The smart money's with Wealthify

Effortless saving and investing, online or on our app:

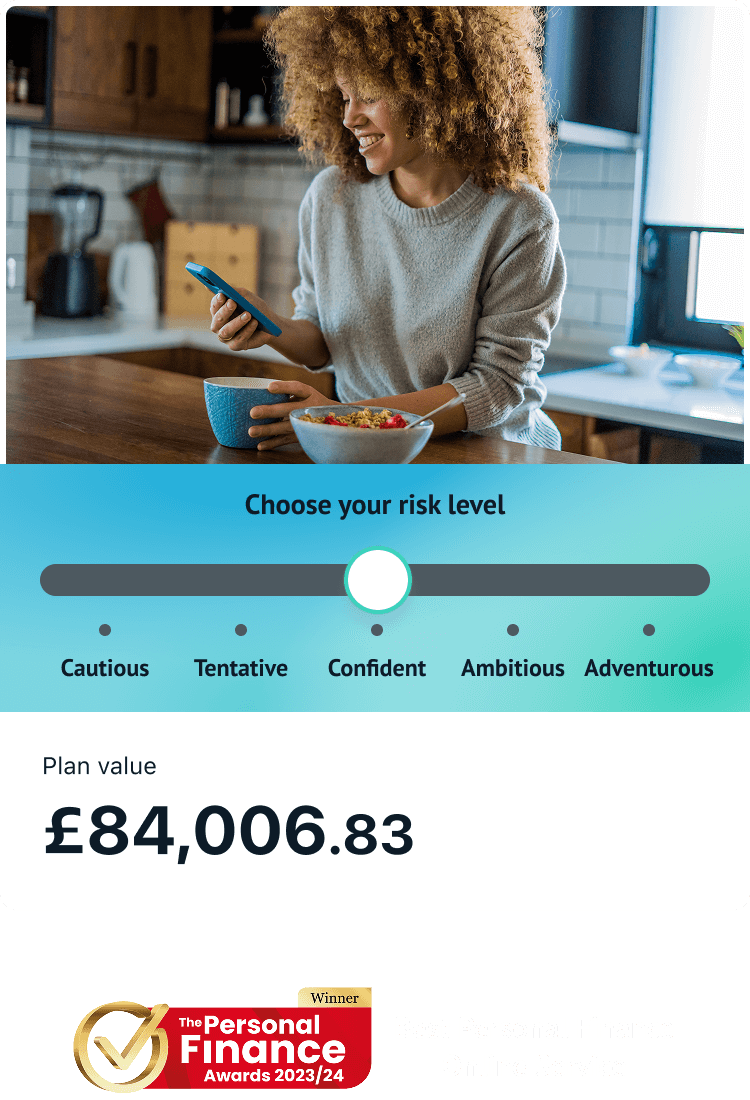

✓ Simple choice of investment styles built around you and expertly managed

✓ A low-cost home for you to bring your old workplace pensions under one roof

✓ Award-winning, UK-based Customer Care team

With investing, your capital is at risk. Tax treatments depend on your individual circumstances and may change in the future.

Our popular investment accounts

Whether you're growing a nest egg for you or your children, or giving your pension some attention, we've built a range of award-winning products to help you keep it simple. All you have to do is choose your investment style (from Cautious to Adventurous), and theme (Original or Ethical) — then let our team of investment experts manage everything else for you!

Stocks and Shares ISA

- Invest up to £20,000 each year with no capital gains tax or income tax to pay on your money as it grows.

- Pay withdrawn money back in the same tax year — without affecting your annual allowance.

- Withdraw your money at any time, without penalty.

Junior Stocks and Shares ISA

- Invest up to £9,000 every year for each child without paying tax on growth.

- Family and friends can contribute directly too.

- Easily transfer another Junior Cash ISA or Child Trust Fund to your Wealthify Junior ISA.

Self-Invested Personal Pension

- Combine previous pensions into one handy pot, making it easy to track and manage.

- Automatic 25% top-up when you make further contributions.

- Reduced fees on balances over £100,000.

With investing, your capital is at risk. Tax treatment depends on your individual circumstances and may change in the future.

Strength in depth

We’re backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 325 years.

Wealthify operates independently, which means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Our awards

Why choose Wealthify?

Smart investing built for performance

Our platform combines cutting-edge technology with the insight of investment professionals. You get the best of both worlds — intelligent automation guided by human expertise.

Expertly Managed Portfolios

Let our experts handle the day-to-day decisions, so you don’t have to. Our managed portfolios save you time by automatically keeping your investments on track with your goals

Simplify your retirement savings

Consolidate your old pensions into a single, manageable pot. Take control of your retirement planning with ease and clarity.

