Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

Junior Stocks and shares ISAs

Invest in your child’s future with an easy to understand, low-fee investment provider. Plus, you choose the investment style that best suits your needs.

Proud winners of Best Junior ISA at the Personal Finance Awards

GIVE THE GIFT THAT CAN KEEP ON GIVING WITH A WEALTHIFY JUNIOR ISA

This Christmas, pick a present for the child or children in your life that grows with them — not one they’ll grow out of. As an added bonus, open and invest £1 in a Junior ISA, and we’ll top-up their Plan with £10 (within 30 days)!

In order to qualify for the offer, you will need to open a Plan by midday on 22nd December and fund the plan by 31st January 2022. Full terms and conditions here. Capital at risk.

WHAT IS A JUNIOR ISA?

TRANSFER TO A WEALTHIFY JUNIOR ISA

Want to give your Junior Cash ISA or Child Trust Fund more potential? The good news is that transferring to Wealthify's Junior Stocks and Shares ISA is a simple, hassle-free process.

Transferring is easy, just let us know you want to move to Wealthify, and we'll do the rest. If you're looking to move an existing Junior Stocks and Shares ISA or Child Trust Fund, we'll need to move the whole amount as you're only allowed one of this type of account per child.

Start a transferGrown up investing for your little ones

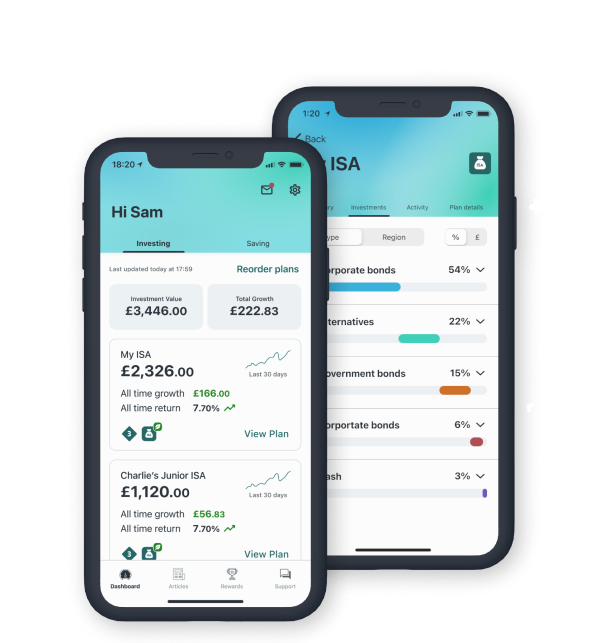

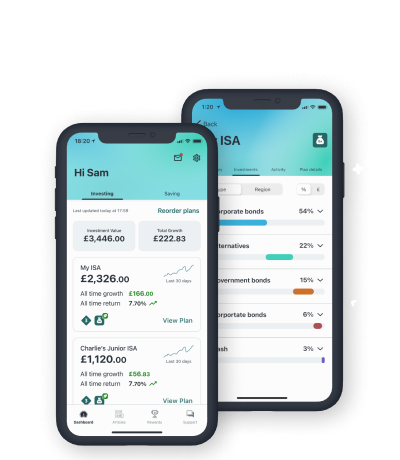

Setting up a Junior Stocks & Shares ISA is simple for your child.

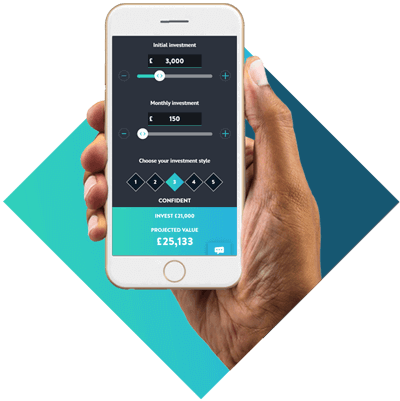

Choose how much you’d like to invest and pick one of five investment styles.

We build a Junior Stocks & Shares ISA Plan and monitor it regularly.

Check how their Junior ISA is performing 24/7 by signing into your dashboard.

Some things are better together

When it comes to preparing for your little one’s future, it’s nice to be able to count on friends and family.

Our Junior ISA lets you invite anyone to chip in and help grow your child’s savings. Whether that’s grandparents, aunts and uncles, your best friends, or even that nice lady down the road, anyone you invite can help build up your child’s Junior ISA to give them a flying start in life.

FREE JUNIOR ISA GUIDE

Junior ISAs come with a set of rules from HMRC, and there are different types you can open. In this useful Junior ISA guide, you'll find out:

- The difference between a Junior Cash ISA and Junior Stocks and Shares ISA

- How much you can pay into a Junior ISA

- How many Junior ISA accounts you can open

- How to transfer a Junior ISA

This guide doesn't offer personal advice, speak to a financial adviser if you're unsure about whether investing is right for you.

