Why invest with Wealthify?

Even though our 125,000+ customers might have their own unique reasons for investing with us, here are some of the more common ones we’ve found since launching in 2016.

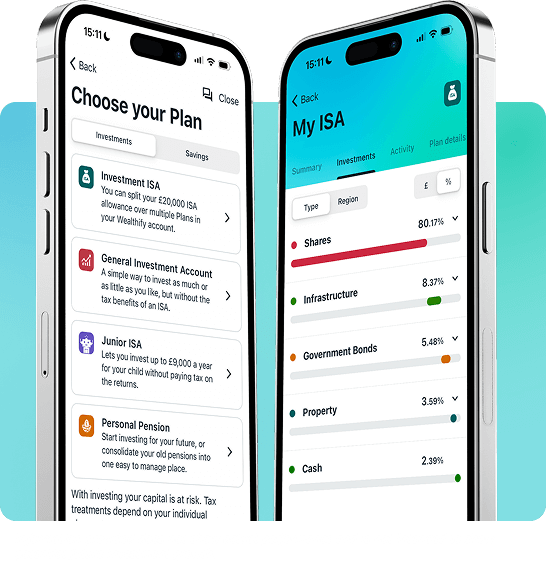

- Award-winning range of investment products to choose from.

- Simple investment styles built and managed for you by our team of experts.

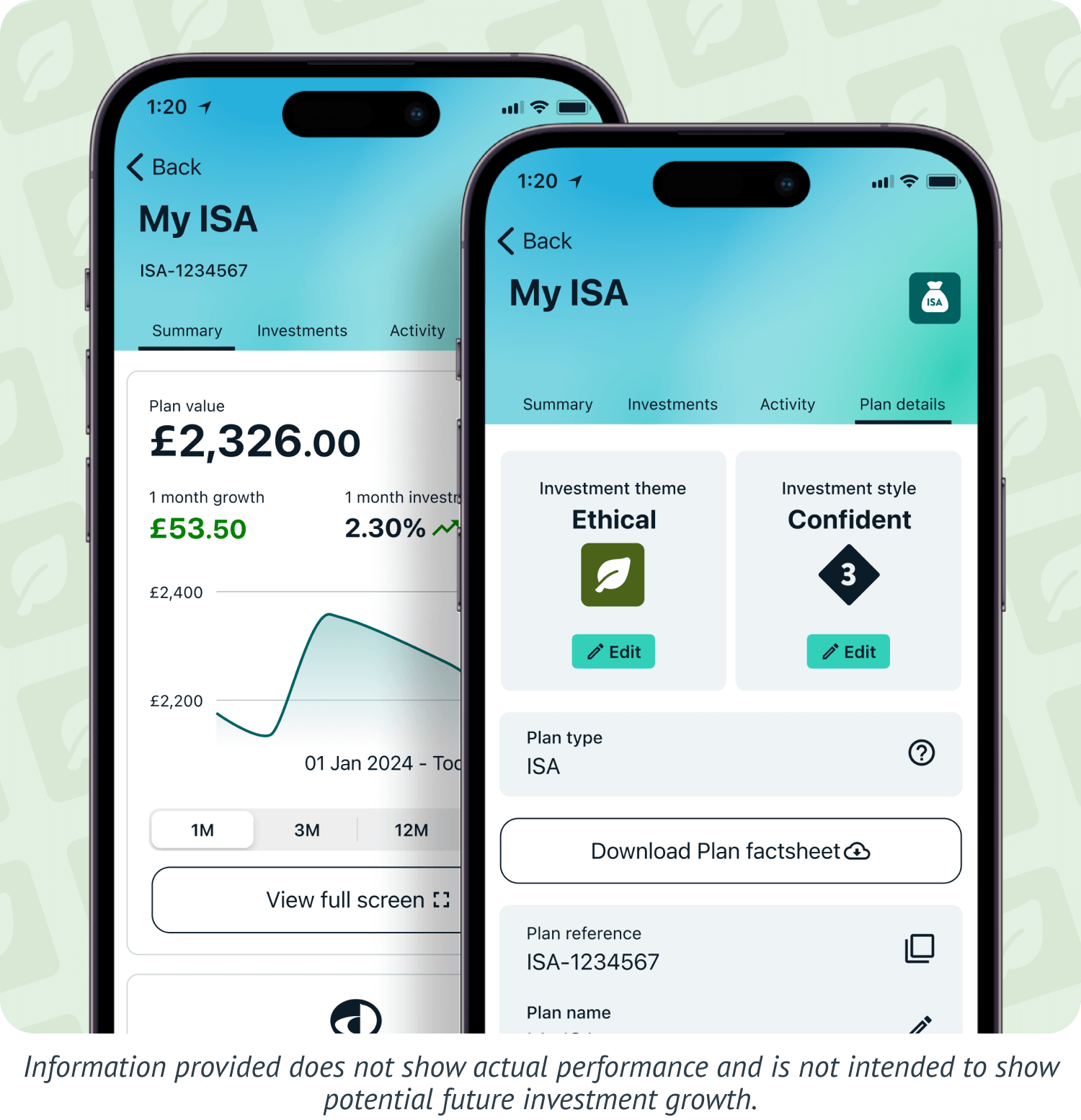

- Track investment performance 24/7, with our easy-to-use app.

