Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

Ready to take control of your pensions?

If your pensions leave you dazed and confused, then it might be time for a change.

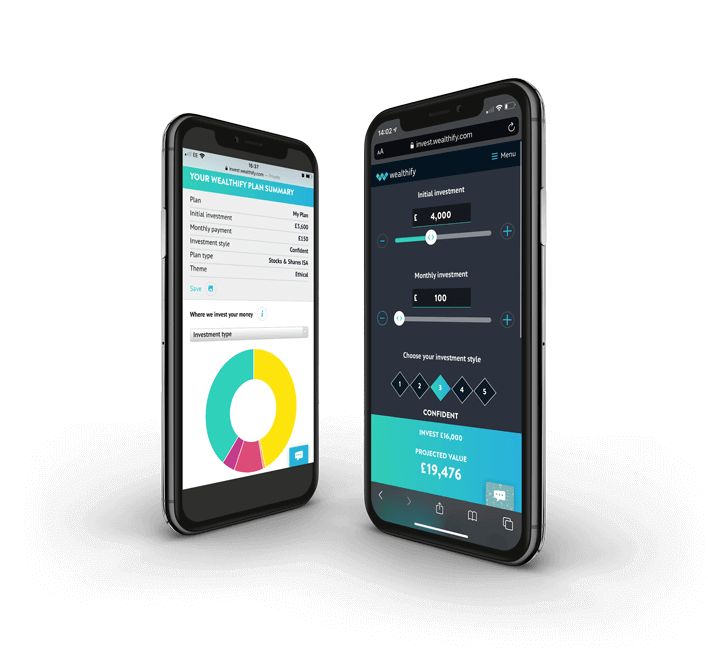

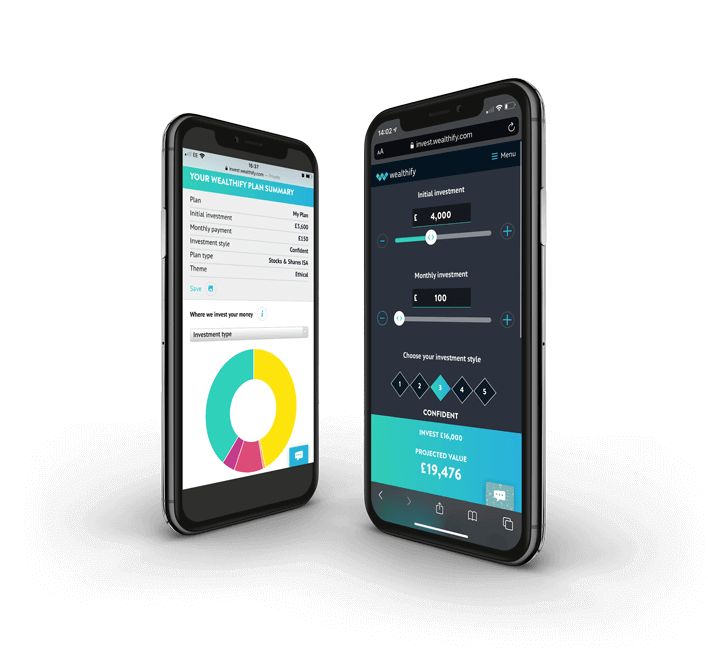

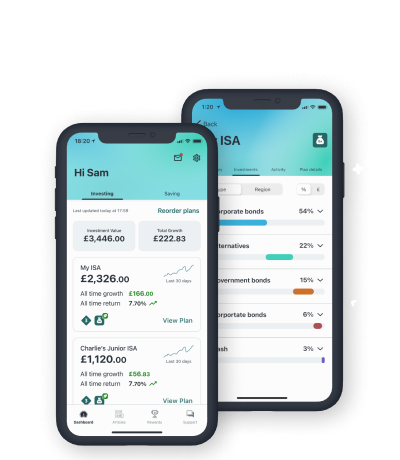

At Wealthify, we make pensions simple! You can easily bring your old pensions together into one pot – and our investment experts will help your money to grow in a way that’s right for you – you can even make it ethical. Instead of struggling to understand a paper statement each year, you’ll be able to quickly check on your retirement pot whenever you want, online or via our app.

