Junior Stocks and Shares ISA

Start investing in your child's future with Wealthify's Junior ISA (JISA) — voted Best Junior ISA seven years running at the Personal Finance Awards.

✓ Save up to £9,000 per year for your child, completely tax-free

✓ More of you child's money stays invested, thanks to our low-transparent fees

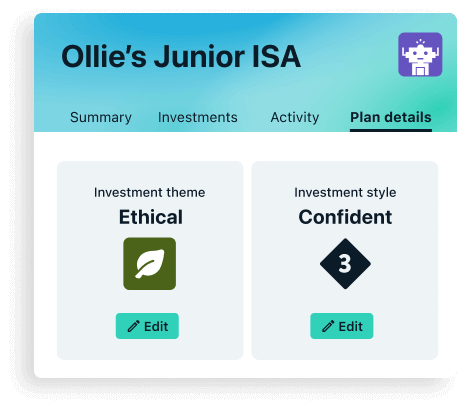

✓ Invest in line with your values with our Ethical Junior ISA option

Minimum £500 deposit. With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and can change. ISA rules apply.

How to open a Junior isa

Choose your investment Plan

Pick from 5 investment styles across our Original or Ethical Plan, and choose how much to invest invest for your child via a one-off payment or Direct Debit.

Take our suitability quiz

This is our way of helping you start your child's JISA in a way that's right for your circumstances and investment style.

We manage everything

Our experts then get to work on building and managing your child's Plan, keeping it in line with your chosen style.

Watch your child's money grow

Your child will have access to their JISA on their 18th birthday, at which point the money can be used as they see fit — including reinvesting it, potentially.

Ethical Junior ISA Investment Options

Help shape a sustainable future for your child.

- Wealthify's Ethical Plans aim to exclude industries and activities that are considered harmful to society and the environment

- The companies your child's money is invested in are actively and regularly monitored

Why choose a Junior ISA account?

A Junior ISA is considered one of the best ways to build a financial head start for your child. Here's why 33,000+ parents already trust Wealthify with their little one's future:

✓ Any growth your child makes is completely free from UK income tax and capital gains tax.

✓ Junior ISAs benefit from compound growth — meaning the earlier you start, the harder your child's money can work.

✓ You can invite family and friends to contribute to your child's JISA, making it easy for loved ones to give a gift that really lasts.

✓ With a Wealthify JISA, you can choose an Ethical investment plan, so your child's future is invested in companies that align with your values.

✓ A JISA has its own annual allowance, completely separate from yours — so saving for your child's future won't touch your own £20,000 ISA limit.

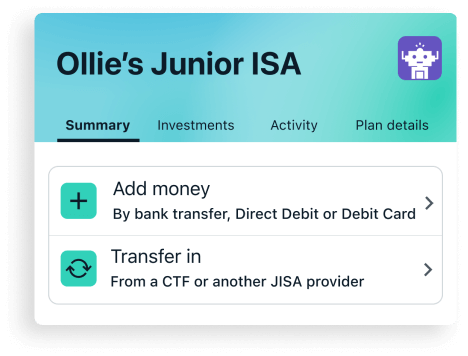

✓ Already have a Child Trust Fund or JISA? You can transfer it into a Wealthify Stocks and Shares Junior ISA without it counting towards this year's allowance.

Invite friends and family to contribute

When it comes to raising a child, there's nothing quite like a helping hand.

Which is why – whether it's family, friends, or that lovely lady next door – our Junior ISA lets you invite anyone to contribute towards and grow your child's savings.

They can even leave a personalised note and picture for every contribution they make, creating that memorable touch.

What our customers say about us

Naturally, we think our Junior ISA is pretty good. But don’t just take our word for it.

Because, as well as being voted Best Junior ISA at The Personal Finance Awards (seven years running), here are just some of our favourite reviews.

“Great JISA products for both of our kids. Best thing we did was to open one for each. Money goes in each month, we send a link to friends and family to deposit for Christmases etc.

– Nathan M

"Moved from CTF to JISA with Wealthify. Kept informed of process knew exactly where I was — and now all details are easily accessible.

Have already recommended to three other people."

– Joyce W

“Generally speaking, I'm not good with following stuff on my laptop. I was pleasantly surprised at how easy it was when I first logged in to check on my granddaughter's ISA.

There's no faffing around with lots of details... just log in and the info is right there! I love it!”

– Christine R

Transfer to a Wealthify Junior ISA

If you want to give your Junior Cash ISA or Child Trust Fund more potential, we've made transferring them to Wealthify's Junior Stocks and Shares ISA a simple, hassle-free process.

Just let us know that you want to move to Wealthify, then we'll do the rest. If you're looking to move an existing Junior Stocks and Shares ISA or Child Trust Fund, please note that we'll need to move the whole amount, as you're only allowed one account of this type per child.

Wealthify Customer Reviews

JUNIOR ISA FAQs

A Junior ISA is a tax-efficient way to save and invest on behalf of your child.

