Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

Bring Your Pensions Together

Our straightforward consolidation process makes it easy to transfer your pensions to Wealthify, giving you a clearer view of your future.

Slide your pensions out of snooze mode

Don't put off dealing with your pensions until later - wake them up with our pension transfer offer. You could earn up to £200 cashback and also be entered into a prize draw for your chance to win £20,000 - now that's an offer worth getting out of bed for!

Here's how much you could earn:

- £50 for transfers between £50 and £9,999

- £100 for transfers between £10,000 and £19,999

- £200 for transfers of £20,000 or over

Terms and conditions apply. Capital is at risk.

Prize draw open until November 11th and excludes Northern Ireland.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Get a clear view of your pensions

In the UK, most people have around 6 jobs by the time they're 45. Don't lose track of your pensions; make the most of them by consolidating them in a Wealthify Pension.

Bringing your pensions together can give you a clear view of how much is in your pot and let you check you're on track.

Start a Transfer

Transfer in 3 easy steps

Tell us about your pensions

Tell us a few details about your pensions, including a reference number and recent value.

We manage your transfer

We’ll talk to your provider and start the transfer. This usually takes 2-6 weeks.

We invest and optimise

We'll monitor your Plan 365 days a year, adjusting it to stay on track.

Reasons to Consolidate

Make it easier to manage your pensions by bringing them together with Wealthify. See how much is in your pot, how it's performing, and what you're paying.

- Simple sign up process

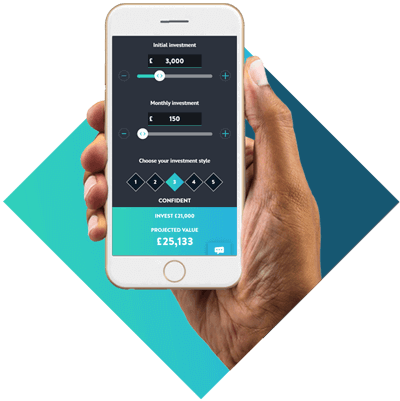

- Change your investment style whenever you need to

- No set up or transfer fees

- Ethical Pensions available

- Low cost, so you keep more of your money

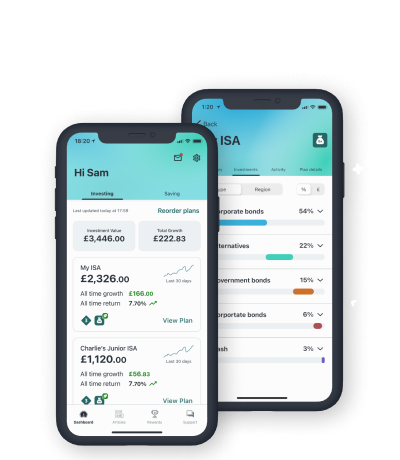

- Track performance 24/7 online or in our app

- Choose how you're invested

- Drawdown from 55 with an option to take 25% tax-free

Your current provider may charge exit fees, so it's worth checking before you transfer. We're unable to accept any pensions that you're already taking an income from, or that have defined benefits or guarantees. You can find out more about this in our FAQs.

WHY CHOOSE WEALTHIFY?

- One Low Fee

- Flexible

- Safe & Secure

- Here for You

Complete transparency

Some providers have a low management fee, but hide extra charges which can impact your returns over time. At Wealthify, we charge a flat fee to manage your Pension, so you always know where you stand.

About our fees

You’re in control

A Pension that fits in with you - choose to set up a regular payment, or top up whenever you can. Change or pause your payments anytime online or in our app.

Get StartedIn safe hands

Up to the first £85,000 of your money can be protected by the Financial Services Compensation Scheme (FSCS) and we’re authorised and regulated by the Financial Conduct Authority (FCA).

How Wealthify works

Here when you need us

From sign up to draw down, we offer no paperwork, no post, just a simple, seamless online pension. If you do need help, our UK based customer care team are available on phone, live chat or email.

Contact usSimulated Past Performance

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 29th February 2016 and 31st March 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

The above graph illustrates past performance for Original Plans only. Even though the past performance data shown is simulated, it represents real transactions we've carried out for actual customer Plans across our five Investment Styles. Please remember that simulated past performance is not a reliable indicator of future performance.

