Wealthify General Investment Account

GET MORE FROM YOUR MONEY WITH A GENERAL INVESTMENT ACCOUNT

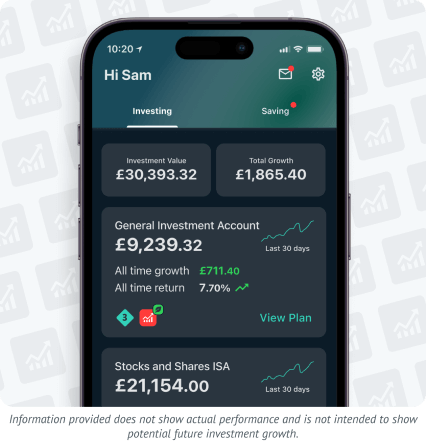

- Invest as much as you like, from as little as £1.

- A good option if you've used up your annual ISA allowance.

- Access the same investment portfolios as our Stocks and Shares ISA.

- Fully managed for you by our team of investment experts.

With investing, your capital is at risk. The tax treatment of your investment will depend on your individual circumstances and may change in the future.

WHAT IS A GENERAL INVESTMENT ACCOUNT?

A General Investment Account (also known as a GIA) is a simple, flexible way to grow your money using a wide range of investments, including shares, bonds, and property.

Even though there’s no limit on how much you can invest with a General Investment Account, one of the most important things to understand is that it doesn’t come with any tax benefits (unlike a Stocks and Shares ISA or Self-Invested Personal Pension).

This means you’ll have to pay income tax on any profits you generate from the investments held in your General Investment Account; the amount you have to pay will depend on your individual circumstances and may change in the future.

As is the case with a Stocks and Shares ISA, you should consider keeping your money in a General Investment account for at least five years, as this gives it enough time to ride out the market's ups and downs.

OUR AWARDS CABINET

HOW OUR GENERAL INVESTMENT ACCOUNT WORKS

Setting up a GIA with Wealthify is easy. In fact, all it takes is three simple steps:

YOU CHOOSE

From Cautious to Adventurous, Original or Ethical; start by telling us what type of investor you want to be.

WE INVEST

Once we’ve established your investment style, our experts will build your General Investment Account Plan with just the right mix of investments.

WE OPTIMISE

You then leave all the heavy lifting to us, as we monitor your Plan on a regular basis, adjusting it to keep everything on track.

GENERAL INVESTMENT ACCOUNT BENEFITS

It’s worth noting that if you’re looking to invest and haven't used up your annual ISA allowance, it could be worth checking out our Stocks and Shares ISA, as this offers a tax-efficient way to invest.

If it is a GIA you’re after, here’s why ours might be the one for you:

