Easy access Cash ISA

Powered by Clearbank

Save up to £20,000 each year — with no tax to pay on any interest earned!

- Earn 3.61% AER / 3.55% tax-free p.a. (variable) paid monthly.

- Access your money anytime, with no fees.

- Transfer your existing ISAs without losing your savings' tax-free status.

- Withdraw and replace funds without affecting your annual ISA allowance.

The tax treatment of your savings will depend on your individual circumstances and may change in the future.

OUR AWARDS CABINET

How does a Wealthify Cash ISA work?

Four simple steps. That’s all it takes to open and start saving with Wealthify’s easy access Cash ISA!

Set up

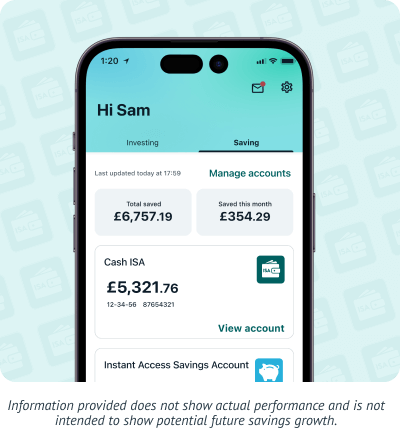

Using our website or app, start by telling us a few basic details about yourself.

Earn

Once your account is open, your savings will start to earn tax-free interest on a daily basis at a rate of 3.61% AER / 3.55% gross p.a. (variable).

Grow

The interest you earn is then paid into your account on a monthly basis, allowing your savings to grow.

Withdraw

If, for whatever reason, you need access to your money, you can withdraw it whenever you want — without any fees!

Please note that Clearbank Limited power our Cash ISA. All money held within it is sent directly to ClearBank, and never held by Wealthify.

The benefits of a Cash ISA account

So much more than just a flexible, easy access account, a Cash ISA with Wealthify has the following benefits:

- Low Minimum Deposit: You can start saving from as little as £1.

- No Monthly Fees: We don’t charge you any monthly fees for using our easy access Cash ISA.

- Award-Winning Platform: Whether it’s our easy-to-use app or friendly Customer Care Team, we make managing your money simple.

Cash ISAs are generally considered a safe option for your savings. If you’re not looking to take much risk but still want to give your finances a steady boost, then a Cash ISA could be a good option for things like your emergency funds and short-term goals.

A Cash ISA also comes with certain tax benefits, potentially making it more appealing than other savings products. Whether you’ve earned £5 or £5,000 in interest, for example, the earnings from a Cash ISA are always tax-free! And if you have other types of ISAs opened, another benefit of a Cash ISA is that you can split your allowance between them.

The tax treatment of your savings will depend on your individual circumstances and may change in the future.

Secure

Your login details will always be kept secure — but never shared with anyone else.

Support

Our friendly Customer Care Team are always happy to help via email, Live Chat, or on 0800 802 1800.

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

Cash ISA transfer

With an award-winning platform, low minimum deposit, and no monthly fees, there are plenty of reasons why you might transfer to a Wealthify Cash ISA. Thankfully, we've made the process of doing so a doddle!

Please note that while Wealthify does not charge transfer fees, some providers may impose exit fees. Always check with your provider before transferring your ISA.

You Choose

Fill out an official transfer form to retain your ISA tax-free status, before choosing how much you'd like to transfer from an existing Cash or Stocks and Shares ISA.

We transfer

We'll then talk to your provider(s) and start the transfer process. A Cash ISA to Cash ISA transfer typically takes up to 15 business days, while other transfers, such as from an investment ISA to Cash ISA, are usually completed within 30 calendar days.

We manage

Just sit back, relax — and let us manage everything for you! We’ll send an email confirmation once your transfer has been completed.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

What is a Cash ISA?

A Cash ISA is a tax-efficient savings account that lets you save up to £20,000 each tax year.

It’s tax-efficient because you don’t pay any tax on the interest you earn, whereas with a traditional savings account – including our Instant Access Savings Account – you usually pay income tax on earnings over £1,000.

