Pension Calculator

RELAX INTO YOUR RETIREMENT PLANNING WITH OUR HELPFUL PENSION CALCULATOR.

- Measure the potential of your personal pension pot.

- Define your chosen retirement age and plan ahead for your lifestyle goals.

- See what combining your past pensions could do for you.

- Add lump sum personal contributions or monthly top-ups to change your pot’s projected value.

- Select an investment style that suits you and your values.

With five investment styles available – ranging from Cautious to Adventurous – you can see the potential impact of each, before choosing the one best suited to your individual needs and investment personality.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Why use Wealthify's pension calculator?

Pensions can be a confusing topic for many people. But what it really comes down for you as an individual is:

- Knowing how to get the most from your money.

- Freeing yourself up to enjoy your well-deserved retirement.

Remove the complexity of your pension pot and help to future-proof your financial planning with the help of our handy pension calculator.

To see what your pension’s projected value could be, simply:

- Enter your details and the target age you hope to retire.

- Tell us about any existing pensions.

- How much you’d like to add in the future.

From there, you can decide whether to retire earlier or later (the minimum retirement age is currently 55 and will increase to 57 in 2028), or make additional contributions to your pension.

Use our calculator to see how making small changes to your retirement age, contributions, or including pension transfers could have an impact on reaching your target goal.

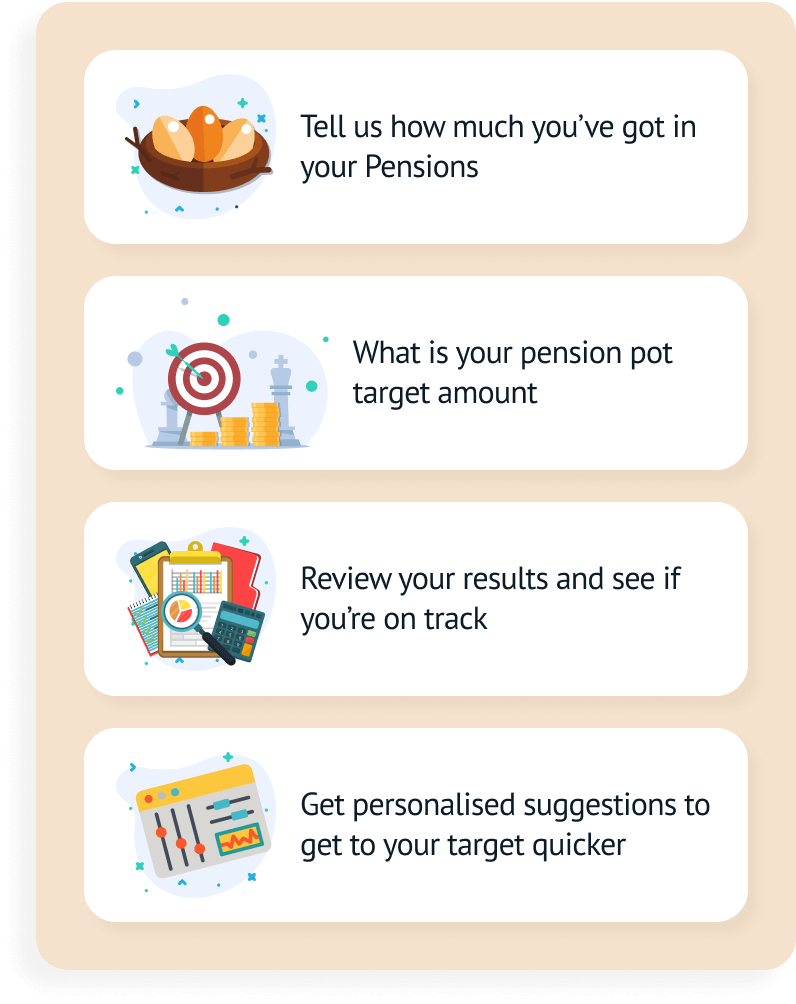

How to calculate my pension

Enter your details

Type in a few basic details and what date you plan to retire.

Your funding

Tell us about any existing pension pots you may be considering transferring and how you would you like to add money to your pot in the future.