And for a limited time, you could get up to £200 by transferring your pension to Wealthify:

- £50 for transfers between £5,000 and £9,999

- £100 for transfers between £10,000 and £19,999

- £200 for transfers of £20,000 or more

To be eligible, you’ll need to register your interest for this cashback offer between 1st September 2021 and 15th October 2021. Once registered, you’ll then have six months to come back and complete your transfer.

- This offer is open to new and existing Wealthify customers who are aged 18 years or older and are tax residents of Great Britain and Northern Ireland.

- This promotion provides cashback for successfully completed pension transfers to Wealthify in line with the following and subject to these terms and conditions:

- Transfers between £5,000 and £9,999 will receive £50 cashback;

- Transfers between £10,000 and £19,999 will receive £100 cashback; or

- Transfers of £20,000 or above will receive £200 cashback

- The cashback promotion is open for six weeks, starting from Wednesday 1st September 2021 and closing on Friday 15th October 2021 at 23:59 (the “Promotional Period).

- A customer must register their interest for this offer within the Promotional Period. Once registered, they then have six months from that date (the “Qualifying Period”) to make all transfer requests and be eligible for the cashback reward.

- The maximum amount of cashback available for a pension transfer is £200. You can transfer multiple pensions to boost the amount of cashback you could receive.

- If you are transferring multiple pensions, all transfer requests must be made within the Qualifying Period and the cashback will only be paid once all transfers have been completed successfully and in accordance with these Term and Conditions.

- To activate this offer and receive cashback, please make sure you’ve registered your account on our pension consolidation offer page. If your account has not been registered before choosing to transfer a pension to Wealthify, then cashback will not be paid.

- This is a transfer promotion only. If the total value falls below the qualifying amount, it cannot be topped up with cash deposits in order to receive the cashback.

- You must remain invested in your Wealthify Pension for six months to be eligible for the cashback.

- Within 30 days following the 6-month period noted in clause 9 above, the cashback will be paid directly into the bank account associated with your Wealthify account.

- Wealthify will not be responsible for paying any exit fees that may be charged by your current provider. It’s worth finding out if your existing provider charges exit fees, as these could limit the financial benefit of changing provider.

- We’re unable to accept any pensions that you’re already taking an income from or transfer any pensions with defined benefits or guarantees.

- This promotion cannot be used in conjunction with any other transfer offer.

- Investing with Wealthify is subject to a suitability assessment and no guarantee is made towards accepting you as a customer.

- By registering for this offer, you agree to receive occasional reminders about this promotion during the Qualifying Period.

- The Wealthify standard terms and conditions also apply and are not affected in any way by this offer.

- This promotion is not transferable and there are no alternatives available.

- Wealthify reserves the right to amend, withdraw or restrict this promotion at any time without notice.

- Wealthify accepts no liability or responsibility for claims under this promotion which are lost, delayed or undelivered, nor any liability for technical errors or communication failures in networks and/or internet access.

- This offer is not open to any employees of Wealthify, Embark or Winterflood Business Services.

- This promotion shall be governed and construed in accordance with the laws of England and Wales.

- The promoter of this offer is Wealthify Limited (“Wealthify”) whose registered office is at Tec Marina, Terra Nova Way, Penarth, CF64 1SA.

Risk Warning: With a Wealthify investment your money is at risk, as the value can go down as well as up. The tax treatment of your investment will depend on your individual circumstances and may change in the future. If you are unsure about whether investing is right for you, please seek financial advice.

Make the most of your old pensions

Many workplace pensions can be moved to another provider - and all it takes is just a few basic details to get started.

Simply let us know what pensions you want to combine, and we'll bring them all together in your Wealthify Pension - it really is as straightforward as that! You'll be able to see exactly how your retirement fund is shaping up, have flexibility over how you add to it, and could even save some money by moving from your old providers.

Start a transferMake the most of your old pensions

Many workplace pensions can be moved to another provider - and all it takes is just a few basic details to get started.

Simply let us know what pensions you want to combine, and we'll bring them all together in your Wealthify Pension - it really is as straightforward as that! You'll be able to see exactly how your retirement fund is shaping up, have flexibility over how you add to it, and could even save some money by moving from your old providers.

Start a transfer

Lost your pensions?

