Effortless investing

PROVIDED BY WEALTHIFY

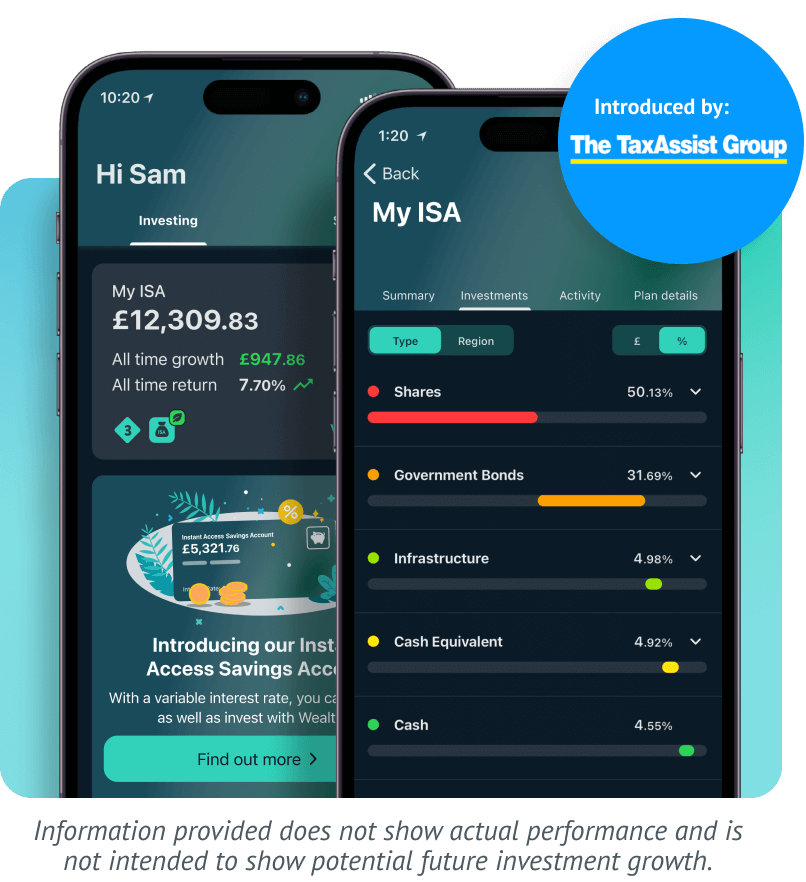

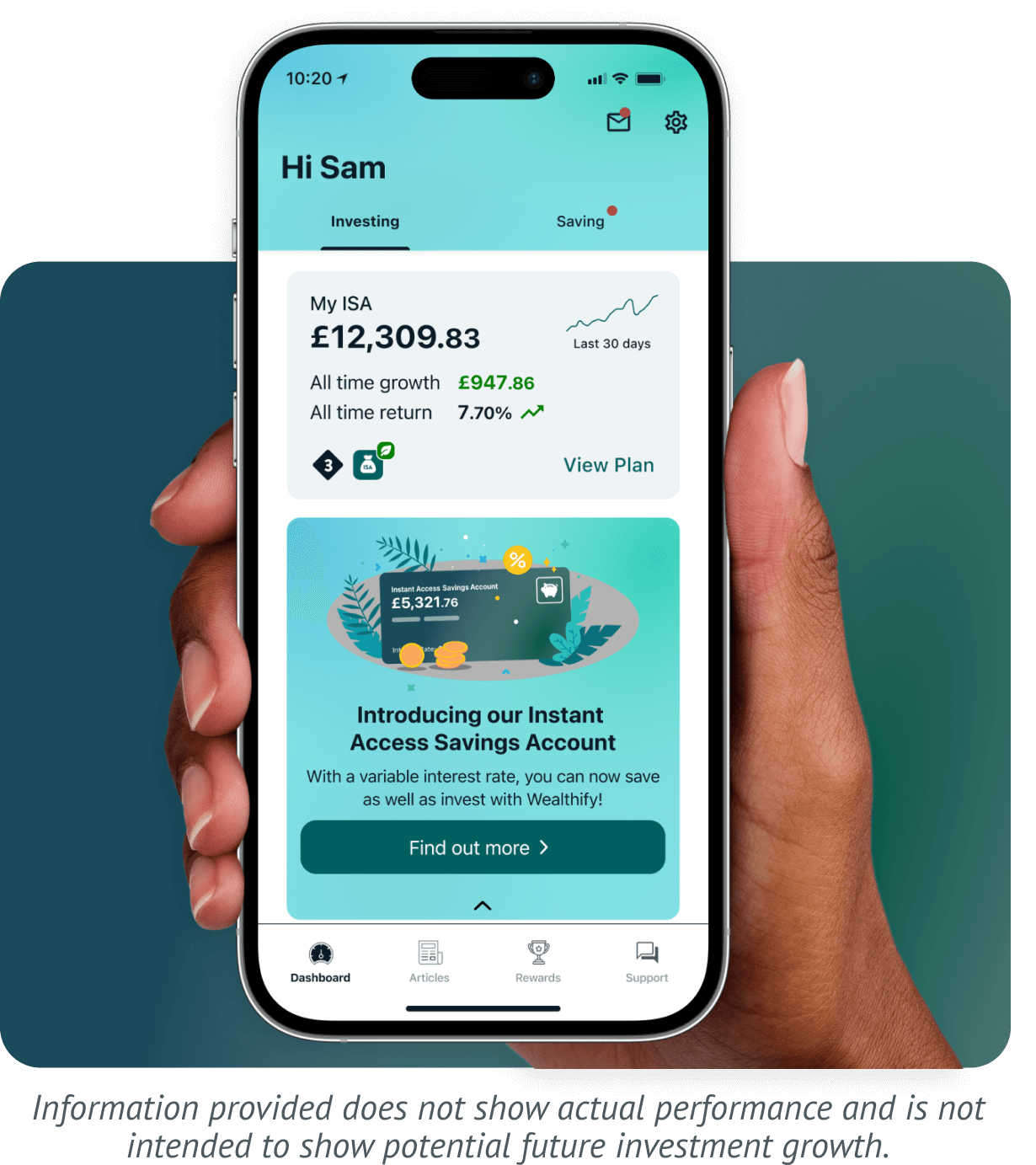

Wealthify offer an easy and affordable way to invest. Your money is carefully managed by their team of experts and invested in a way that matches your needs.

