Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

Wealthify's Investment Outlook

UNCERTAINTY CALLS FOR CAUTIOUS DIVERSIFICATION

A patient and diversified approach is appropriate to limit drawdowns while increasing the number of potential sources of return.

Our thoughts remain with those affected by the war in Ukraine.

As we expected, 2023 has provided a turbulent rollercoaster ride for investors thus far. Even though we don’t expect much change going into the second quarter, the good news is that our diverse exposure has allowed our Plans to benefit from both the ups and downs of market sentiment this year. Our Plans remain exposed to several sources of return as we aim to navigate the rest of 2023. If we are to achieve our long-term goals, then patience is required, meaning it’s vital that we stay the course - remaining invested in a sensible and risk-conscious way.

With market pricing often provoking knee-jerk reactions that ultimately destroy capital, however, this is easier said than done in the rapidly changing economic and market environment we are in.

Going into the second quarter of the year, our outlook remains largely unchanged from the previous quarter. We continue to be wary of the plethora of risks facing markets, preferring bonds to shares due to the deteriorating growth and, in turn, corporate earnings outlook, too (due to the more attractive yields on offer in major bond markets). Shares have tilted Plans towards more defensive share markets, and, within bonds, we still favour short maturity bonds over longer ones, which are more sensitive to interest rate movements. Despite interest rates being hiked into severely restrictive territory, we do think interest rates have the potential to go higher in the near term as a result of stickier-than-expected inflation in the medium term.

Given the heightened uncertainty, we’ve opted for a wait-and-see approach, expecting tighter financial conditions to eventually whittle down growth and inflation to such a degree, that interest rates will once again be used to breathe life into receding economies. Even though we’re not there yet, we do think we’re getting closer to economic slowdown, which will in turn cool rampant inflation — particularly inflation stemming from the jobs market. Engineering an economic outcome of this magnitude through monetary policy tools, however, is fraught with error and uncertainty. The recent banking crisis is certainly an example of unexpected vulnerabilities causing market panic and validates our cautious approach. If history provides any precedent, we see the likelihood of a greater-than-expected slowdown as being a more probable scenario, given the need to bring high-and-sticky inflation under control. We do think safer assets will be sought after by investors in this scenario; hence our maximum allocation to bonds in Plans.

Top Risks

- Global Recession: Central banks’ steep interest rate hikes have heightened policy error risk, and in turn the risk of a greater than expected economic and corporate profit downturn.

- Debt Crises: Geopolitics, high inflation and fiscal policy errors increase the risk of credit downgrades and crises fuelled by debt sustainability concerns.

- Russia Ukraine Crisis: With no end in sight, the threat of escalations remains as the war drags on.

- Stagflation - Energy: A full cut off in gas supplies to Europe would fuel an energy crisis, inflation and a deeper recession. Rising oil prices due to production cuts by OPEC pose a more global threat to inflation. Higher rates would be needed to cool this at a cost of lower growth – stagflation.

- New covid-19 variants are vaccine resistant: While the world, including China, have adopted a ‘live with the virus’ risks of new variants and collapsing health systems remain.

- China: Regulatory crackdowns and property market troubles remain an issue. Relations with the US remain an ongoing threat to global economy.

Good things come to those who wait

While inflation appears to have peaked, upside risks remain given how far away major central banks are away from their long-term inflation targets. There is also considerable uncertainty around how one of the steepest rate hiking cycles in history will affect the global economy. Additionally, there are lots of other of real and near-term risks around the world. Owing to this, we’ve sought to maximise diversification by taking advantage of renewed value in bond yields, while maintaining an overweight allocation to alternative assets such as infrastructure. We have tilted towards more established share markets as a defence against riskier share markets, while maintaining a readily accessible, ultra-short maturity fixed income. While this may mean missing out on the odd false rally, we firmly believe the market and global environment is one that requires caution — because all good things come to those who wait, after all.

Investment Outlook Q2 2023

Outlook Key

| Shares | Outlook | Rationale |

|---|---|---|

| Region | Current Quarter | Why the outlook is what it is |

| United Kingdom |

Both large and small UK companies generate significant amounts of their earnings offshore and are historically cheap. Low valuations and a defensive sector tilt are both good qualities in a slowing economy.

|

|

| United States |

We’re positive on US equities as they offer access to more resilient, diversified, and defensive business models and sectors. Despite valuations still being on the high side given a deteriorating corporate earnings outlook, quality is attractive as negativity increases.

|

|

| Europe ex United Kingdom |

Stubborn inflation and energy risks remain a threat to the region’s economic growth, as policy makers raise rates aggressively. We don’t think the downturn and risk of a deeper downturn are currently priced in making the region relatively unattractive.

