Investing reimagined

Before we tell you about our crowdfunding campaign, here’s a bit about what we do.

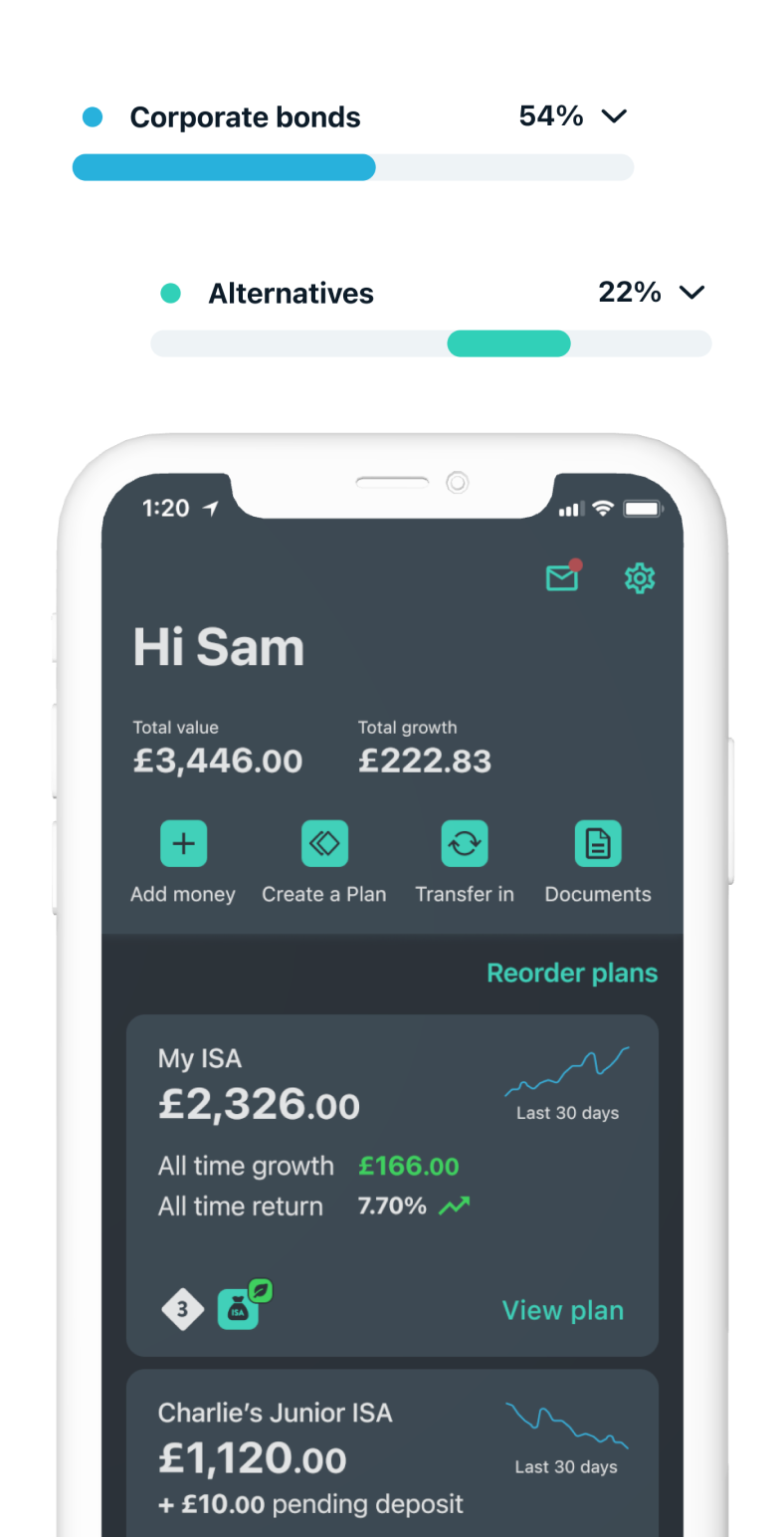

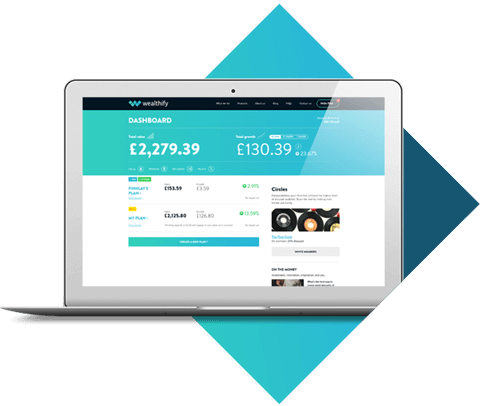

- Fully-managed investment Plans and ISAs

- Low minimums - start investing from as little as £250

- 24/7 access to your Plan online and on mobile

- Withdrawals at any time without notice or penalty

- Low fees

- An investment Plan can be set up in 10 minutes

Invest in the future

Become a shareholder via crowdfunding to help us grow the business and share in our success.

