Inspiring anyone to build their future wealth

- Exit Costs: We won’t charge you if you transfer your pension to us. However, your existing pension provider might have an exit charge. Be sure to check with them first.

- Investment fees: Before transferring your pension, compare your current fees and charges with our pension costs. We keep our costs as low as possible. However, before you make the move, you should understand the different fees and charges, and check that everything makes financial sense for you.

- Pension benefits and guarantees: You cannot transfer a pension to us that has safeguarded benefits or guarantees, these might include defined benefit pensions, or defined contribution pensions with a guaranteed income, or benefits such as getting more than 25% of your cash tax-free. We also cannot accept a transfer if you’re already taking an income from it. For other pensions, you should also consider if you may lose any other valuable features if you transfer, such as loyalty bonuses.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

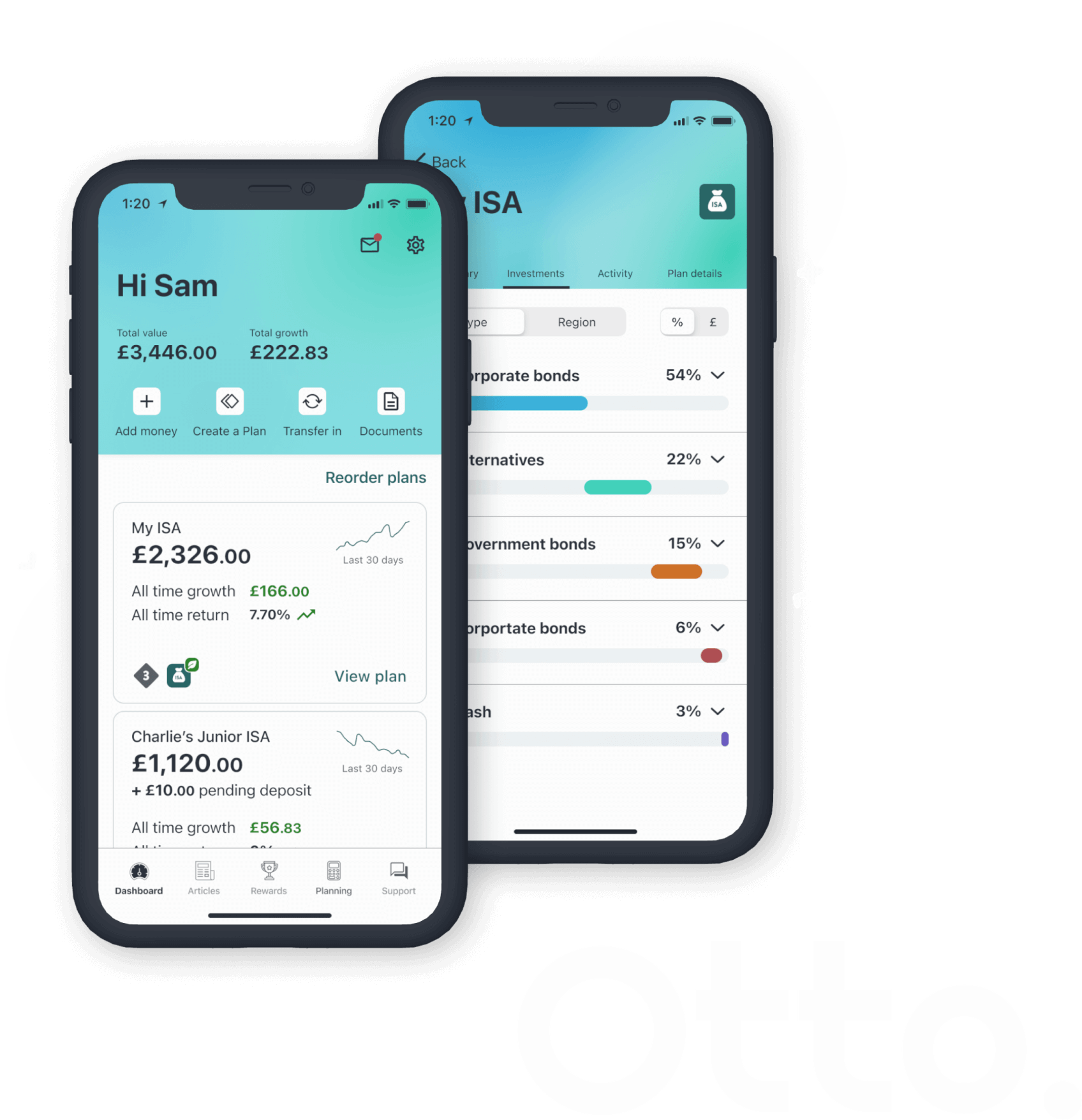

You choose

Create a Plan by choosing your investment style and how much you want to invest. You can start investing with just £1 and add more monthly, if you like.

Tell us how long you expect to invest for, and we'll show you what your Plan could be worth. Don't worry, your money isn't locked away, you can withdraw it anytime, without penalty.

Cautious

Minimising loss is the priority. Small movements up and down in Plan value are acceptable, with the aim of beating inflation.

Tentative

Limiting loss is important. Moderate movements up and down in Plan value are acceptable, with the aim of achieving reasonable growth.

Confident

Minimising losses is as important as making gains. Movements up and down in Plan value are acceptable, with the aim of achieving good growth.

Ambitious

Making gains is the priority. The risk of large losses and large movements up and down in Plan value are acceptable, with the aim of achieving high growth.

Adventurous

Maximising returns is the priority. The risk of substantial losses and substantial movements up and down in Plan value are acceptable, with the aim of achieving the highest growth possible.

