PENSION TRANSFER

There are plenty of good reasons to transfer your pensions to Wealthify — but here are just a handful of the best ones:

• By combining your pensions, you could save money on multiple fees.

• If you've recently changed jobs, transferring that workplace pension could help give you more clarity and control over your investments.

• Our investment experts will manage your Plan for you, taking the hassle out of saving for retirement.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

title needs to be deleted

Protected

Up to the first £85,000 of your money is protected by the Financial Services Compensation Scheme (FSCS).

SAFEGUARDED

As well as FSCS protection, your log-in details will be kept secure and never be shared with anybody else.

SUPPORTED

Our award-winning Customer Care team are happy to help with any queries via Live Chat, or on 0800 802 1800.

WHY TRANSFER YOUR PENSIONS TO WEALTHIFY?

• Hassle-free transfer: all you need to do is just tell us a few basic details about the pension you'd like to transfer to us, then we'll do the rest for you.

• Low fees: we charge a simple annual management fee of 0.6%, but don't charge you to deposit or withdraw money, transfer or close your Plan.

• No investing experience needed: our investment experts set up and manage your pensions for you, making sure you're on track to reach your retirement goals.

• Risk levels that suit you: we build your Pension Plan based on your attitude to risk, with five different risk levels available, from Cautious to Adventurous.

• Ethical Plans: transfer your pensions to us and invest in organisations committed to having a positive impact on society and the environment.

• Instant government top-up: Weathify automatically adds the 25% government top-up to all contributions you make to your transferred pension, giving you one less thing to worry about.

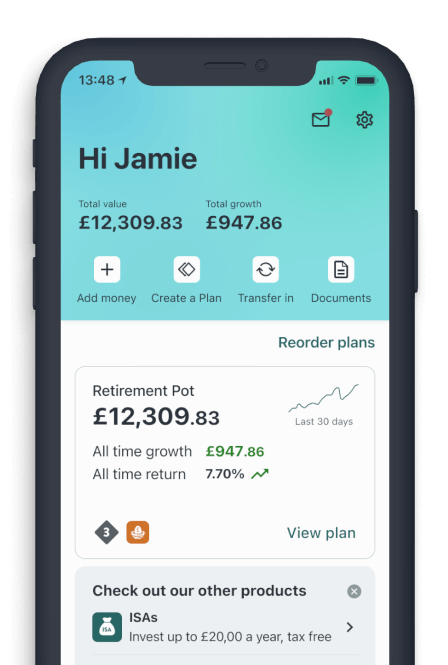

• All your pensions in one place: if you're looking to consolidate multiple pensions.

HOW TO TRANSFER YOUR PENSION

ACCOUNT & PLAN SET-UP

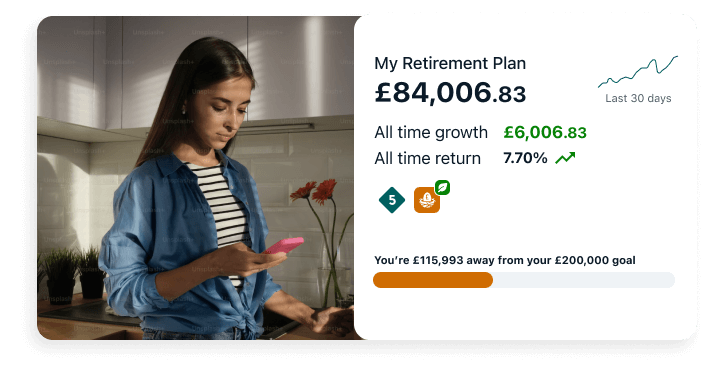

Use our simple Pension transfer plan creator to see how much your pension could be worth when you reach your retirement age.

Tell us a few details about yourself to help us create your account. We will help assess your suitable risk level based off a few suitability questions.

FURTHER INFORMATION

We will need your existing pension provider name, account and reference number as well as the approximate value of your pension.

Additionally, you can add up to 8 beneficiaries, as well as allocate the percentage of your pension they’ll each receive. Learn more about beneficiaries.

TRANSFER MANAGEMENT

We will send an instruction to your existing pension provider to make the transfer of your pension’s current cash value, ready for us to invest it into your new Wealthify Pension Plan.

Authorising the pension transfer allows us to contact your existing pension provider to make the transfer as smooth as possible.

PENSIONS TIPS AND INSIGHTS

"When we’re younger, most people don’t give much thought to pensions and retirement. Stop and think though, because a pension is an investment in YOUR future self to live the lifestyle YOU want beyond work. It’s your reward for a lifetime of effort and discipline — your financial freedom in later life. The great thing about investing in a pension early, is time. Time is your friend, as it allows your pension plan to navigate the inevitable highs and lows of the stock market, giving it a long enough to benefit from the magic of compounding, too. Crucially, time unlocks the key to successful investing: staying the course and staying invested in the market. So, with that in mind: start early, pay yourself first — and retire on your terms."

Colleen McHugh, Chief Investment Officer

HOW YOUR PENSION IS INVESTED

We use mostly low-cost passive investments, such as ETFs and mutual funds. These let your money track a mix of whole markets like the FTSE100 and are proven to be more effective long-term than an active investment strategy. Our portfolios contain a mix of shares, bonds, commodities and other investments, which our experts optimise to keep your Plan on track and rebalance to keep in line with your chosen risk level.

STRENGTH IN DEPTH

Wealthify is backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 300 years.

We operate independently of Aviva, which means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Being part of the Aviva group of companies allows us to develop our business, but at an accelerated pace and with greater confidence.

PENSION TRANSFER FAQS

FAQs will go in here - waiting on dev release

LOOKING TO START A NEW PENSION?

Learn all about our Personal Pensions, and let us help you make the most of your money for your retirement!

Our awards

Here are just a few of the prestigious awards we've picked up along the way

Boring Money Best Buys 2020

Best Investment Provider

Boring Money Best Buys 2020

Best Investment Provider

Boring Money Best Buys 2020

Best Investment Provider

Boring Money

Best Online Investment Service

British Bank Awards 2020

Best Investment Provider

COLWMA

Best Goal Based / Robo Investing

Personal Finance Awards 2019

Best Junior ISA

Shares Awards 2019

Best Online Investment Provider

Robo Investing Awards

Best Interface and Best Ethical Investments

Moneyfacts Consumer Awards 2019

Highly commended: Digital Wealth Management Provider of the Year