Robo-advice, or robo-investing as we prefer to call it, is relatively new in the UK but is already well-established in the US with over $5bn of assets under management. The global market is predicted to grow to $2.2tn† under management by 2020.

Wealthify is targeting the mass market with a mission to persuade a million UK savers to become investors within a decade. Currently UK savers hold around £700bn* in cash savings earning tiny amounts of interest. We enable people to “expect more from their money” by giving them a simple and affordable way to invest.

We’ve already attracted funding from a number of external investors, but we want to give our customers a chance to become shareholders in Wealthify too. That’s why we’re reserving a proportion of our equity for crowdfunding investors.

We’ll use the funds to grow our customer base, develop new sales channels and expand our service into pensions and new types of ISAs. We also plan to involve our shareholders in ongoing research and product testing so that you can play an active role in Wealthify’s future.

We look forward to having you on board!

Richard Theo & Michelle Pearce

Wealthify CEO & CIO

†A.T.Kearney’s 2015 Robo-Advisory Services Report

*FCA Cash Savings Market Study Report 2015 MS14/2.3

Pre-registration is now closed

If you pre-registered for our crowdfunding, you will receive an email with instructions about how access our crowdfunding through Seedrs before public launch on 12th September.

If you haven't received the email, just send us a message through our help centre and we'll sort it out. Or you can invest from Monday 12th September via Seedrs and we will apply your priority afterwards automatically.

Special offer for crowdfunders

Along with owning shares in Wealthify, as a crowdfunder you'll also get an exclusive fee capped at 0.5%* for any new or existing Personal Investment Plans you hold with Wealthify.

*Full annual rate is currently 0.7% for plans under £15,000. Your exclusive rate will be capped at 0.5% for the life of all investments you hold with Wealthify.

In the know - FAQ

-

When did Wealthify launch?

-

Wealthify was co-founded in October 2014 by Dr Richard Theo, Richard Avery-Wright and Michelle Pearce who shared a vision for an easy to use and low-cost service that makes investing accessible to everyone, regardless of wealth or experience. We launched Wealthify to the public in April 2016.

-

Who is behind Wealthify?

-

CEO and Co-founder, Dr Richard Theo is an award-winning entrepreneur. Technology is at the heart of everything Richard does and he has used his PhD in computer sciences to establish a number of successful online companies - including ActiveQuote Ltd, the UK's leading comparison site and broker of health insurance, income protection & life insurance - and most recently, Wealthify.

Richard Avery-Wright, Chairman and Co-founder, has spent over 30 years in the finance industry, establishing a number of successful businesses in the broking, asset management, technology and proprietary trading environments and is Co-founder of RAW Capital Partners, a boutique asset management company based in Guernsey.

Michelle Pearce, Chief Investment Officer and Co-Founder, began her career in stockbroking after leaving medical school. She quickly moved into discretionary wealth management, achieving Chartered Wealth Manager status and gaining a great deal of practical experience in building and managing model portfolios.

-

How big is the team?

-

We currently have a team of 10 full-time and 4 part-time staff covering investment management, customer services, marketing, software development, compliance and finance.

-

Where are you based?

-

Wealthify is based in Cardiff and is a UK limited company registered in England and Wales (No. 09034828). Our registered office is at Global Reach, Dunleavy Drive, Cardiff, CF11 0SN.

-

Is Wealthify FCA regulated?

-

Yes, we’re fully authorised and regulated by the Financial Conduct Authority (No. 662530).

-

Who is the target market?

-

In short – everyone. We’ve designed Wealthify to be accessible and affordable for anyone, no matter how little investing experience you might have. Millions of UK savers have been suffering from low interest rates since 2008, meaning their cash has been earning a meagre return. Our mission is to educate those savers about investing and offer them a simple, jargon-free route to a fully-managed and globally-diversified investment plan.

-

What are the growth targets for the business?

-

In the short term we’re focussed on acquiring 3000 customers as soon as possible whilst continuing to improve and develop our proposition, introducing new sales channels and new products and services like pensions and other types of ISAs. Longer-term we want to encourage 1 million savers to become investors within the next decade and unlock some of the billions held in low interest high street savings accounts in the UK.

-

When does the crowdfunding round open and close?

-

If you have pre-registered, you will have priority access to the crowdfunding via the Seedrs platform from the 9th September, with any remaining equity open to the public on the 12th September. Both customers and non-customers can pre-register now to secure priority access. Crowdfunding campaigns typically run for 4-6 weeks, but equity will be apportioned on a first-come-first-served basis.

-

Is Wealthify eligible for EIS (Enterprise Investment Scheme)?

-

Yes, Wealthify qualifies as an EIS eligible company. EIS is a UK tax scheme offering income tax and capital gains tax reliefs to qualifying private investors who invest in eligible businesses.

-

Is there a minimum investment amount?

-

You can invest any amount starting from £10.