|

|

| Japan |

Japan’s economic environment remains pedestrian, as the effects of Covid restrictions linger. Easy monetary policy has seen a strong devaluation in the yen. The possibility of recovery is decent given the low sentiment, but a lot hinges on the global (US) economy.

|

|

| Emerging Markets |

While EM do look to be in decent shape - in terms of both pricing and underlying fundamentals - they are likely to suffer more in the event of a global recession. In addition, governance and geopolitical issues in China have increased our negativity.

|

|

| Asia Pacific ex Japan |

China remains central to the investment case, and recent governance and geopolitical issues have increased our negativity.

|

|

| Shares Total |

|

We are cyclically underweighting shares due to the potential for greater than expected earnings disappointments as a result of a deteriorating economic backdrop.

|

Total

We are cyclically underweighting shares due to the potential for greater than expected earnings disappointments as a result of a deteriorating economic backdrop.

| Fixed Income | ||

|---|---|---|

| Government Bonds | Outlook | Rationale |

| Region | Current Quarter | Why the outlook is what it is |

| United Kingdom |

UK government bonds (gilts) have been through a sustained period of negative performance, as rates increased rapidly on the back of soaring inflation. With much of the rate hiking cycle behind us, gilts offer attractive upside potential with low downside risk.

|

|

| United States |

US government bond yields have increased dramatically over the past year. While we may see a final leg up in yields, they offer attractive upside potential and protection in the case of a recession. With much of the rate hiking cycle behind us, little downside risk remains.

|

|

| Europe ex United Kingdom |

We remain neutral as we continue to monitor the outlook for this asset class against a very uncertain geopolitical and economic backdrop, where strong ECB interest rate hikes have increased the risk of policy error.

|

|

| Japan |

Japanese bonds offer little income and remain severely distorted due to the BoJ’s “Yield Curve Control” program. While the BoJ might alter this program, there’s little expectation for significant medium-term change.

|

|

| Emerging Markets |

While EM government bonds offer a strong yield premium compared to Developed Markets, we remain slightly negative given the potential for a global recession, which would see a flight to safety in developed markets such as the US.

|

|

| Corporate Credit | Outlook | Rationale |

| Region | Current Quarter | Why the outlook is what it is |

| United Kingdom |

We have a positive outlook on UK investment grade credit, owing to the strong yields and broadly solid fundamentals within a more stabilised interest rate environment. Due to the uncertain interest rate environment, we prefer short-dated bonds.

|

|

| United States |

Our outlook for US investment grade credit has dimmed somewhat, as valuations have realigned with long-term averages.

|

|

| Europe ex United Kingdom |

We remain slightly negative on European credit, owing to the many risks that remain, such as high inflation, weak growth, and geopolitical tensions.

|

|

| Japan |

Like Japanese government bonds, Japanese corporate bond prices offer very little in income and are unattractive.

|

|

| Fixed Income Total |

|

We are cyclically positive on bonds due to the improved yield environment and defensive nature of bonds in a slowing and negative economic environment.

|

Total

We are cyclically positive on bonds due to the improved yield environment and defensive nature of bonds in a slowing and negative economic environment.

| Alternatives | Outlook | Rationale |

|---|---|---|

| Region | Current Quarter | Why the outlook is what it is |

| Environmental |

Companies focused on reducing their environmental impact often have a competitive advantage due to greater resource efficiency, leading to lower costs. They may also experience lower downside risks, due to more robust corporate governance and better management teams.

|

|

| Global Real Estate |

Global real estate offers attractive value, underpinned by improved rental income streams and high interest rates; recent troubles in the banking sector, however, mean caution is needed.

|

|

| Global Infrastructure |

The long-term outlook for Global Infrastructure remains positive, with a global need for advancement and investment. The asset class also offers exposure to stable revenue streams, which make it defensive in nature.

|

|

| Alternatives Total |

|

We are positive on alternatives over the long term.

|

Total

We are positive on alternatives over the long term.

