NO MANAGEMENT FEE FOR 12 MONTHS!

INVEST WITH WEALTHIFY

- Effortless investing. We offer an easy way to invest from as little as £1 (£50 for Pensions)

- It’s simple - choose what type of investor you want to be, from cautious to adventurous

- We’ll build you a Plan and optimise it to keep it on track

- Track the growth of your Plan anytime online or via the app

Excludes the Wealthify Pension product. New customers only. Fund charges and transaction costs apply.

Terms and Conditions

With investing, your capital is at risk. Tax treatments depend on your individual circumstances and may change in the future.

Awards

We're really proud of all the awards (over 50 and counting) we've won since launching in 2016. Not because we enjoy the recognition, but because it means we're doing something right, and that our customers are happy. These awards also help spread the word about Wealthify — meaning other people can start enjoying it, too!

Ready to invest?

Choose from our Plans below and start investing from as little as £1 (£50 for Pensions) today.

STOCKS AND SHARES ISA

Invest up to £20,000 a year with tax free returns.

GENERAL INVESTMENT ACCOUNT

Try a General Investment Account to invest without a cap.

JUNIOR STOCKS AND SHARES ISA

Give your little ones a head start for when they turn 18.

SELF-INVESTED PERSONAL PENSION

Invest for your future in a pension with a 25% tax relief top up.

HOW TO INVEST

Start from as little as £1 (£50 for Pensions), set the terms for your money, then we look after everything for you.

CHOOSE YOUR PLAN

From an ISA to invest up to £20k a year, a GIA to invest without limits, a SIPP to save for retirement, or a JISA for your children's future.

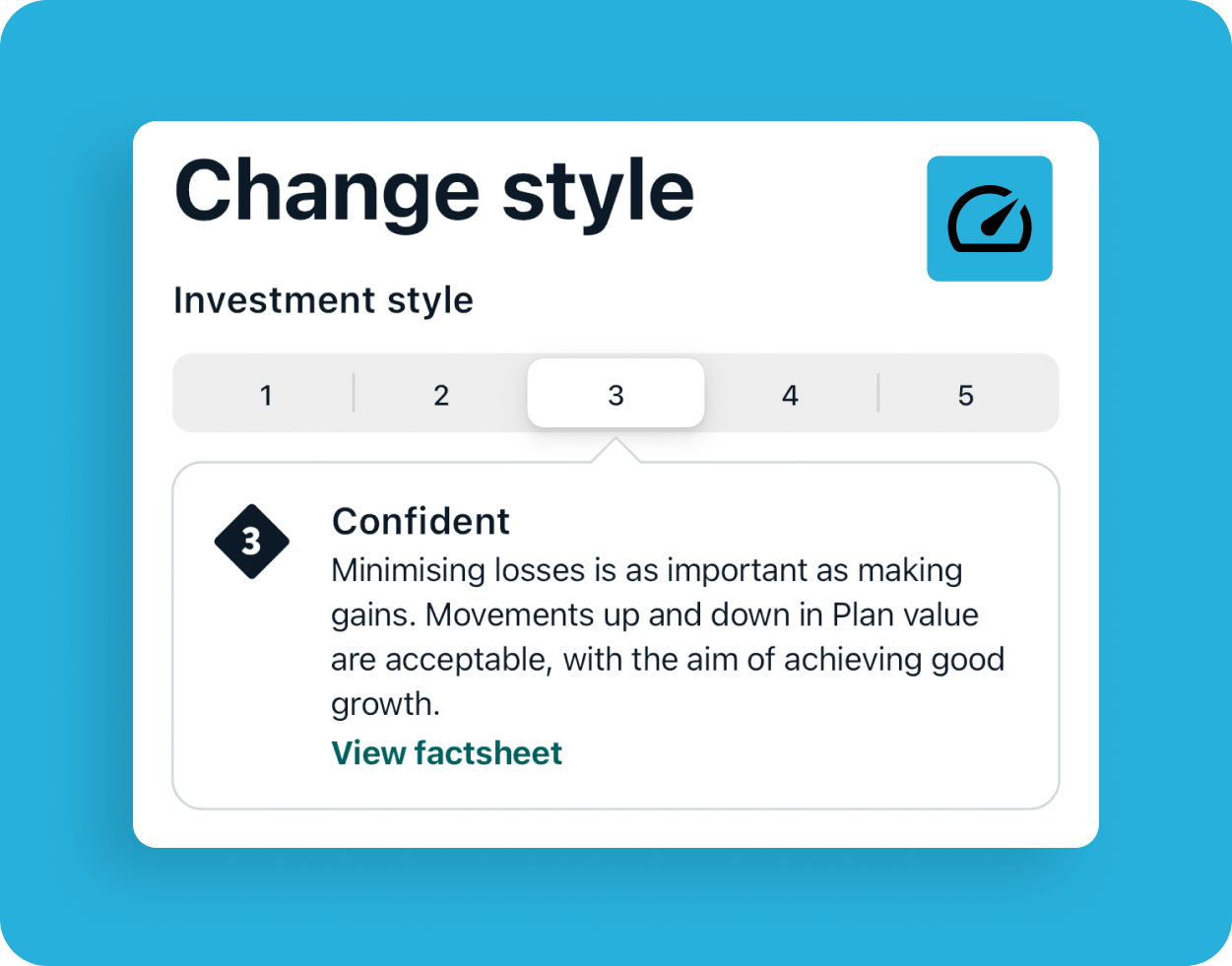

CHOOSE YOUR RISK STYLE

Pick from 5 investment styles and tell us how much you want to invest via a lump sum or by setting up a direct debit, from as little as £1 (£50 for Pensions).

