Self-Invested Personal Pension

Award-winning SIPP from Wealthify

- Managed Plans that give you exposure to global investment markets.

- Receive automatic tax relief with a 25% top-up on personal contributions.

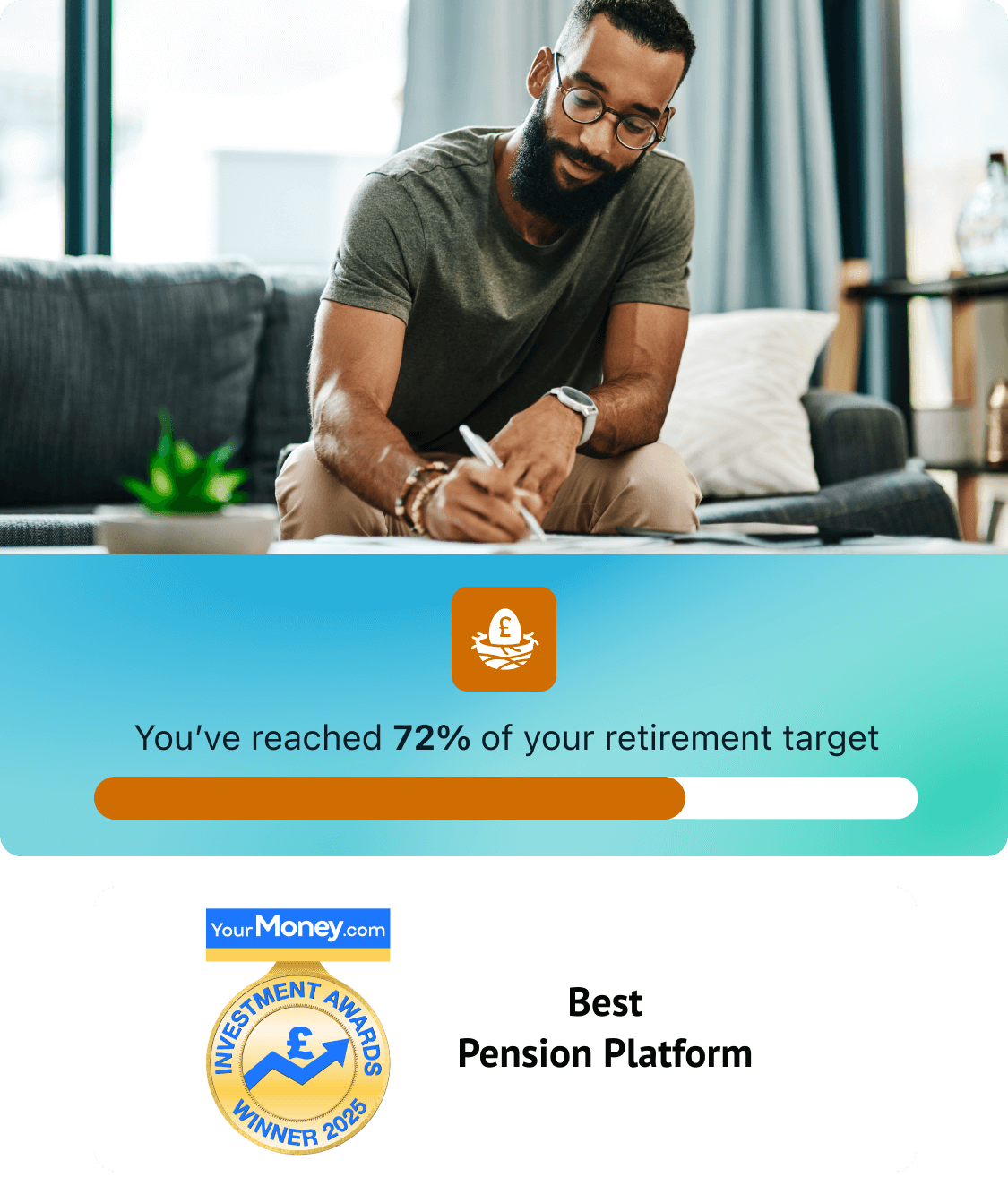

- See what you're on track for in retirement and how small adjustments could change your outcomes.

Get started with a minimum £500 deposit, then make smaller contributions and transfer your old workplace pensions in to boost your retirement pot.

With investing, your capital is at risk. Tax on your investments will depend on your individual circumstances and can change.

HOW DOES A WEALTHIFY SIPP WORK?

Three simple steps. That’s all it takes to open a new Self-Invested Personal Pension with Wealthify!

You Choose

From Cautious to Adventurous, Original or Ethical; start by telling us what type of investor you want to be.

We invest

Once we’ve established your investment style, our experts will build your Personal Pension Plan with just the right mix of investments.

We Optimise

You then leave all the heavy lifting to us, as we monitor your Pension Plan and adjust it to keep your retirement on track.

What is a SIPP?

A Self-Invested Personal Pension (or SIPP, for short) provides two main tax benefits:

- You don’t pay capital gains or income tax on your investments as they grow

- Instant tax relief top-up of 25% on personal contributions.

You pay your own money into a SIPP, and can adjust how much you pay in, making it a popular option for self-employed people looking to make personal contributions — and those looking to have more than just their workplace pension for retirement.