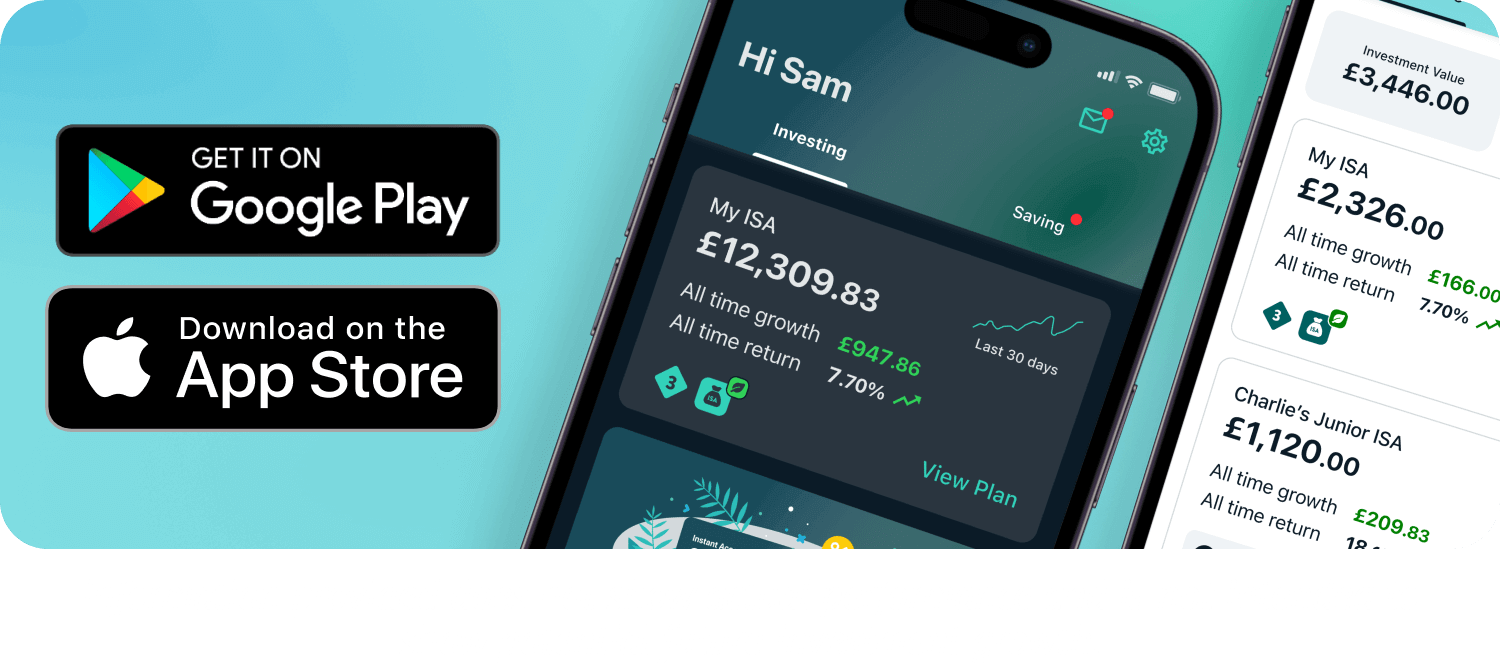

Download the app

Whether you’re looking for an investment app or money saving app, our award-winning wealth platform is available to download on iOS and Android devices (mobile and tablet). Built with security in mind, the Wealthify app is compatible with Face ID and Touch ID enabled handsets, making it an option for all your saving and investment planning.

Save and invest

Make saving easy with no fixed terms or penalties for withdrawing, whether it's building your emergency fund or saving for something special, our savings accounts can compliment the investment accounts you hold with Wealthify.

Wealthify, in collaboration with ClearBank, are providing you with an Instant Access Savings Account and Cash ISA. Wealthify will provide the day-to-day servicing of the account (including being the point of contact for any questions you may have), with ClearBank providing the account itself.

Easy Access Cash ISA

- Earn 3.61% AER / 3.55% tax-free p.a. (variable) paid monthly.

- Save up to £20,000 each year — with no tax to pay on any interest earned!

- Access your money anytime

- Withdraw and replace funds without affecting your annual ISA allowance.

Instant Access Savings Account

- Earn3.61% AER / 3.55% gross p.a. (variable). The interest rate tracks the Bank of England base rate minus a margin (currently 0.45%).

- Deposit as much as you like, with no upper limit.

- Access your money instantly

Our savings accounts provide a variable interest rate, meaning the rate can go both up and down; if you’re after the certainty of a fixed interest rate, then these types of savings accounts might not be for you.