Wealthify Partnerships

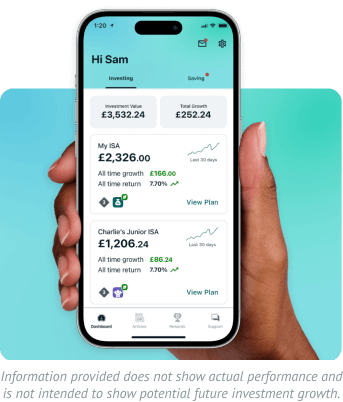

Wealthify is an award-winning, digital savings and investment platform, backed by Aviva. Offering a range of products for people at every stage of their life, we can help your clients reach the financial goals that matter to them most.

- Enhance your business offering

- Support your employees' financial wellbeing

- Generate an additional revenue stream

Partner with us

Have a question or ready to explore a partnership with Wealthify?

Fill out the contact form below, and a member of our team will be in touch over the next five business days to discuss how we can work together.

Thank you for reaching out.

Our partnerships team will be in touch soon.

OUR AWARDS CABINET

The benefits of partnering with Wealthify

Enhance your offering and increase customer loyalty with easy access to an award-winning savings and investment platform.

Create a new revenue stream for your business with our ready-to-launch service.

Partner with Wealthify on a co-branded basis and utilise our APIs.

Our dedicated Partnerships, Compliance, Legal, Customer Care, and Investment teams are on hand for ongoing help.

OUR REVIEWS

How we can help

Wealthify can support your business with a wide range of B2B services. Helping you diversify your product offering, retain valuable customers, and earn a new revenue stream.

Financial services

As the UK's finance industry takes an increasingly digital approach, excel your own service by embedding additional financial services into your customer journey. Wealthify offers you a seamlessly packaged, award-winning investment and savings platform for your customer base to use.

- Launch a co-branded version of our platform: Delivering new products to your banking customers.

- Give your customers an easy route into investing: Our team of experts are on hand to manage their portfolio.

- Offer simple savings options on a secure digital platform: From tax-free Cash ISAs to instant access savings pots.

- Reduce your capital expenses: No standard build costs mean you can increase the speed of rolling out additional products.

- Designed with your service in mind: We’re here to complement your existing financial solutions, rather than replace them.

For financial advisers and wealth managers

A high-value solution for your smaller clientele. Partnering with Wealthify could help you deliver a complimentary service for clients that don’t currently meet your required threshold. Allowing you to address Consumer Duty concerns and create more availability for your higher value clients.

At Wealthify, we don't do financial advice. We provide a beautifully designed, simple investment platform that allows your smaller clients to utilise our service until they reach a scale that makes them commercially viable for you.

Affiliate partnerships

Our affiliate program offers a fast and effective way for companies to monetise their existing content or expand their financial content with the support of an award-winning fintech brand.

- Support from a dedicated team of partnership managers, to help you get the most from your campaigns.

- Guidance from our team to help you navigate the complex financial content landscape.

- Benefit from regular updates, promotions and affiliate program exclusives.

For employers & employee benefit companies

In a world where free fruit and pizza parties have become the norm, why not stand out from the crowd by supporting your employees to make their money work harder.

We understand that you want the best for your employees – and Wealthify could be exactly what you're looking for – offering an excellent way to help your employees maximise the potential of their personal finances.

- Beautifully simple: Access our award-winning platform on app or through web browser.

- No fuss financial management: Opening investment accounts can be confusing. We pride ourselves on making the whole process a smooth sail.

- Financial wellbeing: Deliver an effective financial strategy to your wellness plan — complementing your team’s physical and mental health.

Secure

Your login details will always be kept secure — but never shared with anyone else.

Support

Our friendly Customer Care Team are always happy to help via email, Live Chat, or on 0800 802 1800.

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

See Our Past Performance

The past performance data shown represents real transactions we've carried out for actual customer Plans across each of our five Investment Styles. When it comes to investment performance, if you’d invested in one of our Original Confident Plans from the very beginning (29 February 2016), you’d have enjoyed a 49.09% return so far (up until 31st January, 2025). You can see projections for how your ISA could grow moving forward by using our Plan builder as you Start your ISA.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Plan performance by year

This table shows by how much each of our investment styles have grown each year

| Investment Style | 30/06/2020 - 30/06/2021 | 30/06/2021 - 30/06/2022 | 30/06/2022 - 30/06/2023 | 30/06/2023 - 30/06/2024 | 28/06/2024 - 28/06/2025 |

|---|---|---|---|---|---|

| Cautious | 4.19% | ||||

| Tentative | 4.55% | ||||

| Confident | 4.94% | ||||

| Ambitious | 5.30% | ||||

| Adventurous | 5.55% |

See Our Past Performance

The past performance data shown represents real transactions we've carried out for actual customer Plans across each of our five Investment Styles. When it comes to investment performance, if you’d invested in one of our Ethical Confident Plans from the very beginning (28 February 2018), you’d have enjoyed a 25.63% return so far (up until 31st January, 2025). You can see projections for how your ISA could grow moving forward by using our Plan builder as you Start your ISA.

Original

Ethical

Of course, we experienced the ups and downs of the market along the way and you could get back less than you put in. Although we cannot rely on past performance to predict future results investing for the long-term (5 years or more) typically delivers positive returns. These figures are after all fees have been taken (based on 0.60% p.a Wealthify management charge), and are based on the performance of Plans worth more than £100 and will be different for Plans below that amount.

Plan performance by year

This table shows by how much each of our ethical investment styles have grown each year

| Investment Style | 30/06/2020 - 30/06/2021 | 30/06/2021 - 30/06/2022 | 30/06/2022 - 30/06/2023 | 30/06/2023 - 30/06/2024 | 28/06/2024 - 28/06/2025 |

|---|---|---|---|---|---|

| Cautious | 3.91% | ||||

| Tentative | 3.70% | ||||

| Confident | 3.40% | ||||

| Ambitious | 2.59% | ||||

| Adventurous | 2.45% |