The Smart Money's With Wealthify

Your easy way to manage money online or on our app.

- Simple choice of investment styles built around you and expertly managed

- No-limit ways to grow your cash savings with competitive rates

- A low-cost home for you to bring your old workplace pensions under one roof

With investing, your capital is at risk. Tax treatments depend on your individual circumstances and may change in the future.

SAVE. INVEST. BUILD YOUR FUTURE WEALTH.

Whether you're saving regularly or investing ethically, we've built a range of award-winning products to help you achieve your financial goals.

Stocks and Shares ISA

Self-Invested Personal Pension

Junior Stocks and Shares ISA

General Investment Account

Instant Access Savings Account

Cash ISA

WHY CHOOSE WEALTHIFY?

From rainy days to special days; unexpected bills to poolside chills; your financial piece of the pie to peace of mind: Wealthify is about so much more than just ‘putting money away’.

With a range of products for people at every stage and from all walks of life, it's about the satisfaction of knowing you're on top of your money — and peace of mind that comes with being financially prepared.

Using our simple, award-winning app or website, start from as little as £1 (£50 for Pensions), then let us look after everything for you.

Because Wealthify is for people who want more from their finances by doing less; people who value their time just as much as their money.

STAYING TRUE TO YOUR VALUES

Awards

We're really proud of all the awards (over 50 and counting) we've won since launching in 2016. Not because we enjoy the recognition, but because it means we're doing something right, and that our customers are happy. These awards also help spread the word about Wealthify — meaning other people can start enjoying it, too!

KEEPING YOUR MONEY SAFE

We know the only thing more important than making your money work harder, is making sure it’s safe — here’s how we take care of yours.

Secure

Your login details will always be kept secure – but never shared with anyone else.

Support

Our friendly Customer Care Team are always happy to help via email, Live Chat, or on 0800 802 1800.

Strength

Wealthify is owned and backed by Aviva: one of the UK's largest financial institutions.

Investing for the long-term

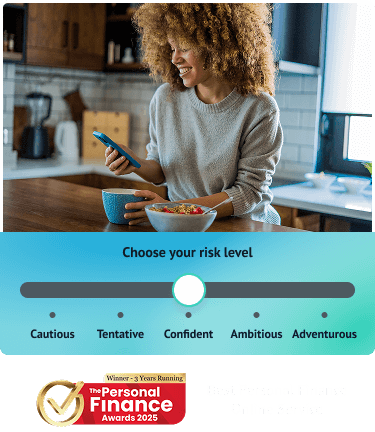

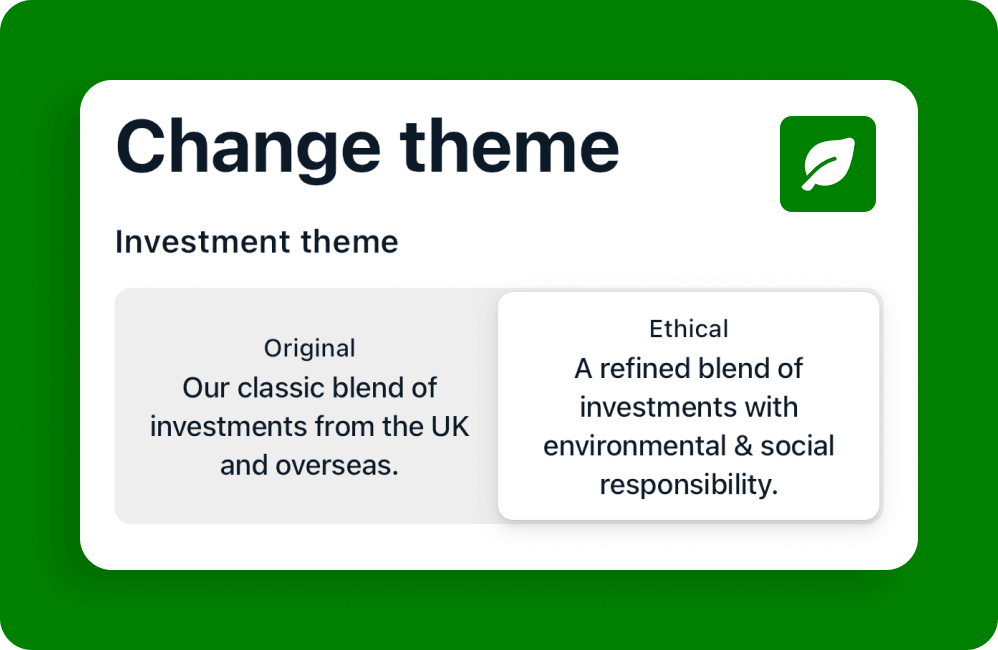

Regardless of your knowledge and experience, we've made the process of investing with Wealthify as simple as possible. All you have to do is choose your investment product, style (from Cautious to Adventurous), and theme (Original or Ethical) — then just let our team of investment experts manage everything else for you!