WHY CHOOSE WEALTHIFY?

- One Low Fee

- Flexible

- Safe & Secure

- Here for You

Complete transparency

Some providers have a low management fee, but hide extra charges which can impact your returns over time. At Wealthify, we charge a flat fee to manage your child’s Junior ISA, so you always know where you stand.

About our fees

You’re in control

A Junior ISA that fits in with you - choose to set up a regular payment, or top up whenever you can. Change or pause your payments anytime online or in our app.

Get StartedIn safe hands

Up to the first £85,000 of your money can be protected by the Financial Services Compensation Scheme (FSCS) and we’re authorised and regulated by the Financial Conduct Authority (FCA).

How Wealthify works

Here when you need us

From sign up to draw down, we offer no paperwork, no post, just a simple, seamless online pension. If you do need help, our UK based customer care team are available on phone, live chat or email.

Contact usUse it or lose it

Use your child’s £4,260 Junior ISA allowance by 5th April, or lose it forever

What is the Junior ISA allowance?

You can transfer your Child Trust Fund into a Junior ISA, but you can’t have both types of accounts open at the same time.

Parents in the UK save, on average, £42.45 a month for each child.

*Source: L&G Investments

For your first child, you may be entitled to £20.70 child benefit per week. If you put it into a Junior Stocks & Share ISA every month, your child could get around £24,343 on their 18th birthday.

This shows a possible future value for a Confident Plan. This is only a forecast and not a reliable indicator of future performance.

*Source: L&G Investments

Simulated Past Performance

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 29th February 2016 and 31st March 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures are based on the performance of Plans worth more than £100, figures will be different for Plans below that amount.

Original

Ethical

The above graph illustrates past performance for Original Plans only. Even though the past performance data shown is simulated, it represents real transactions we've carried out for actual customer Plans across our five Investment Styles. Please remember that simulated past performance is not a reliable indicator of future performance.

FIVE-YEAR PERFORMANCE

The table below shows our actual past five-year performance for each of our Original investment styles.

| Investment Style | 28/06/2024 - 28/06/2025 |

|---|---|

| Cautious | 4.19% |

| Tentative | 4.55% |

| Confident | 4.94% |

| Ambitious | 5.30% |

| Adventurous | 5.55% |

Simulated Past Performance

The graph below shows how each of our investment styles - from Cautious to Adventurous - have performed between 28th February 2018 and 31st March 2025, after all fees have been taken (based on 0.60% p.a. Wealthify management fee). These figures apply to plans of any value.

Original

Ethical

The above graph illustrates past performance for Ethical Plans only. Even though the past performance data shown is simulated, it represents real transactions we've carried out for actual customer Plans across our five Investment Styles. Please remember that simulated past performance is not a reliable indicator of future performance.

FIVE-YEAR PERFORMANCE

The table below shows our actual past five-year performance for each of our Ethical investment styles.

| Investment Style | 28/06/2024 - 28/06/2025 |

|---|---|

| Cautious | 3.91% |

| Tentative | 3.70% |

| Confident | 3.40% |

| Ambitious | 2.59% |

| Adventurous | 2.45% |

GIVE THE GIFT THAT CAN KEEP ON GIVING WITH A WEALTHIFY JUNIOR ISA

Learn more about our Junior ISA

-

What is a Junior ISA?

-

A Junior ISA is a tax-efficient way to save and invest on behalf of your child.

Payments into a Junior ISA are different from adult ISAs, because the money you put in belongs to your child. Once you put money in, you can’t take it out again, except in exceptional circumstances, and your child can only get access to their money when they turn 18.

There are two types of Junior ISA:

- Junior Cash ISAs: earn interest like a savings account. The interest rate is fixed and typically based on the rate set by the Bank of England.

- Junior Stocks & Shares ISAs: (Also known as Junior Investment ISAs), these invest in financial markets with the aim of earning returns for investors that are greater than those you would get in a Junior Cash ISA. Returns are not guaranteed, and the value of your investments can go down as well as up.

Your child can have one or both types of Junior ISA and you can deposit up to the annual limit of £4,260 into them in any combination you like.

For example, you could pay £2,000 into a Junior Cash ISA and up to £2,260 into a Junior Stocks and Shares ISA, or vice versa. You can split the allowance however you want to between the two accounts.

The benefit of a Junior ISA is that you or your child won’t pay tax on any interest, returns or dividends they receive.

Wealthify only offers a Junior Stocks and Shares ISA. Any money paid into a Junior ISA will belong to the child, but they cannot access it until their 18th birthday.

-

How does a Junior ISA work?

-

Junior ISAs allow your child to keep more of their money by protecting any positive returns they receive from income tax and capital gains tax.

