ISA TRANSFER

As with everything we do at Wealthify, we’ve made the ISA transfer process as straightforward as possible. Simply fill out an ISA transfer form, choose your investment style from Cautious to Adventurous — then we do the rest.

Even though an ISA transfer to Wealthify is free, please check your current provider doesn’t charge any penalties.

You can transfer a partial amount from an existing ISA to get started. However, if you’re transferring money from an ISA you’ve opened this tax year with another provider, you must transfer the full amount.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

OUR AWARDS CABINET

Why transfer an ISA?

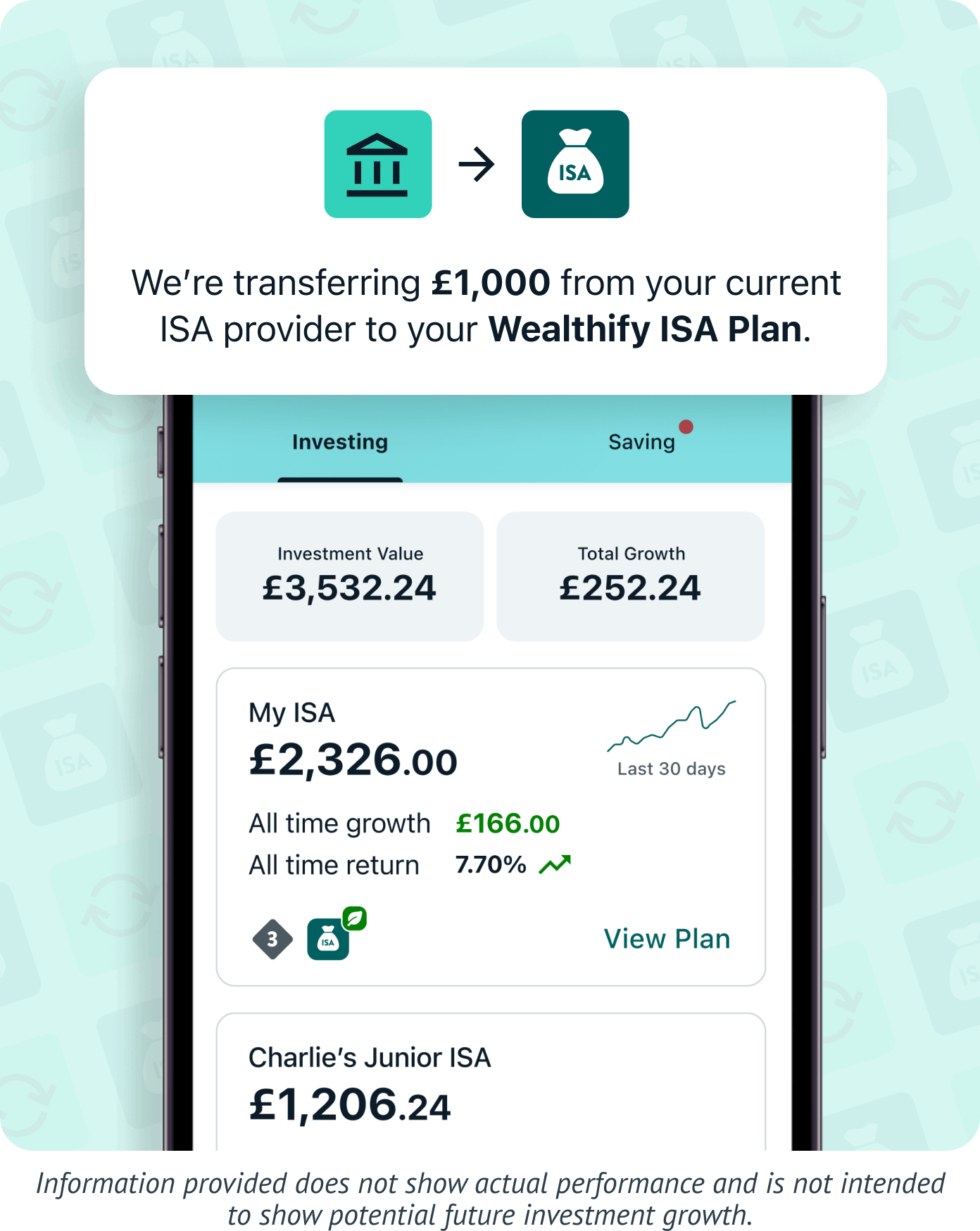

Once we've sent your ISA transfer form to your existing provider (and they've checked all the details you've provided match), any existing investments get sold at their current value. This balance is then transferred to Wealthify and credited to your account. This means for a period of time, your ISA will be 'out of the market'.