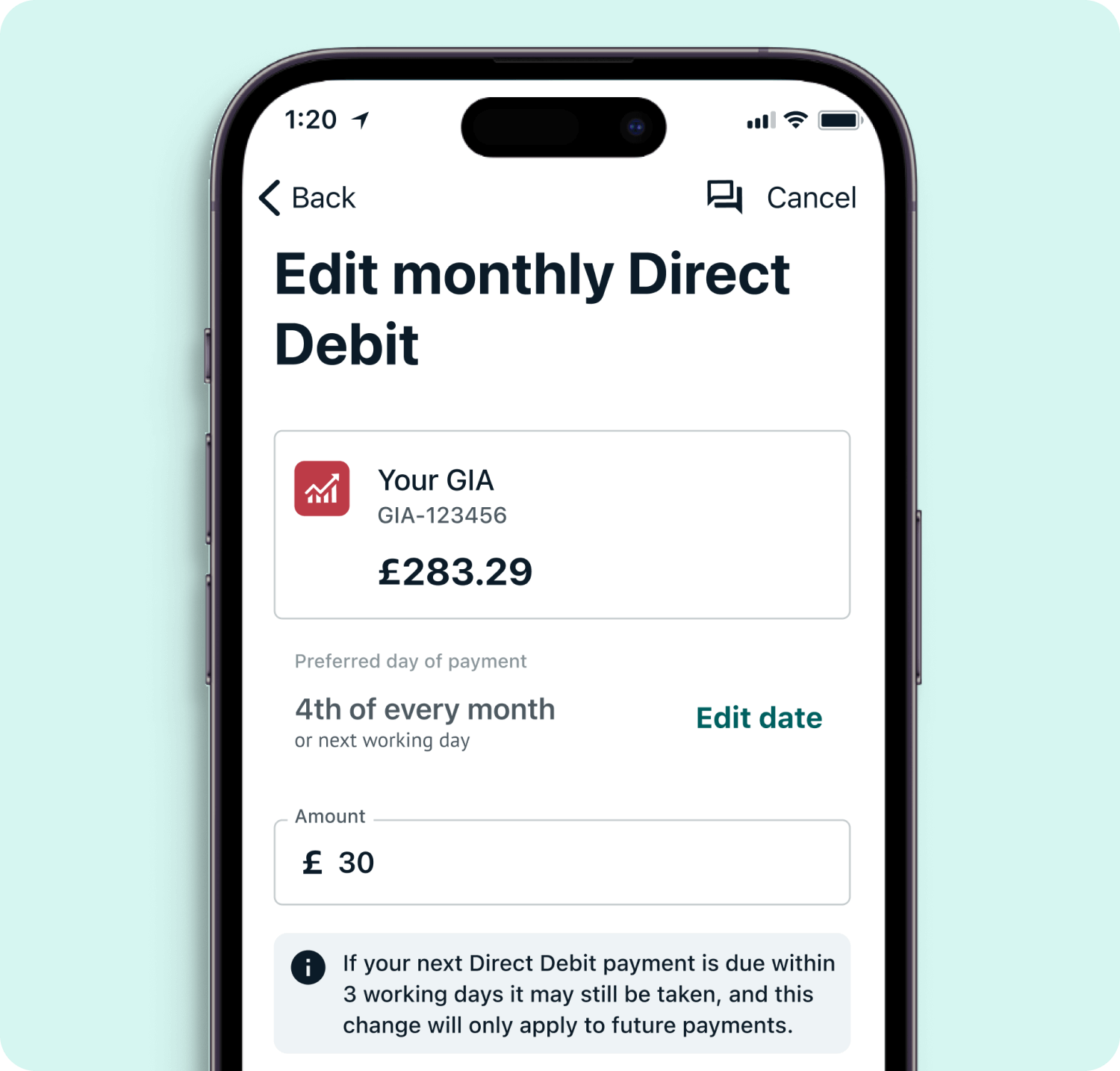

Flexible: Whether you’re starting with £1 or £1,000, making regular or one-off payments; a Wealthify GIA gives you the flexibility to invest on your terms.

Free deposits and withdrawals: Unlike traditional providers, we won't charge you to deposit or withdraw money, transfer or close your GIA.

Cost-effective: Our experts use a blend of active and passive investment funds, containing types of assets like stocks, bonds, and property to build your Plan, ensuring your money’s invested cost-effectively.

No investment limit: With no limit on how much you can invest, a GIA is a good option if you’ve already used your annual ISA allowance, but still have money you want to invest.

KEEPING YOUR MONEY SAFE

We know the only thing more important than making your money work harder, is making sure it’s safe — here’s how we take care of yours.

Secure

Your login details will always be kept secure – and never shared with anyone else.

Support

Our friendly Customer Care Team are always happy to help via email, Live Chat, or on 0800 802 1800.

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

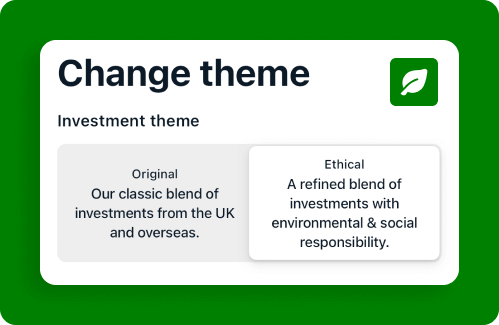

ETHICAL INVESTING OPTIONS FOR YOUR GIA

With a Wealthify GIA, investing for your future also means being able to invest in the planet's future at the same time.

Because, as well as our Original Plans – which use low-cost investment funds to give you the broadest access to the stock market – we've also created five Ethical Plans.

By joining forces with best-in-class ethical fund providers, an Ethical Wealthify GIA lets you invest in organisations committed to having a positive impact on society and the environment. All our fund providers are signatories of the Principles of Responsible Investing (PRI), the world's leading proponent of responsible investing.

With the actively managed ethical funds used in our Plans, fund managers keep a close eye on the organisations they invest in — employing rigorous, ongoing screening to ensure ethical standards are maintained.

GENERAL INVESTMENT ACCOUNT TAX

A GIA doesn’t come with the same tax benefits as a Stocks and Shares ISA or Self-Invested Personal Pension. This means the profits you generate from GIA investments may be subject to the following taxes:

Income Tax: When you receive income on your investments, you might need to pay Income Tax. The amount you need to pay will depend on the tax band you fall into and the size of your gains.

Capital Gains Tax: This is a tax on the profit you make when you sell any investments that have increased in value over time. You'll only have to pay this tax on gains that go above your Capital Gains tax allowance, which is currently £3,000 per year.

