Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

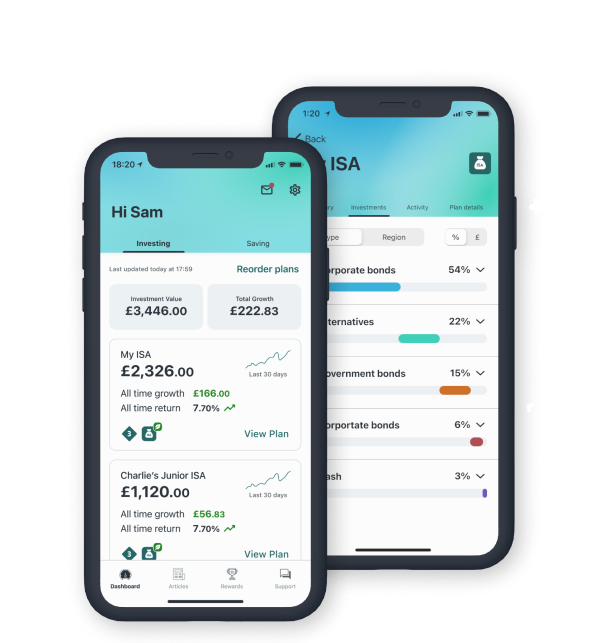

Open a Wealthify General Investment Account

Get more from your money with an investment account that can be set up in just minutes and started with as little as £1.

General Investment Accounts (GIAs) are a simple way to invest and a great option

if you've used up your annual ISA allowance. You can start a GIA with as little

or as much as you like and there's no limit to how much you can put in.

Our experienced investment team will build and manage your General Investment Account for you.

You can add to or withdraw from your GIA whenever you want, and keep an eye on how it's performing any time,

either online or on our app.

Simply choose how much you'd like to invest and the level of risk you are comfortable

with and see how much your money could be worth.

Invest your way

You can choose to invest your money in our Original or Ethical Plans.

Original

Original Plans use low cost investment funds to give you the broadest access to the stock market. They mostly use instruments known as 'passive investments' that track financial markets.

We use funds from leading providers to build our range of five original Plans.

Ethical

Saving for the future is important, and so is staying true to your values.

Wealthify has joined forces with best-in-class ethical fund providers to create a range of five Ethical Plans that let you invest in organisations committed to having a positive impact on society and the environment.

Start investing in 3 simple steps

1. You choose

Tell us what type of investor you want to be: cautious, adventurous or in between.

2. We invest

We build you a Personal Investment Plan with just the right mix of investments.

3. We optimise

We monitor your Plan 365 days a year and adjust it to keep everything on track.

Make your money work as hard as you do

- Start investing with as little or as much as you like

- Choose how much you want to invest and pick a level of risk that's right for you - from Cautious to Adventurous

- Add more monthly to build up your Plan and withdraw if you need to without penalty

- Check how your Plan is performing whenever you like

- Know how much you’re paying with our clear and affordable fees

Simulated Past Performance

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 29th February 2016 and 31st March 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

The above graph illustrates past performance for Original Plans only. Even though the past performance data shown is simulated, it represents real transactions we've carried out for actual customer Plans across our five Investment Styles. Please remember that simulated past performance is not a reliable indicator of future performance.

FIVE-YEAR PERFORMANCE

The table below shows our actual past five-year performance for each of our Original investment styles.

| Investment Style | 28/06/2024 - 28/06/2025 |

|---|---|

| Cautious | 4.19% |

| Tentative | 4.55% |

| Confident | 4.94% |

| Ambitious | 5.30% |

| Adventurous | 5.55% |

Simulated Past Performance

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 28th February 2018 and 31st March 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures apply to plans of any value.

Original

Ethical

The above graph illustrates past performance for Ethical Plans only. Even though the past performance data shown is simulated, it represents real transactions we've carried out for actual customer Plans across our five Investment Styles. Please remember that simulated past performance is not a reliable indicator of future performance.

FIVE-YEAR PERFORMANCE

The table below shows our actual past five-year performance for each of our Ethical investment styles.

| Investment Style | 28/06/2024 - 28/06/2025 |

|---|---|

| Cautious | 3.91% |

| Tentative | 3.70% |

| Confident | 3.40% |

| Ambitious | 2.59% |

| Adventurous | 2.45% |

Wealthify Customer Reviews

Passive Investing

We use mostly low-cost passive investments, such as ETFs and mutual funds. These let your money track a market index like the FTSE 100 in the UK, and many others around the world. Passive investing is proven to be more effective long-term than an active investment strategy, where fund managers pick the stocks they think will do best.

We use funds from leading providers to build your plan

Learn more about general investing

-

Where is my money invested?

-

Your money is invested into mainly passive investment funds, such as Exchange Traded Funds [ETFs] and Mutual funds

-

What is a fund?

-

A fund is a bundle of lots of individual assets, like stocks, bond or property, which you buy all in one go – this makes buying funds a cost-effective way to invest and diversify your portfolio.

-

Who decides what goes into my Plan?

-

Our experts have pre-selected a range of passive investment funds, which we use to build your Wealthify Personal Investment Plan. The mix of funds in your plan will depend on your attitude to risk – if you have a low risk appetite, your Plan will contain a higher percentage of low-risk funds. Higher-risk Plans will include more high-risk investments. Since financial markets are always changing, we might make small periodic changes to the mix of funds in your plan to make sure it still matches your risk profile and goals.

-

What's passive investing?

-

Why invest in one company, when you can invest in them all? That’s the essence of passive investing. Instead of putting all your eggs in one basket and relying on one particular company to perform well, you spread your money across all of them, so that you benefit from their collective strength. To do this, you need funds like ETFs and Mutual Funds (known as passive investment vehicles). These let your money track an index like the FTSE 100, which is composed of the 100 largest companies listed on the London Stock Exchange – companies like Royal Dutch Shell, BT Group and Unilever.

Passive investing is generally accepted as a more effective long-term strategy than the alternative, active investing, where fund managers try to pick the stocks they think will do best. The Dow S&P Indices show that as few as 14% of active fund managers actually manage to beat the market each year, when looked at over a long time period.

-

What assets will I have in my plan?

-

Your plan will consist of a mix of assets, such as shares, government bonds, corporate bonds, cash, property, private equity, commodities and hedge funds. You can find out more about all of these in the Glossary. The exact combination will depend on the preferences you give us when you apply, and will change over time.

-

What returns am I likely to get and are they guaranteed?

-

When you build your Wealthify Personal Investment Plan, we give you a calculation of what it could be worth at the end of your investment timeline. The calculation uses past benchmark data (see explanation below) to predict future performance, so you should only take it as a guide, not a guarantee. With investing, there are no guaranteed returns and you should remember that the exact value of your plan could be more or less than you expect.

-

Why is there cash in my investments?

-

Cash is a type of investment (or asset) itself. It’s a low risk asset, so the return on cash is typically low, but it’s a good way to help protect investors from losses if there’s an indication that markets might lose value. The amount of cash and cash equivalent assets in your plan will depend on the level of risk you choose and will be adjusted periodically in response to market movements.