A Cash ISA is different to a Stocks and Shares ISA (aka an Investment ISA) in that your money isn’t invested in the markets — or subject to its ups and downs. Instead, a Cash ISA gives you an interest rate and returns on your savings.

As well as letting you access your money whenever you want, ours is also a ‘flexible’ Cash ISA. This means you can withdraw and replace funds within the same tax year, without affecting your annual ISA allowance.

Our reviews

Powered by ClearBank

Wealthify, in collaboration with ClearBank, are providing you with an easy access Cash ISA account. Wealthify will provide the day-to-day servicing of the account (including being the point of contact for any questions you may have), with ClearBank providing the account itself.

All your eligible deposits in accounts powered by ClearBank are added together when determining your level of Financial Services Compensation Scheme (FSCS) protection. Compensation is limited to a maximum of £120,000 per person per banking licence. See which other deposit providers have accounts powered by ClearBank using ClearBank's banking licence here: FSCS Protection.

Cash ISA FAQS

Yes, you can have as many Cash ISAs with different providers as you want.

You have until midnight on 5th April each year to use your annual £20,000 ISA allowance, at which point, it resets for the coming year.

So, if you’ve paid £20,000 into a Wealthify easy access Cash ISA for the current tax year, you’d have to wait until the new tax year when your ISA allowance resets, to pay into it (or another one of your Cash ISAs) again.

Similarly, if you’ve only paid £19,000 into your Cash ISA with Wealthify for the current tax year, then you’re still free to save the remaining £1,000 of your allowance in a Cash ISA with another provider.

Yes, you can. Because they’re two different types of ISAs, you’re also allowed to pay into a Cash ISA and Stocks and Shares ISA in the same tax year. In fact, having both could be a good way to prepare for your immediate needs and financial future.

However, you’ll need to make sure your total contributions across both don’t exceed your annual ISA allowance of £20,000.

You can currently put £20,000 in a Cash ISA — although this amount is subject to change each tax year. This £20,000 allowance is for all your ISAs, however, not per ISA.

So, if you had one of each type of ISA, your £20,000 allowance would be spread across all four. You can choose to split this however you want, the only restriction being the Lifetime ISA allowance, which can only be £4,000 of your £20,000 limit.

Cash ISAs – including Wealthify’s easy access Cash ISA – are, subject to eligibility, protected by The Financial Services Compensation Scheme (FSCS).

Up to the first £120,000 of your money saved in a Wealthify easy access Cash ISA can be protected by the FSCS in the event of the insolvency of either our Cash ISA provider, ClearBank, or Wealthify itself.

The FSCS's compensation limit of £120,000 is per banking licence and as our easy access Cash ISA is powered by ClearBank, this means the £120,000 limit is shared across all accounts you hold with ClearBank.

For example, if you have £115,000 saved in a Wealthify easy access Cash ISA and £20,000 saved in another account powered by ClearBank elsewhere, only £120,000 of your deposits would be eligible for FSCS protection.

For more information, and to find a list of other accounts under the ClearBank banking licence, please visit the ClearBank website.

No, they’re just different terms that mean the same thing: being able to deposit and withdraw money from your Cash ISA at any time without penalty.

Some providers may have restrictions in place on their Cash ISAs, but at Wealthify you can rest assured that you can withdraw instantly, whenever you need.

The current interest rate on the Wealthify Cash ISA is 3.61% AER / 3.55% tax-free p.a. (variable) paid monthly.

Cash ISA Account Tips and Insights

If you’re looking for further information about Cash ISAs, why not check out our dedicated Cash ISA guide? Covering all the above subjects in even more depth, you can also learn about things like how Cash ISAs work over the long-term.

Blog Articles

THE WEALTHIFY GUIDE TO SAVING A LUMP SUM

Our handy guide to help you make the most of a lump sum.

INCOME TAX BRACKETS AND ALLOWANCE

What are they — and how do they affect your Personal Tax Allowance?

DO I HAVE TO PAY TAX ON MY SAVINGS ACCOUNT?

Find out more about the potential tax implications of saving money.

WHY DO INTEREST RATES GO UP AND DOWN?

We all know it happens, but have you ever actually asked yourself why?