GENERAL INVESTMENT ACCOUNT FEES

Since launching in 2016, lots of things have changed here at Wealthify.

Being completely transparent with our fees, however, isn’t one of them: we charge one annual management fee of 0.6% — and that's it.

This 0.6% management fee is payable monthly based on the value of your investments and covers everything we do, including setting up your account, looking after your money, and optimising your investments.

As with most investments, other costs can apply, but we aim to keep these as low as possible: on average, around 0.16% p.a. for Original Plans and 0.7% p.a. for Ethical Plans.

CUSTOMER REVIEWS

Blog Articles

CAPITAL GAINS TAX ALLOWANCE

Discover the latest changes to the UK's Capital Gains Tax allowance, and learn how this adjustment might impact your investments.

SAVING VS. INVESTING

While cash could be an option for your short-term financial needs (such as a rainy day fund), it’s a much less desirable option for long-term growth.

FEAR OF INVESTING: DISPELLING INVESTMENT MYTHS

Dispelling investment myths as new research shows 66% of Brits are nervous about investing.

HOW COULD THE UK G.E AFFECT YOUR INVESTMENTS?

Learn how major events like a UK general election can impact financial markets.

GIA FAQs

You can have and pay into as many General Investment Accounts as you like. This is particularly useful if you’ve used your annual ISA allowance, as you can continue to invest your money in multiple GIAs without any investment limits.

You have to be a UK resident aged 18 or over to open a General Investment Account. For under 18s, we offer a Junior ISA, which can only be opened by the parent or legal guardian of a child who fits the eligibility criteria.

Your money is invested into mainly passive investment funds, such as Exchange Traded Funds [ETFs] and Mutual funds

We typically invest your money within two working days of receiving it. However, it may take a couple of extra days for the investments to show on your dashboard, due to the investing process.

No, that’s what we’re here for. You only need to tell us your investment style and how much you want to invest, and we do everything else. Our investment team have pre-selected a range of passive funds, and programmed our automated investment system with algorithms (mathematical formulas) that build your Plan based on what you tell us your goals are.

Our experts have pre-selected a range of passive investment funds, which we use to build your Wealthify Personal Investment Plan. The mix of funds in your plan will depend on your attitude to risk – if you have a low risk appetite, your Plan will contain a higher percentage of low-risk funds. Higher-risk Plans will include more high-risk investments. Since financial markets are always changing, we might make small periodic changes to the mix of funds in your plan to make sure it still matches your risk profile and goals.

Your plan will consist of a mix of assets, such as shares, government bonds, corporate bonds, cash, property, private equity, commodities and hedge funds. You can find out more about all of these in the Glossary. The exact combination will depend on the preferences you give us when you apply, and will change over time.

Your investments will be held with our custodian bank, Winterflood Securities, a global financial services provider and part of Close Brothers Group, who have been trading for more than 130 years. Winterflood Securities hold your assets separately (ring-fenced) from Wealthify, so even if we went into administration, our creditors would not have a claim to your investments. The first £120,000 of your investments may also be covered by the Financial Services Compensation Scheme, however, it’s important to understand that the FSCS doesn't cover you in the event that your investments do not perform as expected and you get back less than you originally invested. For more information visit https://www.fscs.org.uk/