Payments into a Junior ISA are different from adult ISAs, because the money you put in belongs to your child. Once you put money in, you can’t take it out again, except in exceptional circumstances, and your child can only get access to their money when they turn 18.

There are two types of Junior ISA:

- Junior Cash ISAs: earn interest like a savings account. The interest rate is fixed and typically based on the rate set by the Bank of England.

- Junior Stocks & Shares ISAs: (Also known as Junior Investment ISAs), these invest in financial markets with the aim of earning returns for investors that are greater than those you would get in a Junior Cash ISA. Returns are not guaranteed, and the value of your investments can go down as well as up.

Your child can have one or both types of Junior ISA and you can deposit up to the annual limit of £4,260 into them in any combination you like.

For example, you could pay £2,000 into a Junior Cash ISA and up to £2,260 into a Junior Stocks and Shares ISA, or vice versa. You can split the allowance however you want to between the two accounts.

The benefit of a Junior ISA is that you or your child won’t pay tax on any interest, returns or dividends they receive.

Wealthify only offers a Junior Stocks and Shares ISA. Any money paid into a Junior ISA will belong to the child, but they cannot access it until their 18th birthday.

Junior ISAs allow your child to keep more of their money by protecting any positive returns they receive from income tax and capital gains tax.

Only a child’s parent or legal guardian can open a Junior ISA account on their behalf.

Your child can have one Junior Cash ISA and/or a Junior Stocks and Shares ISA at any time, into which you can currently contribute a maximum of £4,260 per tax year, per eligible child. You can split the amount however you choose between a Junior Cash ISA and a Junior Stocks and Shares ISA as long as the combined amount doesn’t exceed the annual limit.

You don’t need to use the same provider for your child’s Junior Cash ISA and Junior Stocks and Shares ISA, so you’ve got flexibility to choose the best option for you and your child.

At the start of each new tax year, on 6 April, the child’s annual Junior ISA allowance re-sets and you can start another year of tax-efficient saving, up to £4,260 for each child.

Your child will only be able to access the money within their Junior ISA when they turn 18.

When they turn 18, the Junior ISA is automatically changed into an adult ISA. At this point, they can choose to keep saving or investing, or they can withdraw some or all of the balance to help pay for things like university, or a new car.

If you want to build an investment pot for your child that neither you or they can touch until your child turns 18, then a Junior ISA could be the answer. Any money paid into a Junior ISA belongs to the child and cannot be withdrawn by anyone other than the child when they turn 18.

Junior ISAs are available to children who:

- Are under the age of 18

- Are residents of the UK, or are dependants of a crown employee (e.g. army employee based overseas)

- And don’t already have a Child Trust Fund (CTF).

You can transfer your Child Trust Fund over to a Wealthify Junior ISA, but your child cannot have a CTF and a Junior ISA at the same time. When transferring a CTF to a Junior ISA, the full balance must be transferred.

No – the Junior ISA can only be opened and funded after the child is born. We need the child’s date of birth so that we will know when your child turns 18.

Junior ISAs can only be opened by the parent or legal guardian of a child under the age of 18 who fits the eligibility criteria. Once opened the parent/guardian will become the registered contact for the account.

As the registered contact for a Junior ISA, you are the only person authorised to make decisions about the management of the account. You’ll also need to keep Wealthify informed if the child’s personal details change; e.g. if they change their name, address, contact number, or get married.

When the child turns 18, they will become the registered contact and their Wealthify Junior ISA will change into an adult ISA. They can either keep investing, move it somewhere else, or withdraw some or all of it e.g. to help pay for university, or a car.

The money in a Junior ISA will never belong to the parent/guardian. It belongs to the child, but they won’t be able to access it until their 18th birthday.

16-year olds can open and start paying into an adult Cash ISA whilst still paying into their own Junior ISA until they reach 18.

Wealthify is authorised and regulated by the Financial Conduct Authority (FCA). Your money is looked after by our team of experienced and qualified investment managers, and we’re backed by global financial services provider, Aviva.

Your child’s money is held securely by our custodian, Winterflood Securities Limited. They are responsible for holding your cash and investments safely. They are regulated by the Financial Conduct Authority (FCA) and are part of Close Brothers Group, who have been trading for more than 130 years. They hold your child’s cash and investments separately from Wealthify (ringfenced) in accordance with the FCA’s client asset rules.

As an authorised firm, Winterflood Securities Ltd. is also a member of the Financial Services Compensation Scheme (FSCS). This means your child’s investments may be protected up to £120,000.

It’s important to remember that the value of your investments can go down as well as up and you may get back less than you invested. The FSCS scheme does not allow you to claim compensation simply because the value of your child’s account falls below what you originally invested.

Yes, you can invite anyone to be a contributor. That could be your parents, siblings, cousins, friends, neighbours… the list goes on. Once they’ve accepted the invite, and passed verification, they’ll be able to add to your child’s ISA whenever they want.

The only caveat to this is that they’ll need to live in the UK and be a UK tax resident, aged over 18.