Only a child’s parent or legal guardian can open a Junior ISA account on their behalf.

Your child can have one Junior Cash ISA and/or a Junior Stocks and Shares ISA at any time, into which you can currently contribute a maximum of £4,260 per tax year, per eligible child. You can split the amount however you choose between a Junior Cash ISA and a Junior Stocks and Shares ISA as long as the combined amount doesn’t exceed the annual limit.

You don’t need to use the same provider for your child’s Junior Cash ISA and Junior Stocks and Shares ISA, so you’ve got flexibility to choose the best option for you and your child.

At the start of each new tax year, on 6 April, the child’s annual Junior ISA allowance re-sets and you can start another year of tax-efficient saving, up to £4,260 for each child.

Your child will only be able to access the money within their Junior ISA when they turn 18.

When they turn 18, the Junior ISA is automatically changed into an adult ISA. At this point, they can choose to keep saving or investing, or they can withdraw some or all of the balance to help pay for things like university, or a new car.

-

Who is a Junior ISA for?

-

If you want to build an investment pot for your child that neither you or they can touch until your child turns 18, then a Junior ISA could be the answer. Any money paid into a Junior ISA belongs to the child and cannot be withdrawn by anyone other than the child when they turn 18.

Junior ISAs are available to children who:- Are under the age of 18

- Are residents of the UK, or are dependants of a crown employee (e.g. army employee based overseas)

- And don’t already have a Child Trust Fund (CTF).

You can transfer your Child Trust Fund over to a Wealthify Junior ISA, but your child cannot have a CTF and a Junior ISA at the same time. When transferring a CTF to a Junior ISA, the full balance must be transferred.

-

Who can open a Junior ISA?

-

Junior ISAs can only be opened by the parent or legal guardian of a child under the age of 18 who fits the eligibility criteria. Once opened the parent/guardian will become the registered contact for the account.

As the registered contact for a Junior ISA, you are the only person authorised to make decisions about the management of the account. You’ll also need to keep Wealthify informed if the child’s personal details change; e.g. if they change their name, address, contact number, or get married.

When the child turns 18, they will become the registered contact and their Wealthify Junior ISA will change into an adult ISA. They can either keep investing, move it somewhere else, or withdraw some or all of it e.g. to help pay for university, or a car.

The money in a Junior ISA will never belong to the parent/guardian. It belongs to the child, but they won’t be able to access it until their 18th birthday.

16-year olds can open and start paying into an adult Cash ISA whilst still paying into their own Junior ISA until they reach 18.

-

What type of Junior ISA does Wealthify provide?

-

Wealthify offers Junior Stocks & Shares ISAs.

Wealthify Junior ISAs contain a range of investments from across the globe matched to the level of risk you choose. Our team of experts build your child’s Junior ISA, choosing which investments to buy and managing them on your behalf.

You can choose to invest for you child in an Ethical Plan or an Original Plan. Read more about our Ethical Plans here.

Each Junior Stocks & Shares ISA will contain up to 20 investment funds from providers like Blackrock and Vanguard. Investment funds are a convenient and cost-effective way to invest, as they contain hundreds or even thousands of expertly-selected shares, bonds and other investment types. This means your Junior ISA will contain a diverse range of investments spread across global markets and regions, helping your child to spread their risk.

-

CAN ANYONE CONTRIBUTE TO MY CHILD’S JUNIOR ISA?

-

Payments made into a Wealthify Junior ISA must come from the registered bank account of the parent or legal guardian who opened the Junior ISA.

Friends and family members are currently unable to gift money directly to a child’s Wealthify Junior ISA, but it can be paid in via their parent or legal guardian.

Gifting can be a great way to help boost the value of a child’s Junior ISA but remember that total payments should not exceed the child’s annual allowance.

-

IS A WEALTHIFY JUNIOR ISA SAFE?

-

Wealthify is authorised and regulated by the Financial Conduct Authority (FCA). Your money is looked after by our team of experienced and qualified investment managers, and we’re backed by global financial services provider, Aviva.

Your child’s money is held securely by our custodian, Winterflood Securities Limited. They are responsible for holding your cash and investments safely. They are regulated by the Financial Conduct Authority (FCA) and are part of Close Brothers Group, who have been trading for more than 130 years. They hold your child’s cash and investments separately from Wealthify (ringfenced) in accordance with the FCA’s client asset rules.

As an authorised firm, Winterflood Securities Ltd. is also a member of the Financial Services Compensation Scheme (FSCS). This means your child’s investments may be protected up to £120,000.

It’s important to remember that the value of your investments can go down as well as up and you may get back less than you invested. The FSCS scheme does not allow you to claim compensation simply because the value of your child’s account falls below what you originally invested.