Plans across our five Investment Styles. Please remember that simulated past performance is not a reliable indicator of future performance.

FIVE-YEAR PERFORMANCE

The table below shows our actual past five-year performance for each of our Original investment styles.

| Investment Style | 28/06/2024 - 28/06/2025 |

|---|---|

| Cautious | 4.19% |

| Tentative | 4.55% |

| Confident | 4.94% |

| Ambitious | 5.30% |

| Adventurous | 5.55% |

Simulated Past Performance

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 28th February 2018 and 31st March 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures apply to plans of any value.

Original

Ethical

The above graph illustrates past performance for Ethical Plans only. Even though the past performance data shown is simulated, it represents real transactions we've carried out for actual customer Plans across our five Investment Styles. Please remember that simulated past performance is not a reliable indicator of future performance.

FIVE-YEAR PERFORMANCE

The table below shows our actual past five-year performance for each of our Ethical investment styles.

| Investment Style | 28/06/2024 - 28/06/2025 |

|---|---|

| Cautious | 3.91% |

| Tentative | 3.70% |

| Confident | 3.40% |

| Ambitious | 2.59% |

| Adventurous | 2.45% |

Our Investment Strategy

Safe & Secure

Regulated

Safeguarded

Help is on hand

Safe & Secure

Regulated

Safeguarded

Help is on hand

In safe hands

Your money is looked after by our team of qualified investment managers with over 50 years experience in established UK firms. They monitor and adjust your plan regularly, making sure it's always optimised

Strength In Depth

We’re backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 300 years.

Wealthify operates independently but Aviva own a majority shareholding, which means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Aviva’s investment in Wealthify allows us to achieve all the things we always wanted to, but at an accelerated pace and with greater confidence.

Multi-award-winning investing

Here are just a few of the prestigious awards we've picked up along the way

Boring Money Best Buys 2020

Best Investment Provider

Boring Money Best Buys 2020

Best Investment Provider

Boring Money Best Buys 2020

Best Investment Provider

Boring Money

Best Online Investment Service

British Bank Awards 2020

Best Investment Provider

COLWMA

Best Goal Based / Robo Investing

Personal Finance Awards 2019

Best Junior ISA

Shares Awards 2019

Best Online Investment Provider

Robo Investing Awards

Best Interface and Best Ethical Investments

Moneyfacts Consumer Awards 2019

Highly commended: Digital Wealth Management Provider of the Year

Learn more about our Investment ISA

-

How do I set up an ISA?

-

When you’re building your Personal Investment Plan, the first question you will be asked is whether you would like to open an ISA or a regular account. Select ‘ISA’ to create an Investment ISA Plan. Under the current rules, you can only open one of each type of ISA per tax year (Investment ISA, cash ISA, Innovative ISA and Lifetime ISA), but you can split your £20,000 annual tax-efficient ISA allowance between them however you like.

If you’re likely to exceed your ISA allowance, you can simply set up a Regular Investment Plan to invest additional funds. There’s no extra cost for having two or more Plans.

-

How much can I contribute to an ISA each year?

-

The maximum you can save in an ISA is £20,000. The tax year runs from 6 April to 5 April the following year. Under the current rules, you can put the full amount in either a cash, peer to peer lending, or investment ISA, or split it between the two in any combination you like.

-

What’s the difference between a Stocks & Shares ISA and an Investment ISA?

-

Nothing at all. They are just different names for tax-free investments.

-

Can I transfer in an existing ISA from elsewhere?

-

Yes, you can transfer your previous years' investment ISAs, innovative finance ISAs, or cash ISAs to another investment ISA provider at any time. Transfers don't impact your current year’s ISA allowance at all, so you can still invest this tax year’s full ISA limit as well as transfer existing ISAs over.

However, always, always, always use the transfer form!! Never withdraw the money to pay in, as you'll lose your tax-efficient benefits on that money forever. To arrange a transfer, simply create a Wealthify ISA Plan, then complete our simple ISA transfer form. We’ll arrange everything else.

-

Can I transfer my Wealthify Stocks and Shares ISA to another provider?

-

Yes, you can transfer your Wealthify Stocks & Shares ISA to either a Stocks & Shares ISA or a cash ISA with a different provider. If you want to transfer money you’ve invested in a Wealthify ISA in the current tax year, HMRC rules state you must transfer all of it, whereas previous years’ ISAs can be transferred in whole or in part. It’s worth checking with your new ISA provider for any restrictions or charges they may apply to transferring ISAs. Wealthify will never charge you for transferring ISAs in or out.

-

Are Wealthify ISA Plans treated differently from regular Wealthify Plans?

-

ISA Plans offer tax-efficient benefits compared to a Regular Investment Plan. With an ISA, you won’t pay any capital gains tax or UK income tax on your returns. The other main difference with an ISA Plan is that you can only pay in up to your annual ISA allowance each year. Regular Wealthify Plans do not limit the amount you can invest, but you will pay tax on your returns.

-

If I have regular and ISA Plans, do they count together to decide what fee I pay?

-

Yes. The fee you pay is a percentage of the combined value of all your Wealthify Plans.

-

Can I withdraw from my ISA?

-

Yes, you can withdraw funds from your ISA plan at any time, without penalty. New flexible ISA rules introduced from April 6 2016 allow you to withdraw money from your ISA without losing any of your tax-free allowance, provided you top up your ISA during the same tax year the withdrawal was made. Prior to April 6 2016, the tax-free status was surrendered on any sum withdrawn from your used ISA allowance.

-

Can I have more than one ISA with Wealthify in the same tax year?

-

Under current tax rules, you can contribute to one cash ISA and one investment ISA (aka Stocks & Shares ISAs) per tax year to take advantage of your tax-efficient savings benefits. These ISAs can be with the same, or different providers.

If you contribute to an investment ISA with Wealthify this tax year, you can’t contribute to an investment ISA with another provider this tax year, regardless of how much of your ISA allowance you have available.

However, you can create as many ISA investment plans within your Wealthify account as you like in one tax year, as long as the combined total contributions you make to these plans does not exceed £20,000. So, if you have various goals in mind, you can create different ISA pots for each one.

-

Who can open an ISA?

-

You can open an ISA with Wealthify if you:

Are over 18

Are UK tax resident

Have not opened an Investment ISA (other than within a Lifetime ISA) with another provider in the current tax year.

You can put up to £20,000 a year in a Cash ISA, Investment ISA, Lifetime ISA, or Innovative Finance ISA, or you can split your allowance between them. Please note, Wealthify only offers Investment ISAs.