Investment Table last updated 06/06/2023

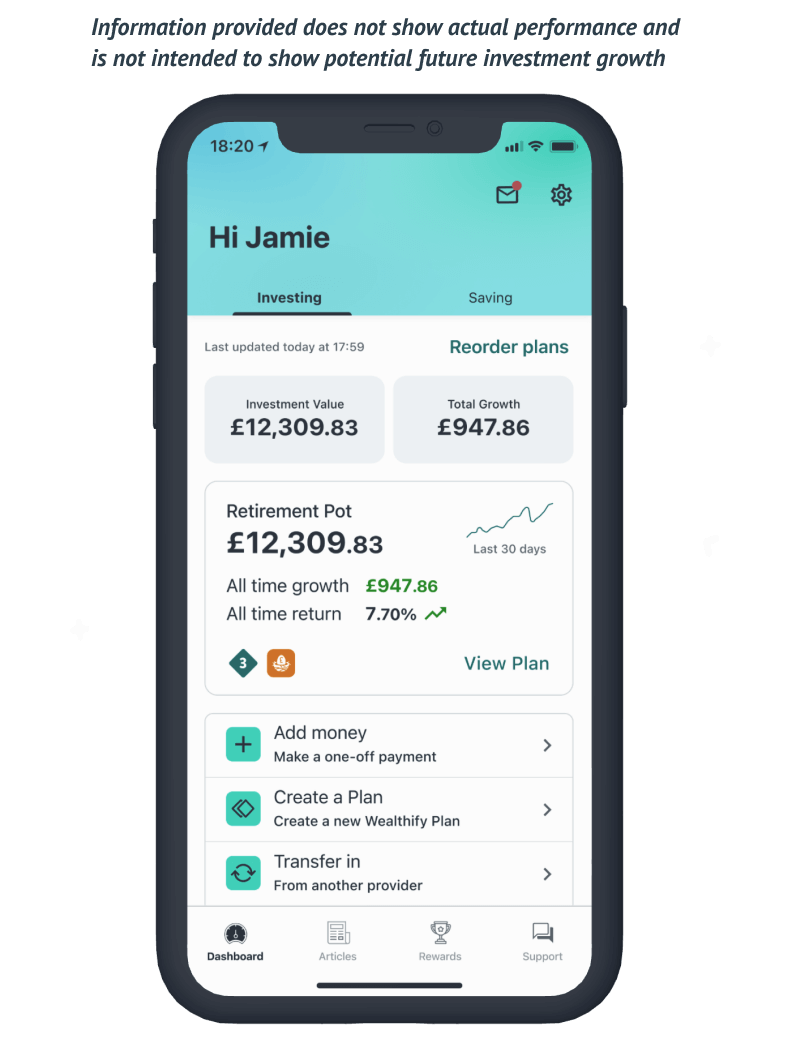

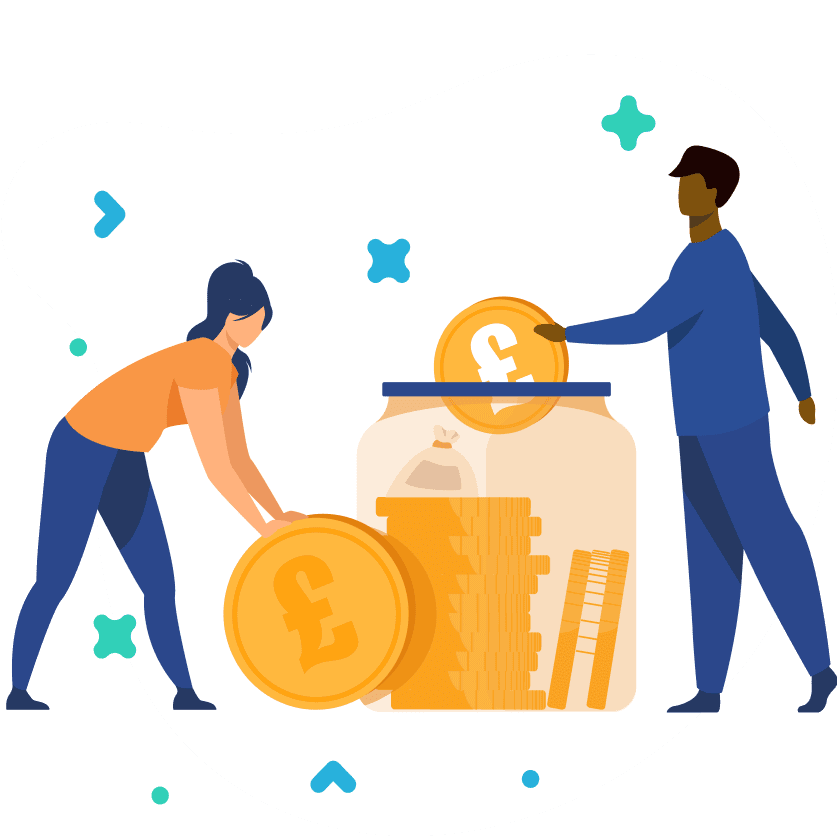

Ready to invest?

We want to help make your money work harder. It’s simple – you choose what type of investor you want to be, from cautious to adventurous, and we’ll build you an investment Plan and manage it for you.

There’s no minimum investment, and you can withdraw anytime with no penalties. We also offer ethical Plans, so you can easily invest in line with your values.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.