With investing, your capital is at risk. Tax treatment depends on your individual circumstances and may change in the future.

Flexible Stocks and Shares ISA

Stocks and Shares ISAs (Individual Savings Account) are a great way for UK residents to invest, with no capital gains tax or income tax to pay on your money as it grows.

- Invest up to £20,000 tax-efficiently each year.

- Withdraw your money at any time, without penalty.

- Your Investment Plan is built and managed by our team of experts.

- Pay withdrawn money back in the same tax year — without affecting your annual allowance.

General Investment Account

General Investment Accounts (GIAs) are a great option if you've used up your annual ISA allowance, but still want access to diversified portfolios built and managed by our experts.

- Start a GIA with a small initial amount.

- No limit on how much you can invest annually.

- Withdraw your money at any time without penalty.

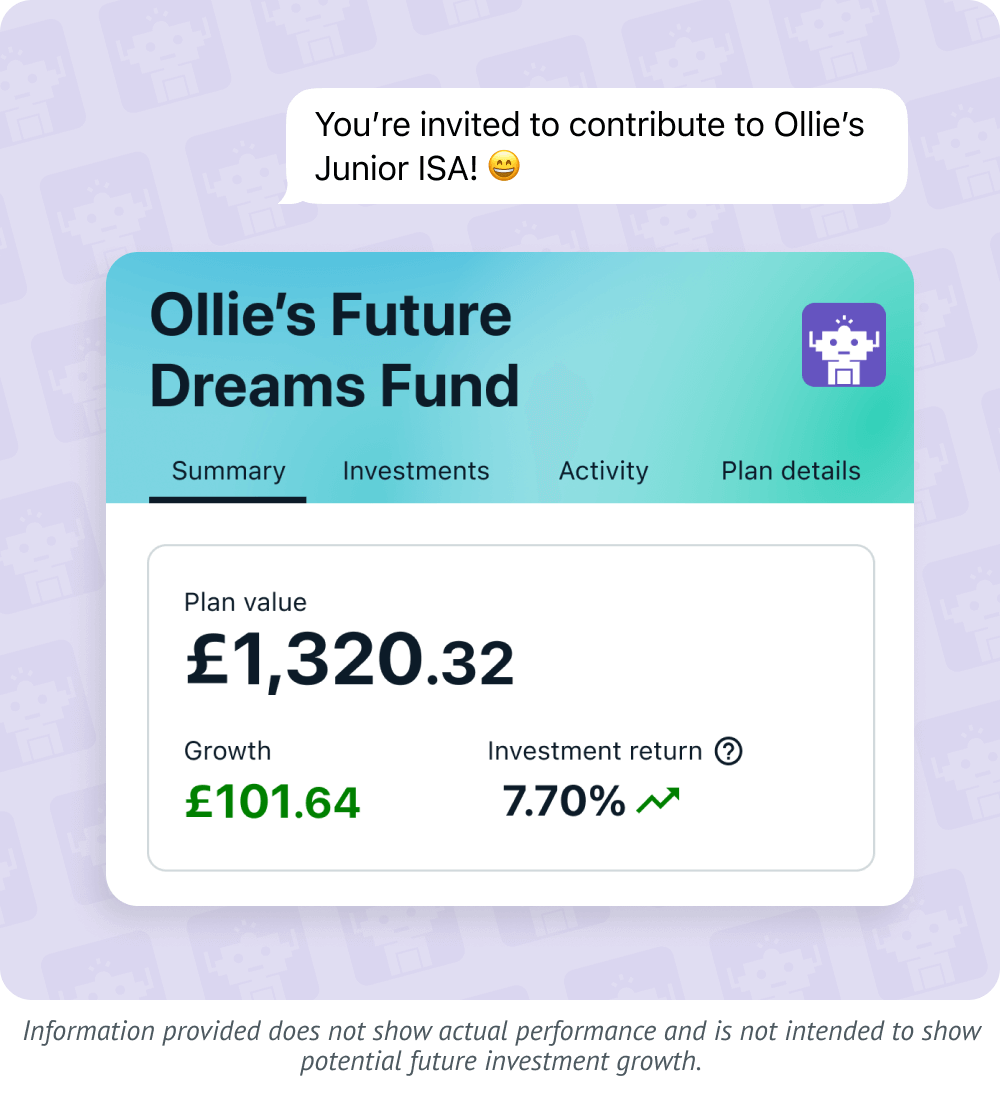

SHAPING YOUR CHILD'S FUTURE

JUNIOR STOCKS AND SHARES ISA

A Junior Stocks and Shares ISA (JISA) is a long-term, tax-free investment account that helps you provide a financial future for your little one.

- A tax-efficient way to save up to £9,000 every year for your child.

- Allow family and friends to contribute directly to your child’s JISA.

- Easily transfer another Junior Cash ISA or Child Trust Fund to your Wealthify JISA.