FIVE-YEAR PERFORMANCE

The table below shows our actual past five-year performance for each of our Original investment styles.

| Investment Style | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 |

|---|---|---|---|---|---|

| Cautious | 0.47% | -11.19% | 4.65% | 1.05% | 6.08% |

| Tentative | 3.72% | -10.82% | 6.21% | 3.36% | 8.02% |

| Confident | 6.66% | -10.33% | 7.76% | 6.09% | 9.93% |

| Ambitious | 9.66% | -9.39% | 9.46% | 9.10% | 11.58% |

| Adventurous | 12.75% | -9.14% | 11.35% | 12.27% | 12.95% |

Simulated Past Performance

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 28th February 2018 and 31st March 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures apply to plans of any value.

Original

Ethical

The above graph illustrates past performance for Ethical Plans only. Even though the past performance data shown is simulated, it represents real transactions we've carried out for actual customer Plans across our five Investment Styles. Please remember that simulated past performance is not a reliable indicator of future performance.

FIVE-YEAR PERFORMANCE

The table below shows our actual past five-year performance for each of our Ethical investment styles.

| Investment Style | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 |

|---|---|---|---|---|---|

| Cautious | 0.73% | -14.93% | 4.80% | 0.70% | 5.22% |

| Tentative | 4.11% | -15.65% | 6.85% | 2.77% | 5.75% |

| Confident | 7.63% | -16.51% | 8.81% | 5.01% | 6.12% |

| Ambitious | 11.18% | -17.42% | 11.08% | 7.34% | 5.64% |

| Adventurous | 14.65% | -18.72% | 13.63% | 9.98% | 5.63% |

Free Pension Guide

Not all personal pensions are the same, so we’ve created this useful guide to give you information on:

- What a Self Invested Personal Pension (SIPP) is

- How the 25% tax relief top up works

- How a SIPP differs from a workplace pension

- Reasons for consolidating pensions

This guide doesn't offer personal advice, speak to a financial adviser if you're unsure about whether investing is right for you.

Wealthify Customer Reviews

Test

Learn more about our Pension

-

Is my money locked in?

-

No, not at all. Although you should always approach investing as a long-term way to grow your money, you can withdraw your money from Wealthify at any time, if you need to and there’s no charge or penalty for withdrawing. It will take up to 10 working days for us to release the money from your investments – it could be quicker, but we can’t promise.

-

Is my money safe?

-

Yes, your investments will be held with Winterflood Securities Limited, who act as custodian for our customers’ money. They are a global financial services provider, regulated by the Financial Conduct Authority (FCA) and part of Close Brothers Group, who have been trading for more than 130 years. They hold your cash and investments separately from their own (ring fenced) in accordance with the FCA’s client asset rules, so even if Wealthify went into administration, our creditors would not have a claim to your investments.

-

Can I invest monthly?

-

Of course! You can make regular payments from just £1 per month by setting up a standing order, or make manual payments as many times as you like each month, whenever you can afford it.

-

What is ethical investing?

-

Ethical Investing aims to exclude profiting from activities that are considered harmful to society and the environment and invest in organisations companies and projects that are committed to operating in a way that is sustainable for the future.

This is typically done by filtering out harmful activities (negative screening) and proactively seeking to invest in companies that are committed to making a positive impact through their environmental, social and governance (ESG) practices (positive screening).

Negative screening: most ethical funds will screen the so-called ‘sin stocks’ such as tobacco, gambling, weapons and adult entertainment. Other issues screened might include animal testing, intensive farming, nuclear power, genetic engineering, deforestation, and poor human or labour rights. The activities screened and the screening criteria used vary between fund providers.

Positive screening: aims to identify those companies demonstrating or showing commitment to achieve the highest standards of practise in the areas of environmental impact, social justice and corporate ethics. Only organisations that score highly across these three areas will be eligible to receive investors’ money.

Wealthify’s ethical plans combine negative screening with proactive selection based on ESG scores as well as consideration of other factors that contribute to a commitment to future sustainability.

Ethical investing is one of a number of terms used to identify sustainable approaches to investing. Others include: Environmental, Social and Governance (ESG), Sustainable investing and Impact investing. Find out more about these below.