Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

Our Savings Calculator

Want an easy way to find out what your savings could be worth? Our savings calculator makes it easy to work out how much your savings could grow.

Tell us how much savings you have, how long you're planning to save for and how much you want to put away each month. Our calculator will then do the hard work, giving you a clear picture of what your savings could be worth.

Calculate Your Savings Pot Now

How much could your savings be worth in a Wealthify plan?

Interested in seeing the difference between saving and investing? Our calculator gives you a side-by-side view of what your money could do if you invested it.

See how saving and investing compare

How low interest rates could impact your savings

Over time prices tend to increase due to an economic principle called inflation - the rate the prices increase is normally shown as a percentage, for example, the current rate of inflation is 3%* This is import to know as it can impact how much your money can buy in the long term.

As the Bank of England's current interest rates are at a historic low of just 0.02%** your savings may not be growing as fast as inflation.

*Source: bankofengland.co.uk as at 01/01/2021 **Source: ons.gov.uk as at 01/02/2021

Calculate your savings pot now

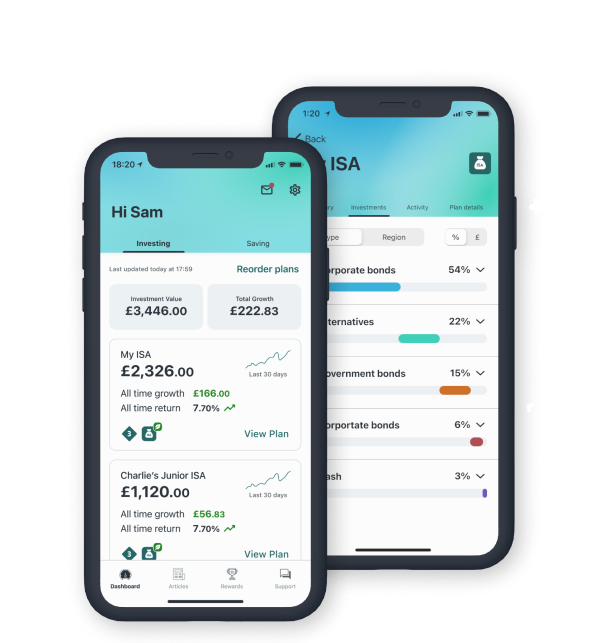

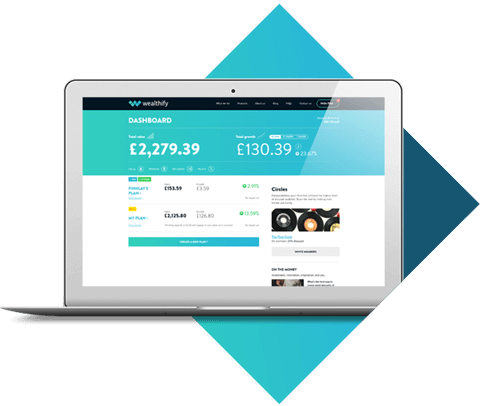

INVESTING REIMAGINED

- Low fees

- No minimum

- Withdraw anytime

- You’re in control

Investing is now affordable.

We charge a simple annual fee of 0.6% for managing your investments. As with most investments other costs can apply but we aim to keep these as low as possible, around 0.29% for our original plans and 0.65% for ethical.

About our fees

Invest as little or as much as you like.

Start with a lump sum or whatever you can afford. Add regular monthly payments and top up your plan whenever you like.

Try it out

Your money is not locked in.

Add to your Plan or withdraw your money whenever you like, without notice or penalty.

How Wealthify works

Set your goals and choose how you want to reach them.

Set up multiple Plans, each with a risk level that you choose. We also have a range of Ethical Plans, to help you invest in line with your values.

How Wealthify worksWealthify Customer Reviews

Learn more about our savings calculator

-

How does the savings calculator work?

-

Our savings calculator uses a bit of clever maths and our investment team’s forecasting to give you an idea of what your money could be worth at a point in the future. We do make a few assumptions when it comes to working these things out – namely, that you’re not withdrawing money from either your savings or investments, and that any returns are put back in as well.

-

How do you work out what my money could be worth?

-

With your savings, it’s simple, we look at how much you already have saved, how much you plan on saving and then calculate that against how long you’re looking to save for and factor in your current savings rate. This will give you an idea of what your money might look like in a savings account.

When investing, the calculation is similar, although instead of factoring in your savings rate, we use our investment team’s forecasting tools. These are only projected values and could change due to different market conditions, but it can give you an idea of the potential you might see when investing.

-

How to I find my current savings rate?

-

We’ll regularly update the average high street savings rate, however what you get may be higher or lower than this so feel free to add your own. You can normally find your current savings rate by logging into your account with online banking provider, choosing your savings account and finding your interest rate. This should also appear on your statements.

-

What are low interest rates?

-

When you save money, your savings provider typically pays you for putting money away – this is called interest and is generally presented as a percentage. The rate they pay is guided by the central bank – in the UK this is the Bank of England – and depends on a huge range of factors. ‘Low’ is subjective, as it’s typically based off a historic average – so if the interest rate was 2% for 10 years but then dropped to 1%, then that is considered to be a ‘low interest rate.’