Pension Consolidation

Combining pensions into one easy-to-manage pot with Wealthify is simple, but to ensure you’re getting a pension that’s right for you, there are a few things to check:

✓ Fees: At Wealthify, there's a low annual management fee of 0.6% for balances below £100,000 — dropping to just 0.3% for any portion above that. Please understand how your current fees compare with ours.

✓ Charges: We don’t charge you for transferring to or from Wealthify. However, always check to see whether your existing pension provider has an exit charge.

✓ Benefits: Check you won't lose features such as loyalty bonuses.

ⓘ You can usually find this information on your existing statements, online account, or over the phone.

Other things to know:

- In your interest, we can't accept transfers of pensions with safeguarded benefits such as Defined Benefit pensions, those with a guaranteed income, or those where you can get more than your 25% tax free cash.

- We can’t accept transfers from pensions you’re already taking an income from.

- While the transfer takes place, your pension will be ‘out of the market’, as your existing provider needs to sell your investments before transferring it as cash.

- Combining two or more pensions doesn’t guarantee more money in retirement and investment performance is never guaranteed.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

What is pension consolidation?

In simple terms, pension consolidation means combining multiple pensions into one.

Considering most people have multiple jobs in their lifetime, chances are they’ll also have multiple pensions with different providers as a result.

By combining pensions – including old workplace ones – the idea is to make it easier to control your finances for retirement by having a single pot to manage (as opposed to multiple pots).

As well as making things easier to manage, pension consolidation also means only having to pay one provider fee — potentially saving you money in the long run if your existing providers have higher fees!

It’s important to understand that pension consolidation doesn’t have to mean transferring all your pension pots: if it makes more sense to transfer just a few, you can do that, too.

How to consolidate your pensions

The first step involves finding your lost pensions, which can be done using the government’s free Pension Tracing Service.

Once found, you’ll then need to check a few things before going ahead with pension consolidation, including:

Fees: At Wealthify, SIPP balances up to £100,000 have one annual management fee of 0.6%, and any portion thereafter is charged at a lower 0.3% fee. When considering consolidation, please understand how your current fees compare with ours.

Charges: We don’t charge you for transferring to or from Wealthify. However, some pension providers may charge an exit fee for transferring out, so make sure you ask your current providers about their transfer policies.

Benefits: It’s important to check that you won't lose features such as loyalty bonuses.

From there, combining pensions with Wealthify can be done in four simple steps. Please note that you can transfer one pension at a time — or add multiple ones if you want to combine more.

You create an account

Simply tell us a few details about yourself, including answering a few suitability questions to help us find the right investment style for you.

You tell us about your provider

This includes your existing pension provider’s name, account reference number, and approximate value.

We transfer everything for you

Authorise the pension transfer, then we’ll contact your existing provider, before transferring your pension's current cash value into your new Wealthify Pension.

We build and manage your pension

Our team of investment experts build your Pension Plan, monitoring and optimising its performance to keep your retirement goals on track.

OUR AWARDS CABINET

Why choose Wealthify for your pension consolidation?

Owned and backed by Aviva – one of the UK’s largest financial services institutions – Wealthify is a name you can trust. That aside, there are plenty of other reasons why you might choose us to look after your pension, including our:

- Simple pension transfer process: When it comes to pension consolidation, we don’t charge you for combining pensions, giving you the flexibility to invest on your terms.

- Instant 25% tax relief top-up: With a Wealthify Pension, we add the government's 25% tax relief top-up on all your personal contributions.

- Easy-to-use platform: Whether you’re using the Wealthify app or online dashboard, our award-winning platform makes managing your pension simple.

- Expertise: As well investment professionals looking after your pension, we’ve also got a team of customer service experts ready and waiting to help you when needed.