With investing, your capital is at risk. Tax treatment depends on your individual circumstances and may change in the future.

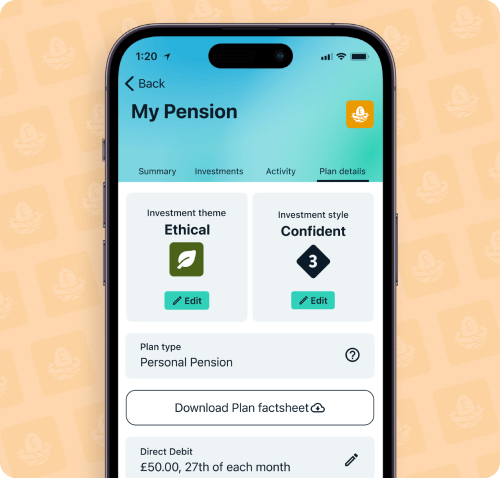

CREATING YOUR PENSION POT

PERSONAL PENSION

Wealthify’s Personal Pension is a great way to take more control over your future wealth, helping your money work harder.

- Combine previous pensions into one handy pot.

- Provides multiple investment options to suit your needs.

- All investments are managed for you by our team of experts.

With investing, your capital is at risk. Tax treatment depends on your individual circumstances and may change in the future.

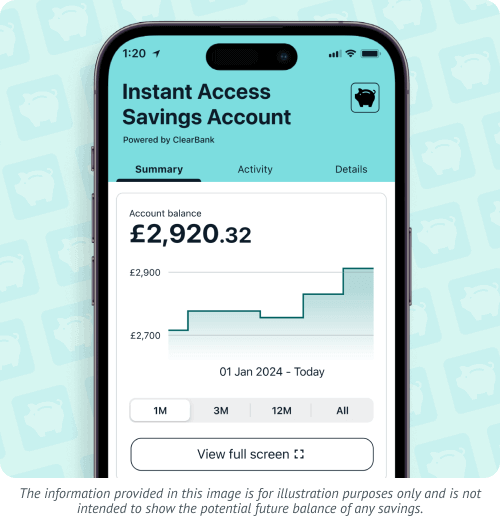

Grow your savings

Make your savings work harder, with our Instant Access Savings Account and Cash ISA.

Our savings accounts provide a variable interest rate, meaning the rate can go both up and down; if you’re after the certainty of a fixed interest rate, then these types of savings accounts might not be for you.

Wealthify, in collaboration with ClearBank, are providing you with an Instant Access Savings Account and Cash ISA. Wealthify will provide the day-to-day servicing of the account (including being the point of contact for any questions you may have), with ClearBank providing the account itself.

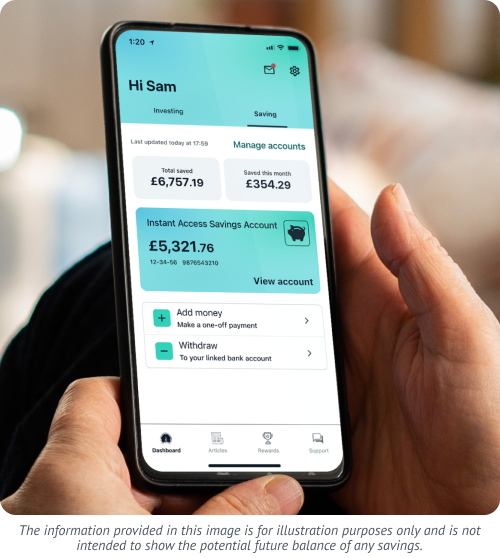

Instant Access Savings Account

The current interest rate: 3.61% AER / 3.55% gross p.a. (variable). The interest rate tracks the Bank of England base rate minus a margin (currently 0.45%).

