Junior ISA Transfer

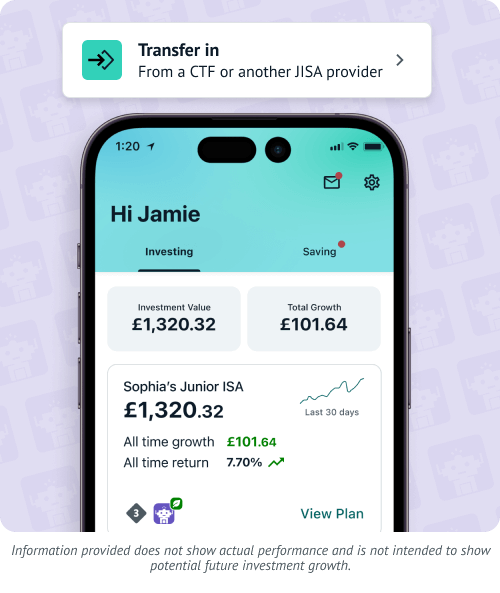

Transferring into a Wealthify Junior Stocks and Shares ISA couldn’t be simpler.

✓ Fees: A simple annual management fee of 0.6% a year for our Junior ISA (JISA) – make sure to check how this stacks up against any current fees.

✓ Charges: It’s free to transfer an existing Junior ISA or Child Trust Fund (CTF), just double-check your current provider doesn’t charge exit fees.

✓ Benefits: Friends and family can contribute, with an annual Junior ISA allowance of £9,000 for the 2025/26 tax year.

Minimum £500 deposit. With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and can change. ISA rules apply.

Best Junior ISA - 7 years running

Personal Finance Awards

How to transfer a Junior ISA to Wealthify

Whether you're moving from another provider or consolidating your child's investments into one pot, our Junior ISA transfer process takes just 4 simple steps.

Enter a few details

Fill in our Junior ISA transfer form, tell us how much you’ll be transferring over, and pick an investment style that suits you.

Answer our quiz

Take our short suitability quiz to help make sure that a Junior ISA is right for you and your child.

We build your little one’s portfolio

We have a team of investment experts on hand to build your child an investment portfolio that’s aligned with your values and investment style.

Leave it to the experts

Sit back, relax and let us do everything for you. You can monitor your child’s investments at any time using our app or online.

Why transfer a Junior ISA to Wealthify?

✓ Hassle-free transfer process.

✓ Low and transparent fees.

✓ Transfer any type of Junior ISA or CTF to a Wealthify JISA.

✓ Choose from 5 investment styles, from Cautious to Adventurous.

✓ Change your Plan’s investment style at any time.

✓ Ethical Plans are available to align with your values.

✓ Anyone can become a contributor to the child’s Junior ISA.

✓ Owned and backed by Aviva.

✓ Winner of the Best Junior ISA Personal Finance Awards - 7 years running.

✓ Deposit up to the £9,000 Junior ISA allowance, per tax year.

Wealthify Junior ISA reviews

Naturally, we think our Junior ISA is pretty good. But don’t just take our word for it.

Because, as well as being voted Best Junior ISA at The Personal Finance Awards (seven years running), here are just some of our favourite reviews.

“Great JISA products for both of our kids. Best thing we did was to open one for each. Money goes in each month, we send a link to friends and family to deposit for Christmases etc."

– Nathan M

"Moved from CTF to JISA with Wealthify. Kept informed of process knew exactly where I was — and now all details are easily accessible.

Have already recommended to three other people."

– Joyce W

“Generally speaking, I'm not good with following stuff on my laptop. I was pleasantly surprised at how easy it was when I first logged in to check on my granddaughter's ISA.

There's no faffing around with lots of details... just log in and the info is right there! I love it!”

– Christine R

Junior ISA Transfer Rules

Here are some considerations to see if transferring into a Junior ISA is the best choice for you and your child.

- Junior ISAs can be either a Junior Cash ISA or a Junior Stocks and Shares ISA (Wealthify offers the latter). Unlike the adult ISA rules, your child is only allowed to have a maximum of one of each type of these ISAs; one Junior Cash ISA, and/or one Junior Stocks and Shares ISA.

- If you’re transferring into Wealthify’s Junior ISA with money that’s been deposited into their existing Junior ISA account during the current tax year (6th April to the following 5th April), all of that deposited money (sometimes called ‘subscriptions’) must be transferred to us in full.