Pension pot calculator

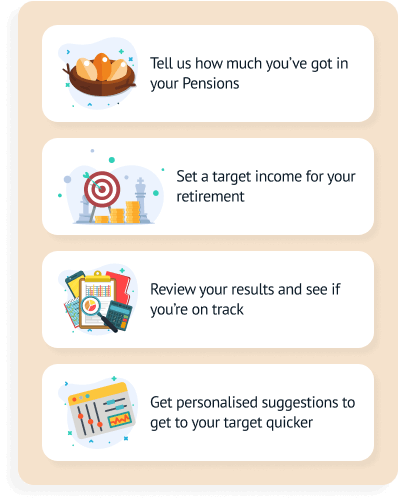

Before combining pensions, you might want to use our pension calculator to get an idea of how much your pot could be worth in retirement. After all, a clearer picture of what you have now, could help create a clearer plan for what you’ll need in the future.

To get the most out of our calculator, all you have to do is let us know how much is in your pension(s), when you're planning to retire, and how much you regularly contribute.

The good thing about our calculator is that you can play around with certain figures to change the projections, which is handy in case your circumstances change in the future — or if you’re just feeling curious!

The calculator will then apply our projected investment performance, giving you an idea of how much your pension could be worth. Please remember, however, that the value of your investment could go down, and up and you could get back less than you put in.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Secure

Your login details will always be kept secure — but never shared with anyone else.

Support

Our friendly Customer Care Team are always happy to help via email, Live Chat, or on 0800 802 1800.

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

How do I find all my pensions?

If you’re looking for a simple starting point when knowing how to merge pensions, look no further than the government’s free Pension Tracing Service.

This service checks over 200,000 workplace and personal schemes to try and track down old pensions — although it can only provide contact details for pension providers. It can’t tell you whether or not you actually have a pension with a particular provider or, if you do, what that pension’s value is.

Once you have found them, don’t forget that we can then take all the hard work out of combining them for you!

For even more information about pension consolidation in the meantime, why not check our guide to finding lost pensions?

Is there a fee for pension consolidation?

If you’ve made it this far and feel as though pension consolidation with Wealthify could well be for you, one last thing to consider is fees.

With Wealthify, however, we don’t charge you for combining pensions — and it’s as simple as that.

Read our Pension Guide

Not all personal pensions are the same, so we’ve created this useful guide to give you information on:

- What a Self-Invested Personal Pension (SIPP) is.

- What the annual pension allowance is.

- How a SIPP differs from a workplace pension.

- Reasons for consolidating pensions.

This guide doesn't offer personal advice, speak to a financial adviser if you're unsure about whether investing is right for you.

OUR REVIEWS

Blog Articles

PENSION ALLOWANCE

When it comes to pensions, there’s a lot to consider. But before withdrawing from it, you need to know about your pension allowance.

HOW TO FIND A LOST PENSION

If you’ve lost a pension then you might be glad to know it’s easier to find it than you might think. Click here to learn how to find lost pensions.

PENSION CONSOLIDATION

If you're considering consolidating your pensions to bring them all together in one place — here’s what you need to know.

WHEN CAN I ACCESS MY PENSION?

Hoping to retire young or want to spend some of your pension savings before you retire? Here’s everything you need to know about accessing pensions early.

Pension FAQs

You can access your pension when you turn 55 (rising to 57 in 2028). Subject to current pension rules, you'll be able to withdraw 25% of the total amount tax-free, with the rest being taxed based on your individual circumstances. However, you don’t have to take any of your pension if you don’t want to. If you’re still working, for example, you can leave the money in your pension – and continue to contribute – until you retire.

The way you take your money out of your pension (a process known as moving your pension into drawdown), will vary depending on the type of pension you have.

If you have a defined benefit pension, you will receive a specific income for life, which should increase every year. If you have a defined contribution scheme, then you’ll be able to choose how you want to withdraw your funds using one of the following methods:

- Take your whole pension in one go as a lump sum.

- Withdraw money whenever you need it.

- Receive a regular income.

Wealthify doesn’t offer a pension tracing service.

However, if you're looking to transfer your pension to us, we will need to know who your pension is with and a reference number.

Normally, pension providers will issue you an annual statement that comes through the post — even if it's a lost pension you no longer pay into.

Your policy number should be included in the letter. If you know the pension provider but can’t find a statement, you may still be able to find your pension by contacting the provider.

In the case of a workplace pension (a pension set up by your employer), if you don’t know who the provider is, then your first port of call should be contacting your employer.

If you need help finding a lost workplace or personal pension, please visit the Pension Tracing Service, which is a free, government-run service.