- Owned and backed by Aviva.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Our Five Investment Styles

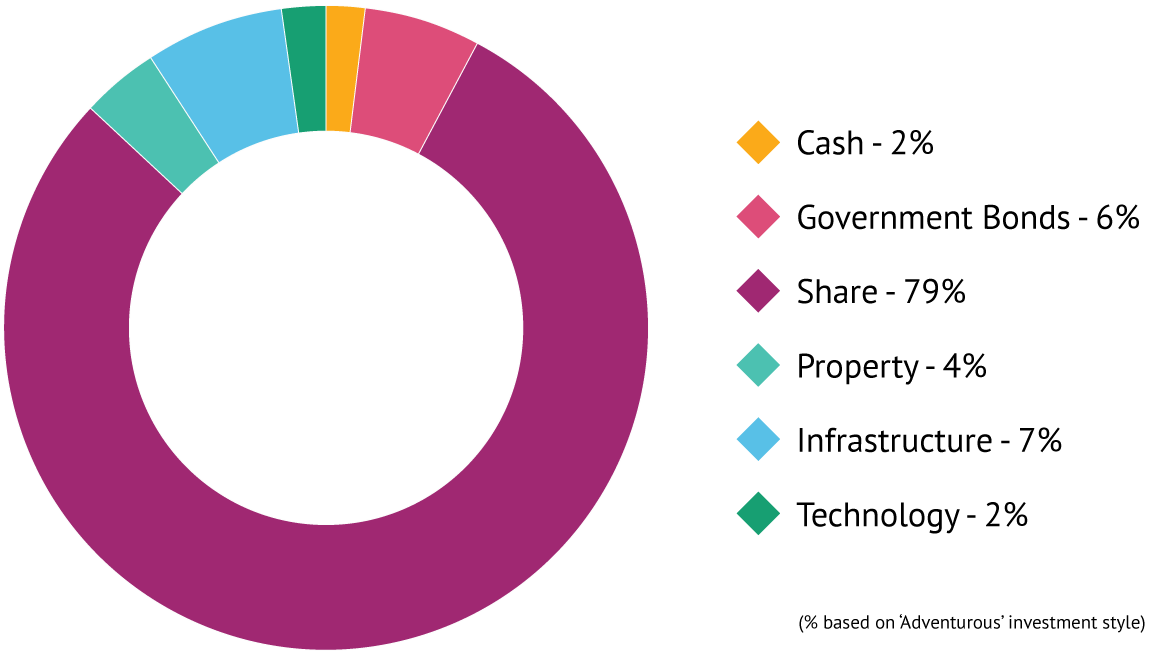

Our team of experts invest your money using a number of funds. A convenient, cost-effective way to access stock markets, think of funds as financial shopping baskets. From shares to bonds, property to commodities; funds contain a balanced mix of different investment types, helping you spread your risk. This risk-spreading strategy is known as diversification.

What goes into your basket depends on a number of different choices you make. As well as helping you determine what kind of investor you want to be, these choices give you the flexibilty to personalise your Investment Plan with ease.

Cautious

Our lowest-risk Plan for those with low expectations of potential returns.

Tentative

For investors looking to take more risk than our Cautious Plan, in exchange for potentially higher returns.

Confident

Aimed at investors looking for a middle-of-the-road option, with potentially higher returns, volatility, and fluctuations than our Tentative Plan.

Ambitious

For investors wanting potentially higher returns than a Confident Plan, but aren’t quite ready for the possible volatility and fluctuations of an Adventurous Plan.

Adventurous

Our highest-risk Plan is designed for investors comfortable with regular market volatility, seeking the potential for higher long-term growth.

Original vs Ethical Plans

In addition to our five styles, we also offer two investment themes across all products.

Using funds from leading providers, our Original Plan gives you the broadest access to the stock market.

If you want your money to go towards organisations committed to having a positive impact, you could start investing with an Ethical Plan instead.

The fund providers used for Ethical Plans aim to avoid your money being invested in harmful industries and activities, including tobacco, gambling, controversial weapons, and adult entertainment.