You can transfer a Cash ISA or existing Stocks and Shares ISA to a Wealthify Stocks and Shares ISA — and here are some of the reasons as to why you might.

Transferring a Stocks and Shares ISA

- Tracking investment performance is easy thanks to our dashboard.

- You could get lower fees than with your existing provider.

- This means you could have more money invested for your future.

Transferring a Cash ISA

- A Stocks and Shares ISA gives you long-term exposure to the financial markets.

- As a result, it could provide better long-term returns than a Cash ISA.

- By transferring a Cash ISA balance via the transfer form, that money retains it’s tax benefits.

Capital at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

How to transfer an ISA

Transfer your ISA to Wealthify in four simple steps.

You transfer

Fill out a transfer form, before choosing your investment style and how much you'd like to to transfer from an existing Cash or Stocks and Shares ISA.

You answer

Answer a few questions in our suitability quiz, which helps you start an ISA that's right for your circumstances and attitude towards investing.

We build

Our team of investment experts then get to work building your Plan, making sure it’s aligned with your chosen investment style.

We manage

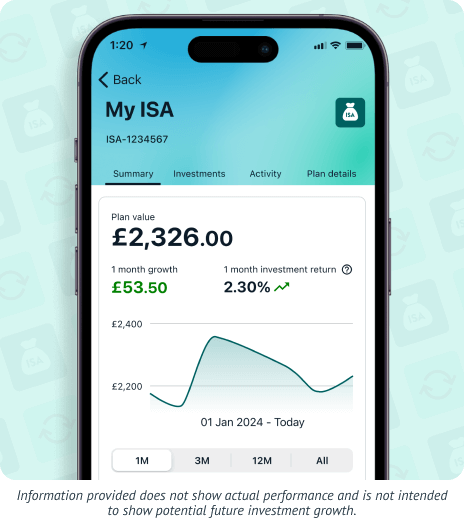

Just sit back, relax, let us manage everything for you — and use our online dashboard or app to follow your Plan's performance!

Things to consider

When you transfer an ISA to Wealthify, you should always use the official ISA Transfer Form to retain the ISA tax benefits.

What can you transfer?

- You can transfer any Cash ISAs or Investment ISAs (aka Stocks and Shares ISAs) you have with other providers to Wealthify.

- Transferring ISAs from previous tax years doesn’t impact your current ISA allowance at all, so you can still put up to £20,000 into an ISA this tax year.

How long will my ISA transfer take?

- Transferring from a Cash ISA typically takes around 15 days.

- Transferring from an existing Stocks and Shares ISA typically takes around 20 days.

Capital at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

why choose wealthify?

Whether you're looking for your financial piece of the pie or peace of mind: investing with Wealthify is about so much more than just ‘putting money away’.

It’s about the satisfaction of knowing you're on top of your finances — and confidence that comes with building for the future.

Using our simple, award-winning app or website, start a Wealthify Stocks and Shares ISA from as little as £1. Whether you’re cautious, ambitious, or ethical with your money, we manage everything for you, guiding your investments all the way.

Because Wealthify is for people who want more from their finances by doing less; people who value their time just as much as their money.

KEEPING YOUR MONEY SAFE

Secure

Your login details will always be kept secure — and never shared with anybody else.

Supported

Our award-winning Customer Care team are happy to help via Live Chat, or on 0800 802 1800.

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

HOW YOUR MONEY'S INVESTED

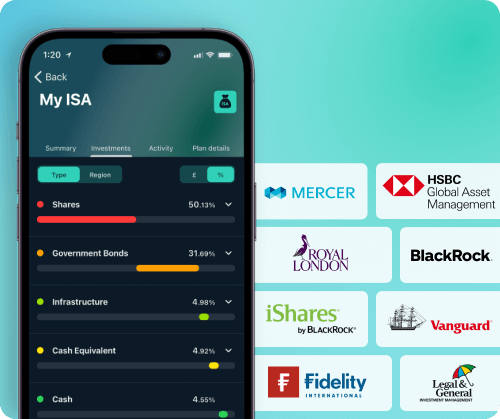

We invest your money using passive and active investments called mutual funds.