See your options

Experiment with our investment styles and themes to find a Plan that suits your needs.

Your retirement target

Set your retirement goal and see what you could do to reach it.

OUR AWARDS CABINET

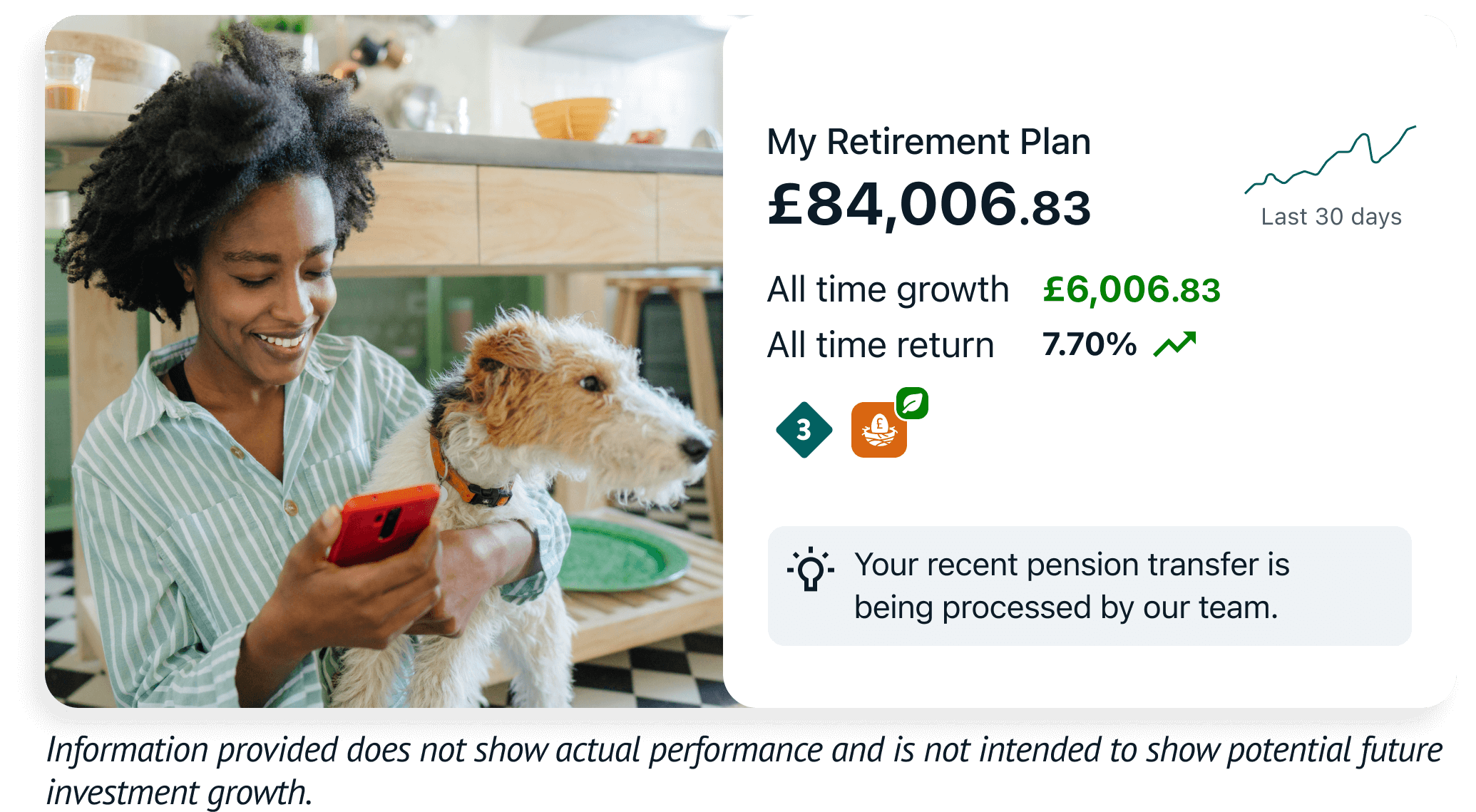

What you’ll find out

Our calculator is designed for you to help with your retirement planning and the results will be unique to you. So, have a play with the options available!

