Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

Investing Made Simple

Discover effortless investing. IFA & Co would like to introduce you to Wealthify, a simple and affordable investment service.

There’s no need to be a stock market genius or have thousands of pounds to invest. Whether you’re cautious, ambitious, or ethical with your money, Wealthify’s team of experts manage everything, guiding your investments along the way.

With straightforward, low-cost investments, it’s easy to create good money habits and give your savings more potential.

Make your money work as hard as you do

With a Wealthify Investment introduced by IFA & Co you’re always in control:

- Start investing with as little or as much as you like

- Know how much you’re paying with our clear and affordable fees

- Choose how much you want to invest and pick a level of risk that’s right for you – from Cautious to Adventurous

- Add regular monthly payments or top up whenever you like

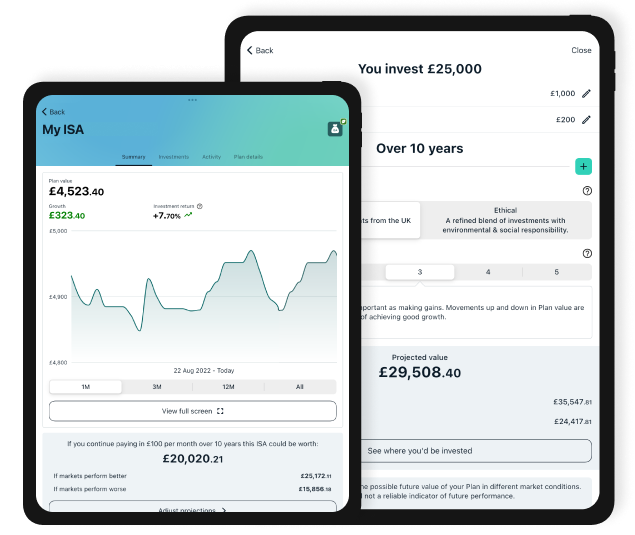

- Check your performance 24/7 online or in the app

Start investing in 3 simple steps

You choose

Tell us what type of investor you want to be: cautious, adventurous or somewhere in between.

We invest

We build you a Personal Investment Plan with just the right mix of investments.

We optimise

We monitor your plan 365 days a year and adjust it to keep everything on track.Choose How You Invest

Invest your way

You can choose to invest your money in our Original or Ethical Plans.

Original

Original Plans use low cost investment funds to give you the broadest access to the stock market. They mostly use instruments known as ‘passive investments’ that track financial markets.

We use funds from leading providers to build our range of five original Plans.

Ethical

Saving for the future is important, and so is staying true to your values.

Wealthify has joined forces with best-in-class ethical fund providers to create a range of five Ethical Plans that let you invest in organisations committed to having a positive impact on society and the environment.

What do I get for my fee?

- Your Personal Investment Plan built by experts

- 365 days a year monitoring

- Ongoing adjustments to your Plan to keep it on track

- Buying and selling investments for your Plan

- Track your money 24/7 online

- Your money and assets held separately with a custodian

- Live chat, phone and email support

We keep costs low and transparent so that you can maximise your returns.

Calculate your fees

Original

Ethical

| Annual % | Annual estimate | |

|---|---|---|

| Wealthify fee | 0.60% | ... |

| Average investment costs | ... | ... |

| Total | ... | ... |

Make your money work as hard as you do

- Choose a level of risk that’s right for you - from Cautious to Adventurous or somewhere in between

- Add more monthly to build up your Plan and withdraw if you need to without penalty

- Check how your Plan is performing whenever you like

- Know how much you’re paying with our clear and affordable fees

Safe & Secure

Managed

Safeguarded

Help is on hand

Safe & Secure

Managed

Safeguarded

Help is on hand

Frequently Asked Questions

-

Do you provide financial advice?

-

No. We are not regulated to give you advice on whether investing is right for you. If you’re unsure, you should always seek the advice of an Independent Financial Adviser (IFA).

-

Is my money safe?

-

Yes, your investments will be held with Winterflood Securities Limited, who act as custodian for our customers’ money. They are a global financial services provider, regulated by the Financial Conduct Authority (FCA) and part of Close Brothers Group, who have been trading for more than 130 years. They hold your cash and investments separately from their own (ring fenced) in accordance with the FCA’s client asset rules, so even if Wealthify went into administration, our creditors would not have a claim to your investments.

-

Who decides how my money is invested?

-

Your money is looked after by a team of qualified investment managers with experience in established UK firms like Brooks Macdonald, Man Group Plc and RAW Capital Partners in Guernsey. Our experts have developed an investment system that uses algorithms to pick the best funds available to you, then builds you an investment plan that suits your goals and attitude to risk. And because things are always changing in the financial markets, our team monitors and adjusts your plan regularly, to make sure your money is always invested in the best places.

-

Is my money locked in?

-

No, not at all. Although you should always approach investing as a long-term way to grow your money, you can withdraw your money from Wealthify at any time, if you need to and there’s no charge or penalty for withdrawing. It will take up to 10 working days for us to release the money from your investments – it could be quicker, but we can’t promise.

-

Is there a minimum amount I need to invest?

-

We think everyone should have access to investing, to help their money grow. That’s why you can get started from just £1. It’s flexible too, so you can make additional one-off or regular monthly payments, or withdraw your money whenever you like.