These funds contain a collection of investments – including shares, bonds, and property – and provide the following benefits:

- A convenient, cost-effective way to invest.

- Diversification, meaning your risk is spread.

- Your money tracks entire markets, like the FTSE 100.

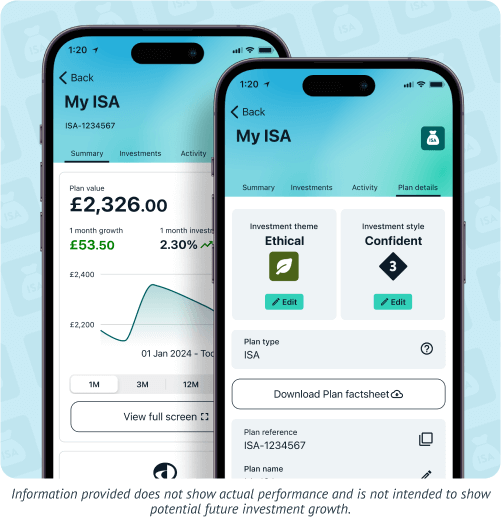

Even though the mix of funds will change over time, our team of experts optimise your Plan regularly, keeping it in line with your chosen investment style.

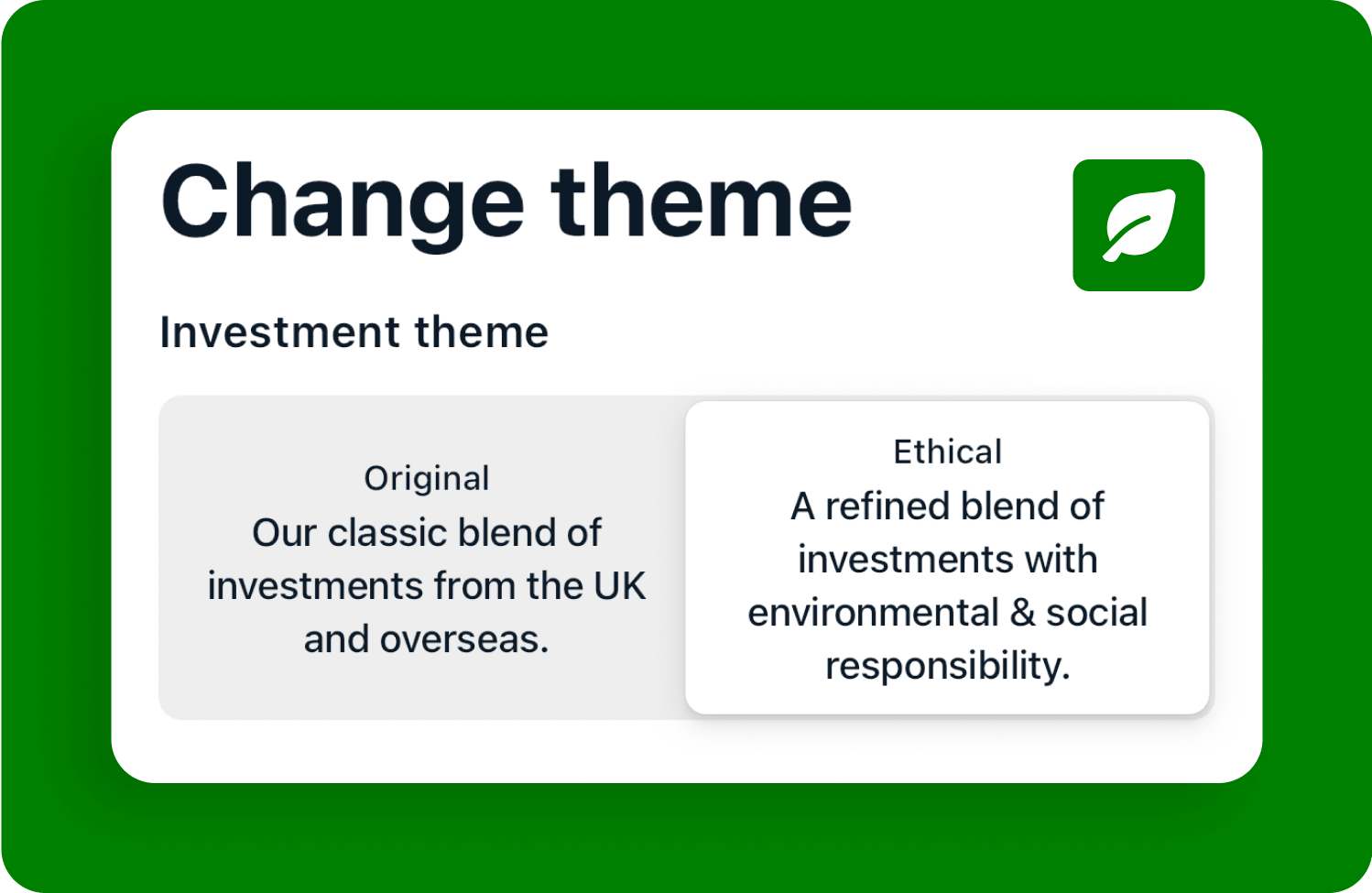

ETHICAL INVESTMENT OPTIONS

With Wealthify, investing for your future also means being able to invest in the planet's future at the same time.

That's why we've joined forces with best-in-class ethical fund providers, to create five Ethical Plans that let you invest in organisations committed to having a positive impact on society and the environment. All our fund providers are signatories of the Principles of Responsible Investing (PRI), the world’s leading proponent of responsible investing.

The actively managed ethical funds employed in plans keep a close eye on the organisations in which they invest - employing rigorous, ongoing screening to ensure ethical standards are maintained.

WEALTHIFY CUSTOMER REVIEWS

INVESTMENT FAQs

Yes, you can do an ISA transfer from your previous years' Investment ISAs, Innovative Finance ISAs, or Cash ISAs to another investment ISA provider at any time. Transfers don't impact your current year’s ISA allowance at all, so you can still invest this tax year’s full ISA limit as well as transfer existing ISAs over.

However, please ensure to use a transfer form. If you withdraw the money you pay in, you'll lose your tax-efficient benefits on that money. To arrange a transfer, simply create a Wealthify ISA Plan, then complete our simple ISA transfer form. We’ll arrange everything else.

If you’re an existing customer, simply head to your Dashboard and use the ‘transfer in’ button on your home screen. You can then choose whether you want to transfer your money into an existing Plan, or create a new one.