- We offer an easy way to invest from as little as £1 (£50 for Pensions).

- It’s simple - choose what type of investor you want to be, from cautious to adventurous.

- Wealthify build you a Plan and optimise it to keep it on track.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Awards

We're really proud of all the awards (over 50 and counting) we've won since launching in 2016. Not because we enjoy the recognition, but because it means we're doing something right, and that our customers are happy. These awards also help spread the word about Wealthify — meaning other people can start enjoying it, too!

Ready to invest?

Start from as little as £1 (£50 for Pensions), set the terms for your money, then we look after everything for you.

STOCKS AND SHARES ISA

Invest up to £20,000 a year with tax free returns.

GENERAL INVESTMENT ACCOUNT

Invest as much as you like, returns subject to tax. Great if you've used your ISA allowance. Get started today!

JUNIOR STOCKS AND SHARES ISA

Invest up to £9,000 a year with tax free returns for children under 18.

SELF-INVESTED PERSONAL PENSION

Invest for your future in a pension with a 25% tax relief top up.

Why Wealthify

We want to help make your money work harder. It's simple - you choose what type of investor you want to be, from cautious to adventurous, and we'll build you an investment Plan and manage it for you.

There's no minimum investment, and you can withdraw anytime with no penalties. We also offer ethical Plans, so you can easily invest in line with your values.

WEALTHIFY: A NAME YOU CAN TRUST

Secure

Your login details will always be kept secure — but never shared with anybody else.

Supported

Our award-winning Customer Care team are happy to help via Live Chat, or on 0800 802 1800.

Strength in depth

Wealthify is backed by Aviva: one of the UK's largest financial services institutions, which has looked after British consumers for more than 300 years.

Wealthify Customer Reviews

LEARN MORE ABOUT WEALTHIFY

Wealthify is backed by Aviva, the UK’s largest insurance provider and a global financial services company.

Wealthify remains fully authorised and regulated by the Financial Conduct Authority. Our customers’ money will be covered by the Financial Services Compensation Scheme (FSCS) up to £85,000.

Aviva and Wealthify are independently covered by the FSCS scheme, so a customer holding funds with both companies will be covered by the FSCS on each other their balances up to £85,000.

Yes, your money is safe when using Wealthify, as we work with global finance service providers who are regulated by the Financial Conduct Authority. These custodians hold your cash securely and separately from their own, which means that if Wealthify went into administration, our creditors wouldn’t have a claim to your investments.

The two companies we use as custodians are Winterflood Securities Limited, who hold the funds for our ISA and General Investment Accounts, and Embark Investment Services Limited, who hold the funds for our pensions. Up to the first £85,000 of your money invested with Wealthify can be protected by the Financial Services Compensation Scheme (FSCS) in the event of the insolvency of Wealthify, Winterflood Securities or Embark. However, it’s important to understand that the FSCS doesn't cover you in the event that your investments do not perform as expected and you get back less than you originally invested. For more information visit https://www.fscs.org.uk/

We’re based in Cardiff, in South Wales. Wealthify is a UK limited company registered in England and Wales (No. 09034828). Our registered office is Tec Marina, Terra Nova Way, Cardiff, CF64 1SA. We are authorised and regulated by the Financial Conduct Authority (No. 662530).

Your money is looked after by a team of qualified investment managers with experience in established firms all over the world. Our experts have developed an investment system that uses algorithms and industry experience to pick the best funds available to you, then builds you an investment plan that suits your goals and attitude to risk. And because things are always changing in the financial markets, our team monitors and adjusts your plan regularly, to make sure your money works as hard as you do.

No. We are not regulated to give you advice on whether investing is right for you. If you’re unsure, you should always seek the advice of an Independent Financial Adviser (IFA).

No, that’s what we’re here for. We build your Investment Plan based on what you tell us about your attitude to risk with money, how much you have to invest, and by when you hope to reach your investment goals. Then we monitor your investments to make sure they’re on track.

We’ve aimed to make it as affordable as possible to open an account with us. You can start your ISA, GIA or Junior ISA account with us for as little as £1, and open a pension with just £50. You can then choose if you want to make additional one-off or regular monthly payments. There’s no minimum top up amount for our Junior ISA, ISA or a GIA accounts, but each payment to your pension needs to be at least £50.

There are two costs and charges to be aware of when investing with Wealthify – a Wealthify management fee and investment costs. Investment costs include fund charges (taken directly by the fund provider) and market spread.

Wealthify Management fee

Wealthify charges a simple annual fee, payable monthly based on the value of your investments. This fee covers everything we do, including setting up your account, looking after your money and optimising your investments, which is known as rebalancing’.

Fund charges

We invest your money in carefully selected, low-cost investment funds from providers such as Vanguard and Blackrock. These incur a small annual charge, which is taken at source by the fund provider.

Market spread

These costs are incurred as a result of the process of buying and selling investments and as such must be considered as part of the overall cost of investing.

To get an idea of what your fee would be, why not check out our Fee Calculator.