So, whether it’s a moral, religious, or social decision, investing ethically helps you grow wealth in a way that aligns with your values.

Built by experts

Our interactive ‘Create a Plan’ slider helps you explore projected growth rates based on your investment amount, style, theme, and timeframe. If you are on the fence about how to start investing, this could be a good opportunity to see what works best for you.

Many people choose Wealthify because they value their time just as much as their money. And that time-saving process starts with our team of experts building an Investment Plan. Combining decades of insight and experience, here’s how they’ll build yours.

Diversification

At Wealthify, diversification underpins our investment strategy. Diversification refers to spreading your money (and risk) across as many different assets and regions as possible.

Think of it as not putting all your eggs in one basket. As an example, let’s say you’ve got all your money invested in UK companies. If something happened in the UK that negatively affected share prices, all your investments could be impacted at once. And, with no other regions or assets to fall back on, you're left with nothing but losses.

If your money had been diversified, however, those other investments could have performed well, helping offset and minimise your overall losses. Diversification helps smooth out market bumps and dips in performance — which is why it’s so important to us when building your Investment Plan.

Passive and active investing

Passive investment funds simply follow the ups and downs of global market indices (like S&P 500 and FTSE 100), and let the market determine your returns. If the market goes up, the value of your investments increases (and vice versa).

Active investing, on the other hand, sees investment experts pick and combine individual stocks into a fund — with the aim of outperforming a given index.

Our experts use both passive and active investment funds to build your Investment Plan. Containing different types of assets like stocks, bonds, and property, this blended approach helps ensure your money is invested cost-effectively.

Actively managed for you

With so much market data and trends to analyse, technology plays an incredibly important role within the Wealthify platform.

The only role more important? Human expertise.

Thanks to our team of investment experts, your money’s performance is actively managed, monitored, and optimised (regardless of your product, style, or theme).

One day, for example, they could be monitoring global events, ready to pounce on the latest investment opportunity for your Plan. The next, they could be rebalancing it, a process that involves selling and buying assets to ensure your chosen investment style stays on track.

And because your financial goals span years – or even decades – we don’t believe in a one-and-done approach, either. Instead, an ongoing, proactive one that combines the industry’s best tech and human intuition — to create meaningful, long-term growth.

DIY or Wealthify?

How to start investing differs based on whether you’re doing everything yourself — or choosing a company like Wealthify to do it for you. Even though there’s not a one-size-fits-all, right-or-wrong option, understanding the differences could help you get the most out of your investment journey.

Managed Wealthify Investment Plan

- No previous investment experience or knowledge needed.

- A wide range of pre-built investment products, styles, and themes.

- Actively monitored, managed, and optimised for you.

- Could be less costly, with lower overall fees and barriers to entry.

DIY Investment Plan

- More control over your investments, including when you buy or sell them.

- Requires thorough research and prior investment knowledge.

- You’ll need to manage everything and make changes yourself.

- A potentially long, complicated list of fees and charges to be aware of.

Strength in depth

We’re owned and backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 325 years.

Wealthify operates independently, which means you get the best innovation in smart, simple investing, together with the security of knowing that we’re here to stay and operate to the highest standards.

See Our Past Performance

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 29th February 2016 and 31st July 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Plan performance by year

This table shows by how much each of our investment styles have grown each year

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 |

|---|---|---|---|---|---|---|

| Cautious | 2.70% | 0.47% | -11.19% | 4.65% | 1.05% | 6.08% |

| Tentative | 3.88% | 3.72% | -10.82% | 6.21% | 3.36% | 8.02% |

| Confident | 4.87% | 6.66% | -10.33% | 7.76% | 6.09% | 9.93% |

| Ambitious | 5.11% | 9.66% | -9.39% | 9.46% | 9.10% | 11.58% |

| Adventurous | 5.06% | 12.75% | -9.14% | 11.35% | 12.27% | 12.95% |

See Our Past Performance

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 28th February 2018 and 31st July 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Plan performance by year

This table shows by how much each of our ethical investment styles have grown each year

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 |

|---|---|---|---|---|---|---|

| Cautious | 4.14% | 0.73% | -14.93% | 4.80% | 0.70% | 5.22% |

| Tentative | 6.45% | 4.11% | -15.65% | 6.85% | 2.77% | 5.75% |

| Confident | 9.04% | 7.63% | -16.51% | 8.81% | 5.01% | 6.12% |

| Ambitious | 11.16% | 11.18% | -17.42% | 11.08% | 7.34% | 5.64% |

| Adventurous | 13.43% | 14.65% | -18.72% | 13.63% | 9.98% | 5.63% |