Step 1 - Your Details

Enter a few basic details to give us a timeframe to calculate.

Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

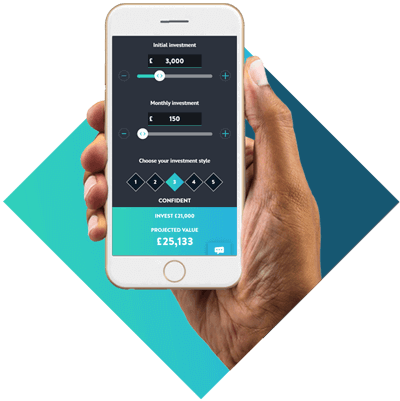

Want a more detailed way of finding out how much your pensions could be worth? Wealthify’s pension calculator uses advanced forecasting to help you with your retirement planning. Enter a few details into our pension calculator, and it’ll show you:

Plus, you could earn up to £200 cashback by transferring your pensions to Wealthify. You can activate this after you’ve got your pension calculator results.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Enter a few basic details to give us a timeframe to calculate.

Tell us about your pensions and how much you'd like to add in the future.

See how small changes could impact the way your pension grows.

Set your target retirement goal and see what you could to do to reach it.

Our calculator shows what your pension could pay either monthly or yearly, and if you're not sure how much you'll need, our target retirement income will help you figure that out too.

Want to retire earlier or put even more in your pension? Use the calculator to see how making small changes to your retirement age, contributions, or including pension transfers could have an impact on reaching your target goal.

Calculate your pension pot now

Some providers have a low management fee, but hide extra charges which can impact your returns over time. At Wealthify, we charge a flat fee to manage your Pension, so you always know where you stand.

About our fees

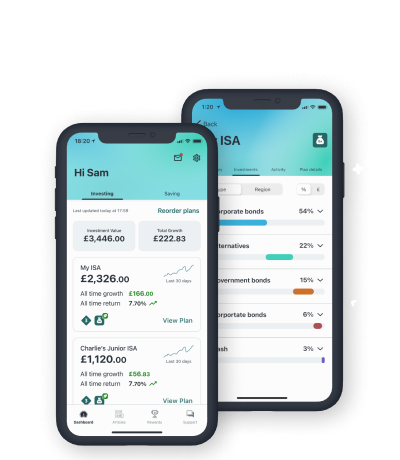

A Pension that fits in with you - choose to set up a regular payment, or top up whenever you can. Change or pause your payments anytime online or in our app.

Get StartedUp to the first £85,000 of your money can be protected by the Financial Services Compensation Scheme (FSCS) and we’re authorised and regulated by the Financial Conduct Authority (FCA).

How Wealthify works

From sign up to draw down, we offer no paperwork, no post, just a simple, seamless online pension. If you do need help, our UK based customer care team are available on phone, live chat or email.

Contact usYour money is invested into mainly passive investment funds, such as Exchange Traded Funds [ETFs] and Mutual funds

Wealthify is backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 300 years.

We operate independently of Aviva, which means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Being part of the Aviva group of companies allows us to develop our business, but at an accelerated pace and with greater confidence.