Our approach

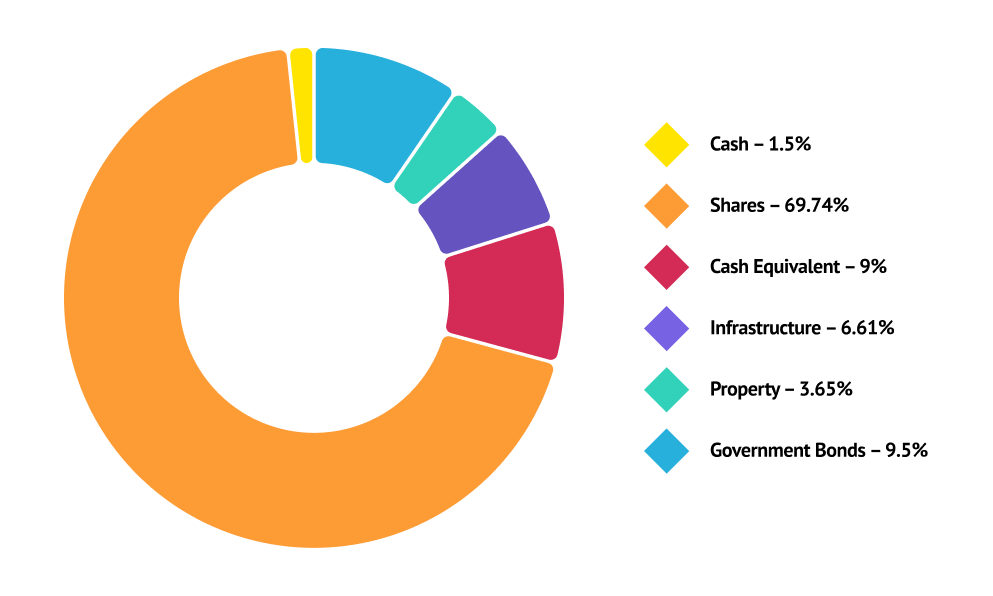

Your money is invested using a number of funds. Funds contain a collection of investments and are a convenient and cost-effective way to invest.

Some of these funds contain shares, but they also contain other good stuff, like bonds, property and commodities (such as precious metals, energy and agriculture). This is known as diversification and is a way to spread out your risk.

The mix of funds will change over time and depends on your attitude toward risk, as well as how financial markets are doing. Always bear in mind, the value of your investments can go down as well as up. With investing, your capital is at risk.

Passive investing

We use mostly low-cost passive investments, such as ETFs and mutual funds as they are proven to be more effective long-term than an active investment strategy.

LOW INVESTMENT FEES

We keep costs low and transparent so that you can maximise your returns.

Annual fee

We charge a simple annual fee of 0.6% for managing your investments. Unlike traditional providers, we won’t charge you to deposit or withdraw money, transfer or close your Plan.

Additional fees

As with most investments, other costs can apply but we aim to keep these as low as possible, around 0.16% for original plans and 0.71% for ethical.

Our products

You choose what type of investor you want to be, from cautious to adventurous, and we’ll build you an investment plan and manage it for you.

Investment ISA

General investment

Junior ISA

Personal pension

Our awards

Here are just a few of the prestigious awards we've picked up along the way

Boring Money Best Buys 2020

Best Investment Provider

Boring Money Best Buys 2020

Best Investment Provider

Boring Money Best Buys 2020

Best Investment Provider

Boring Money

Best Online Investment Service

British Bank Awards 2020

Best Investment Provider

COLWMA

Best Goal Based / Robo Investing

Personal Finance Awards 2019

Best Junior ISA

Shares Awards 2019

Best Online Investment Provider

Robo Investing Awards

Best Interface and Best Ethical Investments

Moneyfacts Consumer Awards 2019

Highly commended: Digital Wealth Management Provider of the Year

Safe & secure

Protected

Up to the first £85,000 of your money can be protected by the Financial Services Compensation Scheme (FSCS).

Safeguarded

Your bank login information will never be shared with Wealthify or anybody else.

Help is on hand

Our customer services team are happy to help with any queries on 0800 802 1800 or on live chat.

Wealthify customer reviews

Test icon stripe

Testing table

| Withdrawals | Best for long term | Fees | Personal Pension | Instant Access Cash Savings Account | |

|---|---|---|---|---|---|

| ✓ | ✓ | ✓ | ✓ | ✕ | |

| General Investment Account | ✓ | ✓ | ✕ | ✕ | |

| Junior ISA | Swanson | $300 | $100 | $100 | $100 |

| Personal Pension | Brown | $250 | $100 | $100 | $100 |

| Instant Access Cash Savings Account | Brown | $250 | $100 | $100 | $100 |

Which product is right for me

Stocks & Shares Investment ISA

- Pay in up to £20,000 every tax year

- Tax free returns

- £1 minimum investment

Junior Stocks & Shares ISA

- Pay in up to £9,000 every tax year

- Tax free returns

- The money belongs to your child, and can only be accessed by them when they turn 18

General Investment Account

- A flexible, standard investment account

- The money belongs to your child, and can only be accessed by them when they turn 18

- Returns are subject to tax

Personal Pension

- Invest up to £60,000 or 100% of your earnings (whichever is lower) across all your pensions

- We automatically add 25% tax relief

- If you're a higher rate tax payer you can claim additional relief through your tax return

- Minimum initial investment is £50 and minimum monthly investment is £50

Instant Access Cash Savings Account

- Pay in up to £20,000 every tax year

- Tax free returns

- £1 minimum investment