Take our Suitability Quiz

This is our way of helping you start a Plan that's right for your circumstances and attitude to risk.

LET US DO THE REST!

Our experts will build your Plan and manage it for you, keeping it in line with your chosen style.

Why choose Wealthify?

We want to help make your money work harder. It’s simple – our investment styles allow you to choose what type of investor you want to be, from cautious to adventurous, and we’ll build you an investment Plan and manage it for you.

Start with a cautious level if minimising loss is your priority or adventurous level to maximise returns! We also offer ethical Plans, so you can easily invest in line with your values.

WEALTHIFY: A NAME YOU CAN TRUST

Secure

Your login details will always be kept secure — but never shared with anybody else.

Supported

Our award-winning Customer Care team are happy to help via Live Chat, or on 0800 802 1800.

Strength in depth

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

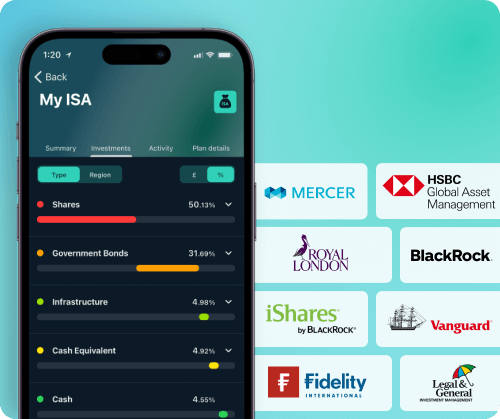

HOW YOUR PLAN IS INVESTED

We use mostly low-cost passive investments, such as mutual funds from top investment management firms, to let your money track a mix of whole markets, like the FTSE100. This way of investing is proven to be more effective long-term than an active investment strategy.

Our portfolios contain a mix of shares, bonds, commodities and other investments, which our experts optimise to keep your Plan on track and rebalance to keep in line with your chosen investment style.

Blogs and articles

Read the latest from our experts to help you understand investing, including how we invest for you — and why this could be a great time-saver for busy investors.

Investment faqs

Your money is looked after by a team of qualified investment managers with experience in established firms all over the world. Our experts have developed an investment system that uses algorithms and industry experience to pick the best funds available to you, then builds you an investment plan that suits your goals and attitude to risk. And because things are always changing in the financial markets, our team monitors and adjusts your plan regularly, to make sure your money works as hard as you do.

There are hundreds of great reasons why you might want to invest with Wealthify – from our clear and simple platform to our flexible investment plans and excellent customer service.

We’ve also won a number of awards over the years, including Best Investment Platform for User Experience at the YourMoney.com Investment Awards 2022, Best Investment ISA at the Personal Finance Awards, Best Investment Platform at the Online Personal Wealth Awards 2021, and Best Investments Provider at the British Bank Awards 2020.

Not only that, but our JISA was named the Best Junior ISA at the Personal Finance Awards in 2021, 2020 and 2019!

We’re not a fully-automated investment service. We automate certain parts of the investment process, like monitoring how well global markets are performing, using computers programmed with algorithms (mathematical formulas). This is more cost-effective than having highly-paid fund managers do it and we pass those savings onto you. Our experts use the market information along with their own their knowledge and experience, to make small adjustments to the mix of funds in your investment plan, where appropriate. So Wealthify uses a mix of smart algorithms and human expertise to make sure your plan stays on track.

Yes, they are. All your investments in our ISAs and General Investment Account products are held with our custodian bank, Winterflood Securities, a global financial services provider and part of Close Brothers Group, who have been trading for more than 130 years. The custodian of our Pension products is Embark Pensions, who are part of the Embark Group – the UK’s fastest-growing digital retirement platform.

Winterflood Securities and Embark both hold your assets separately (ring-fenced) from Wealthify, so even if we went into administration, our creditors would not have a claim to your investments.

The Financial Services Compensation Scheme may also cover the first £85,000 of your investments, however, it’s essential to understand that the FSCS doesn’t cover you if your investments do not perform as expected and you get back less than you originally invested. For more information visit https://www.fscs.org.uk/

Why invest in one company, when you can invest in them all? That’s the essence of passive investing. Instead of putting all your eggs in one basket and relying on one particular company to perform well, you spread your money across all of them, so that you benefit from their collective strength. To do this, you need funds like ETFs and Mutual Funds (known as passive investment vehicles). These let your money track an index like the FTSE 100, which is composed of the 100 largest companies listed on the London Stock Exchange.

Passive investing is generally accepted as a more effective long-term strategy than the alternative, active investing, where fund managers try to pick the stocks they think will do best. The Dow S&P Indices show that as few as 14% of active fund managers actually manage to beat the market each year, when looked at over a long time period.

No. We are not regulated to give you advice on whether investing is right for you. If you’re unsure, you should always seek the advice of an Independent Financial Adviser (IFA).

Wealthify considers the security of your personal information to be of the utmost importance and we take several measures to ensure it is kept safe.

Any information you provide on our website is transmitted using secure SSL technology with 256-bit encryption. Where we store sensitive information, such as passwords and bank account numbers, we use strong encryption algorithms similar to those used by the major high-street banks.

We also insist on a minimum password length and require you to use upper case letters and numbers in your password to make it more secure.

Account security is also your responsibility. You should never share your password with anyone else, or let anyone else have access to your Wealthify account.