Yes, they are. All your investments in our ISA and General Investment Account products are held with our custodian bank, Winterflood Securities. A global financial services provider, Winterflood are part of Close Brothers Group, who have been trading for more than 130 years.

The custodian of our Pension products is Embark Pensions, who are part of the Embark Group: the UK’s fastest-growing digital retirement platform.

Winterflood Securities and Embark both hold your assets separately (ring-fenced) from Wealthify, so even if we went into administration, our creditors would not have a claim to your investments.

The Financial Services Compensation Scheme may also cover the first £85,000 of your investments. However, it’s essential to understand that the FSCS doesn’t cover you if your investments do not perform as expected, and you get back less than you originally invested. For more information, visit https://www.fscs.org.uk/

There's nothing more important to us than the security of your personal information — which is why we take several measures to ensure its safety.

Any information you provide on our website is transmitted using secure SSL technology with 256-bit encryption. Where we store sensitive information (such as passwords and bank account numbers), we use encryption algorithms similar to those used by the major high-street banks.

We also insist on a minimum password length, as well as the use of upper case letters and numbers to make it more secure.

You should never share your password or let anyone else have access to your Wealthify account.

Your money is looked after by our team of qualified investment managers.

With experience across established global firms, our experts have developed an investment system that uses algorithms and industry experience to pick the best funds available to you. They then build an Investment Plan that suits your goals and attitude to risk.

And, because things are always changing in the financial markets, they monitor and adjust your Plan regularly, keeping it in line with your investment style.

Need more help?

If you’ve got any more questions, then our award-winning Customer Care Team are ready to answer them. Just click on the button below to get in contact.