- Deposit as much as you like, with no upper limit.

- Access your money instantly, with no limit on withdrawals.

- No fees for withdrawing your savings.

Easy Access Cash ISA

Our Cash ISA lets you save up to £20,000 each year — with no tax to pay on any interest earned!

- Earn 3.61% AER / 3.55% tax-free p.a. (variable) paid monthly.

- Access your money anytime, with no fees or restrictions.

- Withdraw and replace funds without affecting your annual ISA allowance.

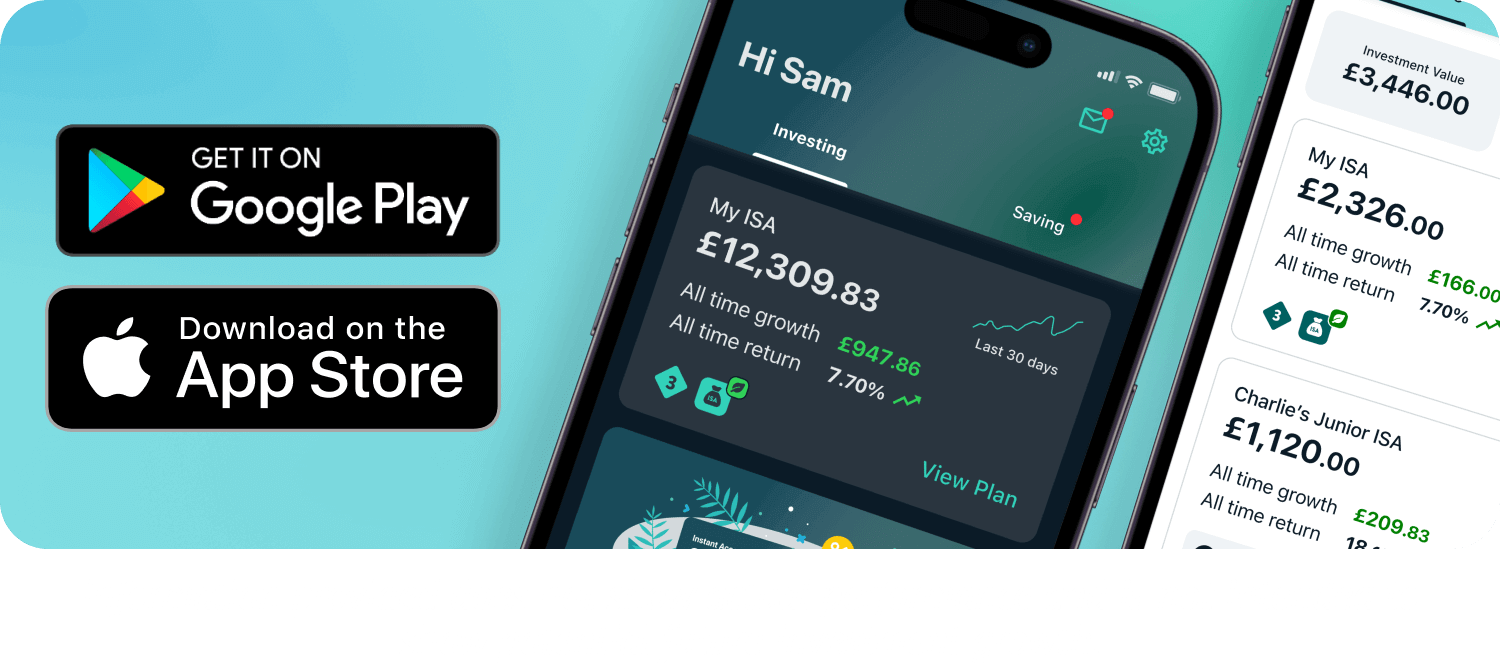

DOWNLOAD THE APP

Whether you’re looking for an investment app or money saving app, our award-winning wealth platform is available to download on iOS and Android devices (mobile and tablet). Built with security in mind, the Wealthify app is compatible with Face ID and Touch ID enabled handsets, making it an option for all your saving and investment planning.