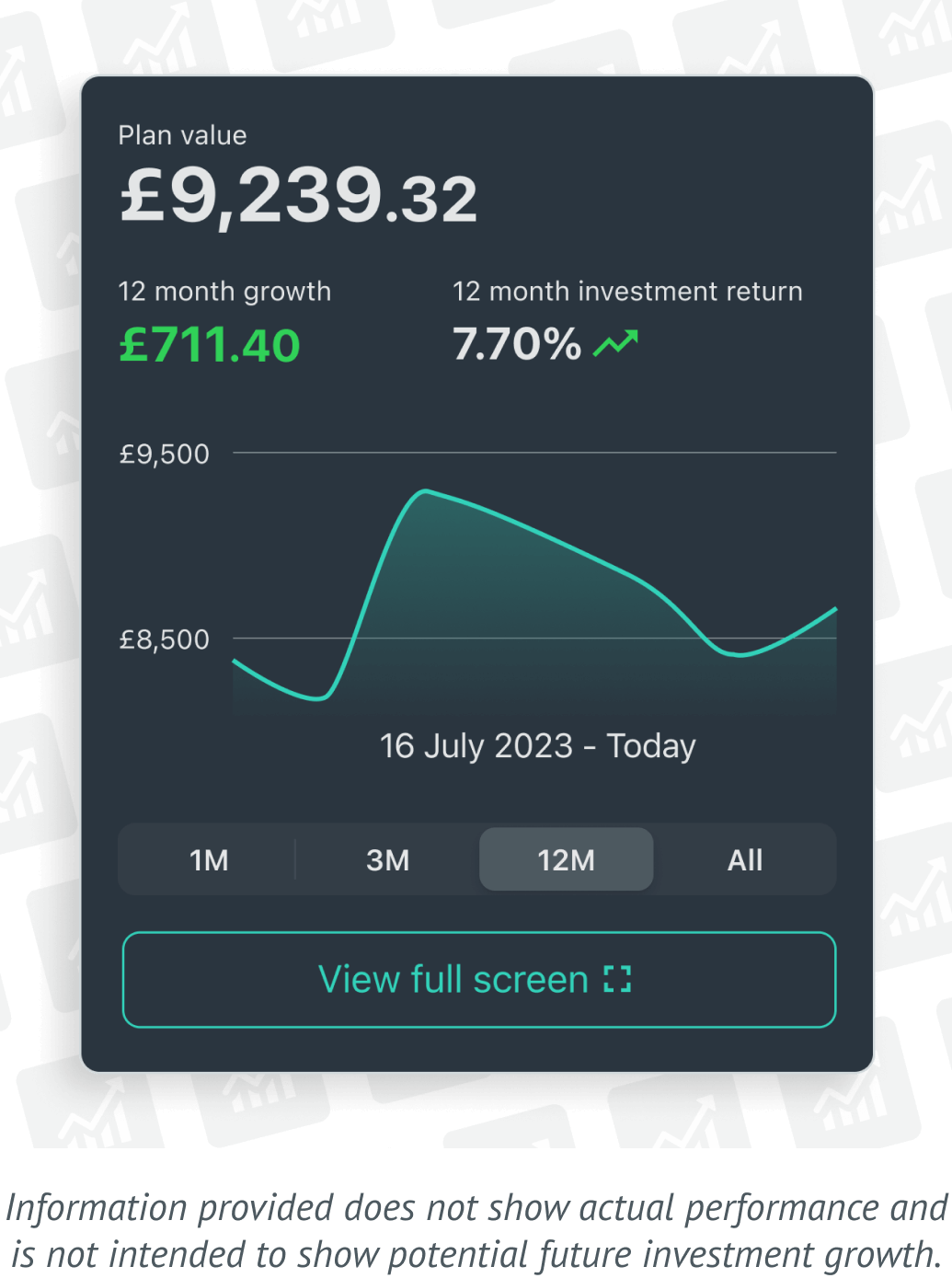

No, we won’t tell you when we adjust your Plan. We build and manage your plan for you on a discretionary basis and depending on what the markets do, we could be adjusting your Plan regularly, so it wouldn’t be practical to let you know. You can, however track your investments via your dashboard at any time to see exactly what investments you are holding and how your Plan is performing.

With investing your capital is at risk and you could get back less than you put in. As an investor, it’s important to understand that stock markets have good periods and bad periods and that you shouldn’t panic at first sight of a bad period. You should think of investing as a long-term prospect, and remember that markets will generally see growth over the long-term.

There is currently no facility for this, but there may be in future. You can access and withdraw your money 24/7, although it’s worth remembering that making regular withdrawals will affect how quickly you reach the investment goals you set when you created your plan.

We’re not a fully-automated investment service. We automate certain parts of the investment process, like monitoring how well global markets are performing, using computers programmed with algorithms (mathematical formulas). This is more cost-effective than having highly-paid fund managers do it and we pass those savings onto you. Our experts use the market information along with their own their knowledge and experience, to make small adjustments to the mix of funds in your investment plan, where appropriate. So Wealthify uses a mix of smart algorithms and human expertise to make sure your plan stays on track.

Why invest in one company, when you can invest in them all? That’s the essence of passive investing. Instead of putting all your eggs in one basket and relying on one particular company to perform well, you spread your money across all of them, so that you benefit from their collective strength. To do this, you need funds like ETFs and Mutual Funds (known as passive investment vehicles). These let your money track an index like the FTSE 100, which is composed of the 100 largest companies listed on the London Stock Exchange – companies like Royal Dutch Shell, BT Group and Unilever.

Passive investing is generally accepted as a more effective long-term strategy than the alternative, active investing, where fund managers try to pick the stocks they think will do best. The Dow S&P Indices show that as few as 14% of active fund managers actually manage to beat the market each year, when looked at over a long time period.

Capital is just another way of saying 'the money you invest'. There’s always a risk with investing that you might not get back everything you put in.