Don't worry if you can't find your pension, you're not alone! Losing track of traditional pensions is easily done, especially if you've moved house or can't find that all important paper statement.

The good news is that this problem is so common that we've pulled together a step by step guide to tracing your pensions. And if you're still stuck and want a bit more help, then get in touch with our Customer Care team.

Lost your pensions?

Don't worry if you can't find your pension, you're not alone! Losing track of traditional pensions is easily done, especially if you've moved house or can't find that all important paper statement.

The good news is that this problem is so common that we've pulled together a step by step guide to tracing your pensions. And if you're still stuck and want a bit more help, then get in touch with our Customer Care team.

Transfer in 3 easy steps

Tell us about your pensions

Tell us a few details about your pensions, including a reference number and recent value.

We manage your transfer

We’ll talk to your provider and start the transfer. This usually takes 2-6 weeks.

We invest and optimise

We'll monitor your Plan 365 days a year, adjusting it to stay on track.

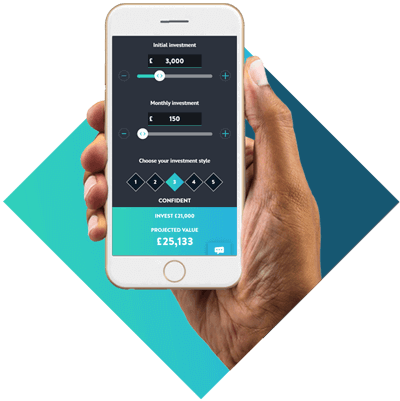

Take control of your future with our pension calculator

Remove the guesswork about your retirement with our simple four step pension calculator to find out how much you could have in your pension pot and what you might need for your perfect retirement

Start calculating my pensionALL YOUR PENSIONS IN ONE PLACE

- One Low Fee

- Flexible

- Safe & Secure

- Here for You

Complete transparency

Some providers have a low management fee, but hide extra charges which can impact your returns over time. At Wealthify, we charge a flat fee to manage your Pension, so you always know where you stand.

About our fees

You’re in control

A Pension that fits in with you - choose to set up a regular payment, or top up whenever you can. Change or pause your payments anytime online or in our app.

Get StartedIn safe hands

Up to the first £85,000 of your money can be protected by the Financial Services Compensation Scheme (FSCS) and we’re authorised and regulated by the Financial Conduct Authority (FCA).

How Wealthify works

Here when you need us

From sign up to draw down, we offer no paperwork, no post, just a simple, seamless online pension. If you do need help, our UK based customer care team are available on phone, live chat or email.

Contact usLearn more about pension consolidation

-

Who are Winterflood Securities Limited and what do they do?

-

Winterflood Securities Limited act as your custodian. This means they are responsible for holding your cash and investments safely. They are regulated by the Financial Conduct Authority (FCA) and are part of Close Brothers Group, who have been trading for more than 130 years. They hold your cash and investments separately from their own (ring fenced) in accordance with the FCA’s client asset rules.

-

Who is Wealthify backed by?

-

In February 2018, Wealthify entered into a strategic partnership with Aviva, the UK’s largest insurance provider and a global financial services company, which included Aviva taking a majority stake in the business.

This is great news for Wealthify customers. With Aviva’s backing we’ll be able to accelerate our ambitious growth plans and bring you a host of new features and products, so watch this space!

Our investment team will continue to manage your investments independently of Aviva. We do not currently use Aviva funds in our investment Plans, and there is no obligation for us to do so in the future.

Wealthify remains fully authorised and regulated by the Financial Conduct Authority and our customers’ money can be covered by the Financial Services Compensation Scheme (FSCS) up to £50,000.

-

Is my money safe?

-

Yes, your investments will be held with Winterflood Securities Limited, who act as custodian for our customers’ money. They are a global financial services provider, regulated by the Financial Conduct Authority (FCA) and part of Close Brothers Group, who have been trading for more than 130 years. They hold your cash and investments separately from their own (ring fenced) in accordance with the FCA’s client asset rules, so even if Wealthify went into administration, our creditors would not have a claim to your investments.

Wealthify Customer Reviews

Strength in depth

Wealthify is backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 300 years.

We operate independently of Aviva, which means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Being part of the Aviva group of companies allows us to develop our business, but at an accelerated pace and with greater confidence.