GROWING YOUR SAVINGS

INSTANT ACCESS SAVINGS ACCOUNT POWERED BY CLEARBANK LIMITED

The current interest rate: 3.61% AER / 3.55% gross p.a. (variable). The interest rate tracks the Bank of England base rate minus a margin (currently 0.45%).

Our Instant Access Savings Account provides a variable interest rate, meaning the rate can go both up and down; if you’re after the certainty of a fixed interest rate, then this type of savings account might not be for you.

- Start saving from just £1, with no upper limit.

- Access your money instantly, with no limit on withdrawals.

- No fees for withdrawing your savings.

Wealthify, in collaboration with ClearBank, are providing you with an Instant Access Savings Account. Wealthify will provide the day-to-day servicing of the account (including being the point of contact for any questions you may have), with ClearBank providing the account itself.

INVESTING FOR THE LONG-TERM

Regardless of your knowledge and experience, we've made the process of investing with Wealthify as simple as possible. All you have to do is choose your investment product, style (from Cautious to Adventurous), and theme (Original or Ethical) — then just let our team of investment experts manage everything else for you!

With investing, your capital is at risk. Tax treatment depends on your individual circumstances and may change in the future.

Stocks and Shares ISA

Stocks and Shares ISAs (Individual Savings Account) are a great way for UK residents to invest, with no capital gains tax or income tax to pay on your money as it grows.

- Invest up to £20,000 tax-efficiently each year.

- Invest from as little as £1; withdraw your money at any time without penalty.

- Your Investment Plan is built and managed by our team of experts.

General Investment Account

General Investment Accounts (GIAs) are a great option if you've used up your annual ISA allowance, but still want access to diversified portfolios built and managed by our experts.

- Start a GIA from as little as £1.

- No limit on how much you can invest annually.

- Withdraw your money at any time without penalty.

STRENGTH IN DEPTH

We’re backed by Aviva, one of the UK’s largest financial services institutions which has looked after British consumers for more than 325 years.

Wealthify operates independently but Aviva own a majority shareholding, which means you get the best innovation in smart simple investing together with the security of knowing that we’re here to stay and operate to the highest standards.

Aviva’s investment in Wealthify allows us to achieve all the things we always wanted to, but at an accelerated pace and with greater confidence.

Wealthify Customer Reviews

Chart title

Chart Description (Original) 29th February 2016

Original

Ethical

Chart Disclaimer (Original)

Table Heading (Original)

Table Description (Original)

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 |

|---|---|---|---|---|---|---|

| Cautious | 2.70% | 0.47% | -11.19% | 4.65% | 1.05% | 6.08% |

| Tentative | 3.88% | 3.72% | -10.82% | 6.21% | 3.36% | 8.02% |

| Confident | 4.87% | 6.66% | -10.33% | 7.76% | 6.09% | 9.93% |

| Ambitious | 5.11% | 9.66% | -9.39% | 9.46% | 9.10% | 11.58% |

| Adventurous | 5.06% | 12.75% | -9.14% | 11.35% | 12.27% | 12.95% |

Chart title

Chart Description (Ethical) {{earliestStartDate}}

Original

Ethical

Chart Disclaimer (Ethical)

Table Heading (Ethical)

Table Description (Ethical)

| Investment Style | 31/12/2019 - 31/12/2020 | 31/12/2020 - 31/12/2021 | 31/12/2021 - 31/12/2022 | 30/12/2022 - 30/12/2023 | 29/12/2023 - 29/12/2024 | 30/12/2024 - 30/12/2025 |

|---|---|---|---|---|---|---|

| Cautious | 4.14% | 0.73% | -14.93% | 4.80% | 0.70% | 5.22% |

| Tentative | 6.45% | 4.11% | -15.65% | 6.85% | 2.77% | 5.75% |

| Confident | 9.04% | 7.63% | -16.51% | 8.81% | 5.01% | 6.12% |

| Ambitious | 11.16% | 11.18% | -17.42% | 11.08% | 7.34% | 5.64% |

| Adventurous | 13.43% | 14.65% | -18.72% | 13.63% | 9.98% | 5.63% |