You’ll be able to see your results instantly; and when you’ve decided on a Wealthify Personal Pension Plan that suits your vision for retirement, you can have an email copy sent to yourself and put it into action.

You can start withdrawing from your workplace and personal pension pots when you turn 55 (rising to 57 in 2028), but if your projection is not what you want it to be by that age, you still have a few options to bulk up your pot before retirement begins.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

The benefits of choosing Wealthify for your pension

- Get an instant 25% tax relief top-up from personal contributions.

- SIPP balances up to £100,000 have one annual management fee of 0.6%, and any portion thereafter is charged at a lower 0.3% fee.

- Choose from Ethical or Original Investment Plans.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

Secure

Your login details will always be kept secure — but never shared with anyone else.

Support

Our friendly Customer Care Team are always happy to help via email, Live Chat, or on 0800 802 1800.

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

OUR REVIEWS

Transfer a pension to Wealthify

Consolidating your pensions (transferring your previous pension pots to be all together in one place) could be a good starting point for bulking up your retirement funds.

With Wealthify, you can:

- Manage past pensions all in one place.

- Use our simple transfer process.

- Enjoy straightforward investing (no experience needed, leave it to our team of experts).

All your pensions in one place

Complete transparency

Some providers have a low management fee, but hide extra charges which can impact your returns over time. At Wealthify, we charge a simple annual management fee depending on the value of your investments; 0.6% for pension balances up to £100,000, dropping to just 0.3% for any portion of £100,000 or more.

You’re in control

A Pension that fits in with you - choose to set up a regular payment, or top up whenever you can. Change or pause your payments anytime online or in our app.

Here when you need us

From sign up to draw down, we offer a simple, seamless online pension. If you do need help, our UK based customer care team are available on phone, live chat or email.

Read our Pension Guide

Not all personal pensions are the same, so we’ve created this useful guide to give you information on:

- What a Self-Invested Personal Pension (SIPP) is.

- What the annual pension allowance is.

- How a SIPP differs from a workplace pension.

- Reasons for consolidating pensions.

This guide doesn't offer personal advice, speak to a financial adviser if you're unsure about whether investing is right for you.

Blog Articles

PENSION ALLOWANCE

When it comes to pensions, there’s a lot to consider. But before withdrawing from it, you need to know about your pension allowance.

HOW TO FIND A LOST PENSION

If you’ve lost a pension then you might be glad to know it’s easier to find it than you might think. Click here to learn how to find lost pensions.

PENSION CONSOLIDATION

If you're considering consolidating your pensions to bring them all together in one place — here’s what you need to know.

WHEN CAN I ACCESS MY PENSION?

Hoping to retire young or want to spend some of your pension savings before you retire? Here’s everything you need to know about accessing pensions early.

Frequently Asked Questions

You can access your pension when you turn 55 (rising to 57 in 2028). Subject to current pension rules, you'll be able to withdraw 25% of the total amount tax-free, with the rest being taxed based on your individual circumstances. However, you don’t have to take any of your pension if you don’t want to. If you’re still working, for example, you can leave the money in your pension – and continue to contribute – until you retire.

The way you take your money out of your pension (a process known as moving your pension into drawdown), will vary depending on the type of pension you have.

If you have a defined benefit pension, you will receive a specific income for life, which should increase every year. If you have a defined contribution scheme, then you’ll be able to choose how you want to withdraw your funds using one of the following methods:

- Take your whole pension in one go as a lump sum.

- Withdraw money whenever you need it.

- Receive a regular income.

Wealthify doesn’t offer a pension tracing service.

However, if you're looking to transfer your pension to us, we will need to know who your pension is with and a reference number.

Normally, pension providers will issue you an annual statement that comes through the post — even if it's a lost pension you no longer pay into.

Your policy number should be included in the letter. If you know the pension provider but can’t find a statement, you may still be able to find your pension by contacting the provider.

In the case of a workplace pension (a pension set up by your employer), if you don’t know who the provider is, then your first port of call should be contacting your employer.

If you need help finding a lost workplace or personal pension, please visit the Pension Tracing Service, which is a free, government-run service.