A Wealthify SIPP will typically be invested in a wide range of investments, including shares, bonds, and property.

OUR AWARDS

Why choose Wealthify for your pension?

Backed and owned by Aviva, we’re trusted by over 100,000 customers to look after their savings and investments.

Simple

You don’t need any previous investing experience with a Wealthify SIPP. Simply choose your investment style (from Cautious to Adventurous).

Flexible

Whether via Direct Debit or one-off payments, you can pay into a Wealthify SIPP, helping you to build a pension pot on your terms.

Great Value

With a Wealthify SIPP, there’s one simple annual management fee of 0.6%, reducing to 0.3% on the value of balances over £100,000. Fees are payable monthly and deducted automatically, based on the value of your investments.

Managed for you

Our Investment Team manage and optimise your investments. This includes your 25% tax relief top-up on personal contributions, which we’ll automatically add to your pot and invest for you.

Essential Tools

Use our Pension Calculator at any time to give you confidence over where you are with your Pension, and how changes you make might affect how much your pension could be worth, or even when you could retire.

Support

When dealing with something as important as your pension, sometimes you just need to be able to speak to an actual human being about it. Thankfully, we’ve a Customer Care team ready and waiting to answer your call, email, or secure message. (please note, they're unable to give any financial or product advice).

TRANSFERRING A PENSION TO WEALTHIFY

Looking to transfer an old pension to a Wealthify SIPP?

Perhaps you have a handful of old workplace ones you’ve been wondering what to do with? If this sounds like you, then the good news is that transferring them is an equally simple three-step process, as we do all the hard work for you. And, with all your old pensions consolidated, your investments could build as one larger, combined amount!

1. Find your old pensions

Start by telling us a few details about your old pensions via an online transfer form, including a reference number and recent value.

2. The transfer process

We'll then talk to your provider(s) and start the transfer process, which usually takes within 30 days to complete.

Please note there are some pensions we can’t accept, such as those with 'defined benefits', a ‘guaranteed income’, or ones you’re already taking an income from. When transferring a pension, you will also need to consider if there any fees and charges from your current provider.

PENSION CALCULATOR

For many people, the most daunting part of saving towards retirement is actually figuring out just how much you might need in the first place!

Easy and free-to-use for everyone - including non-Wealthify customers - our SIPP calculator is here to help you just do that.

Whether you're 25 or 65; Cautious or Adventurous with your investing style; making regular contributions or one-off payments; use it to explore and tweak various factors, helping you decide how to hit your target income for retirement.

SIPP FEES

When saving over long periods of time, fractions make a difference. Sure, an extra 0.01% per year might not seem like much now. But over a lifetime, that small number could add up to a big one, essentially eating into your retirement savings.

Fees cover everything we do, including setting up your account, looking after your money, and optimising your investments. Unlike some traditional providers, we won’t charge you for depositing or withdrawing money, transferring funds, or closing your Plan.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Pension Guide

Not all personal pensions are the same, so we’ve created this useful guide to give you information on how a pension works, the different types of pension, how to set up a pension, reasons for consolidating pensions and much more.

This guide doesn't offer personal advice, speak to a financial adviser if you're unsure about whether investing is right for you.

OUR REVIEWS

Pension Blogs

PENSION ALLOWANCE

When it comes to pensions, there’s a lot to consider. But before withdrawing from it, you need to know about your pension allowance.

HOW TO FIND A LOST PENSION

If you’ve lost a pension then you might be glad to know it’s easier to find it than you might think. Click here to learn how to find lost pensions.

PENSION CONSOLIDATION

If you're considering consolidating your pensions to bring them all together in one place — here’s what you need to know.

WHEN CAN I ACCESS MY PENSION?

Hoping to retire young or want to spend some of your pension savings before you retire? Here’s everything you need to know about accessing pensions early.

Pension FAQs

You can access your pension when you turn 55 (rising to 57 in 2028). Subject to current pension rules, you'll be able to withdraw 25% of the total amount tax-free, with the rest being taxed based on your individual circumstances. However, you don’t have to take any of your pension if you don’t want to. If you’re still working, for example, you can leave the money in your pension – and continue to contribute – until you retire.

The way you take your money out of your pension (a process known as moving your pension into drawdown), will vary depending on the type of pension you have.

If you have a defined benefit pension, you will receive a specific income for life, which should increase every year. If you have a defined contribution scheme, then you’ll be able to choose how you want to withdraw your funds using one of the following methods:

- Take your whole pension in one go as a lump sum.

- Withdraw money whenever you need it.

- Receive a regular income.

Wealthify doesn’t offer a pension tracing service.

However, if you're looking to transfer your pension to us, we will need to know who your pension is with and a reference number.

Normally, pension providers will issue you an annual statement that comes through the post — even if it's a lost pension you no longer pay into.

Your policy number should be included in the letter. If you know the pension provider but can’t find a statement, you may still be able to find your pension by contacting the provider.

In the case of a workplace pension (a pension set up by your employer), if you don’t know who the provider is, then your first port of call should be contacting your employer.

If you need help finding a lost workplace or personal pension, please visit the Pension Tracing Service, which is a free, government-run service.