- These rules around deposits that have been made in the current tax year don’t apply to the Child Trust Fund in the same way. If you’re transferring from a Child Trust Fund into a Junior ISA, the child’s full Junior ISA allowance of £9,000 for the tax year is available to them, no matter how much has been deposited into the CTF during that tax year. After that tax year, they will have only the £9,000 allowance available to them as standard.

- As Child Trust Funds are no longer available to new customers, the entire fund must be transferred and the account will then close.

Looking to start a new Junior ISA?

Daydreaming about your child’s financial future shouldn’t be taxing.

Our tax-efficient Junior Stocks and Shares ISA is designed to take the heavy lifting out of building your child’s first nest egg.

With a JISA, you can teach your kids about money management as they grow while potentially building a fund to springboard their future ambitions.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Invite friends and family to contribute

Add a personalised touch to gift giving with a Junior Stocks and Shares ISA from Wealthify.

From Aunty Mary’s annual birthday cheque – to Grandpa Dave’s regular pocket money – you can invite family members or close friends to become contributors to your child’s Junior ISA, with the option to include a heartfelt message for your child to look back on.

Wealthify Customer Reviews

Looking for support?

Our Customer Care team are always there to help, whether you have a question about your Wealthify Plan, you’re having trouble with the app, or you’re simply unsure of how to get started when it comes to investing with us. Whatever you need, just get in touch.

Telephone

Chat with our friendly team on 0800 802 1800, Monday - Friday, from 8.00am - 5.30pm.

Live Chat

Chat to one of our team online.

JUNIOR ISA FAQs

A Junior ISA is a tax-efficient way to save and invest on behalf of your child.

Payments into a Junior ISA are different from adult ISAs, because the money you put in belongs to your child. Once you put money in, you can’t take it out again, except in exceptional circumstances, and your child can only get access to their money when they turn 18.

There are two types of Junior ISA:

- Junior Cash ISAs: earn interest like a savings account. The interest rate is fixed and typically based on the rate set by the Bank of England.

- Junior Stocks & Shares ISAs: (Also known as Junior Investment ISAs), these invest in financial markets with the aim of earning returns for investors that are greater than those you would get in a Junior Cash ISA. Returns are not guaranteed, and the value of your investments can go down as well as up.

Your child can have one or both types of Junior ISA and you can deposit up to the annual limit of £4,260 into them in any combination you like.

For example, you could pay £2,000 into a Junior Cash ISA and up to £2,260 into a Junior Stocks and Shares ISA, or vice versa. You can split the allowance however you want to between the two accounts.

The benefit of a Junior ISA is that you or your child won’t pay tax on any interest, returns or dividends they receive.

Wealthify only offers a Junior Stocks and Shares ISA. Any money paid into a Junior ISA will belong to the child, but they cannot access it until their 18th birthday.

Junior ISAs allow your child to keep more of their money by protecting any positive returns they receive from income tax and capital gains tax.

Only a child’s parent or legal guardian can open a Junior ISA account on their behalf.

Your child can have one Junior Cash ISA and/or a Junior Stocks and Shares ISA at any time, into which you can currently contribute a maximum of £4,260 per tax year, per eligible child. You can split the amount however you choose between a Junior Cash ISA and a Junior Stocks and Shares ISA as long as the combined amount doesn’t exceed the annual limit.

You don’t need to use the same provider for your child’s Junior Cash ISA and Junior Stocks and Shares ISA, so you’ve got flexibility to choose the best option for you and your child.

At the start of each new tax year, on 6 April, the child’s annual Junior ISA allowance re-sets and you can start another year of tax-efficient saving, up to £4,260 for each child.

Your child will only be able to access the money within their Junior ISA when they turn 18.

When they turn 18, the Junior ISA is automatically changed into an adult ISA. At this point, they can choose to keep saving or investing, or they can withdraw some or all of the balance to help pay for things like university, or a new car.

If you want to build an investment pot for your child that neither you or they can touch until your child turns 18, then a Junior ISA could be the answer. Any money paid into a Junior ISA belongs to the child and cannot be withdrawn by anyone other than the child when they turn 18.

Junior ISAs are available to children who:

- Are under the age of 18

- Are residents of the UK, or are dependants of a crown employee (e.g. army employee based overseas)

- And don’t already have a Child Trust Fund (CTF).

You can transfer your Child Trust Fund over to a Wealthify Junior ISA, but your child cannot have a CTF and a Junior ISA at the same time. When transferring a CTF to a Junior ISA, the full balance must be transferred.